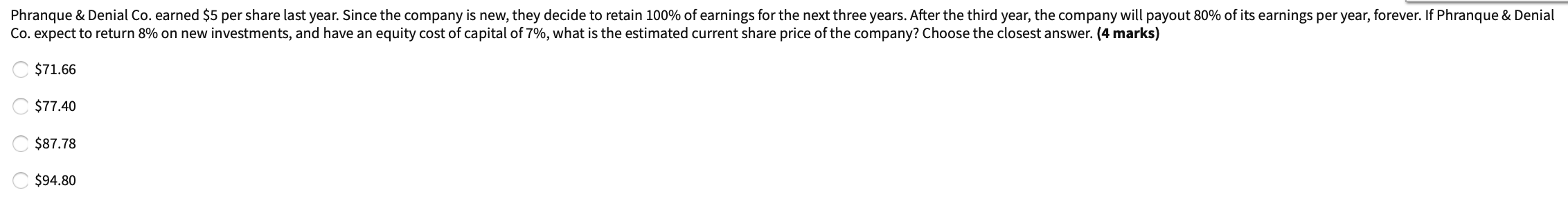

Question: Hi please help me answer these multi choice questions, thanks! (all info provided) Phranque & Denial Co. earned $5 per share last year. Since the

Hi please help me answer these multi choice questions, thanks! (all info provided)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock