Question: Hi! Please help me on question #5. Please make sure your works are clearly to read. Thank you so much! 5. Consider a CRR model

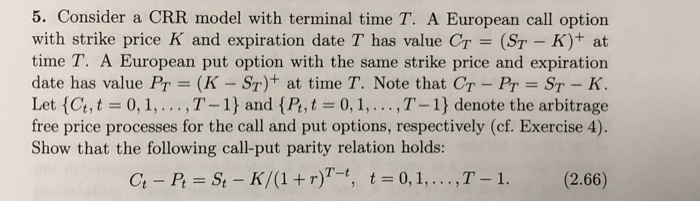

5. Consider a CRR model with terminal time T. A European call option with strike price K and expiration date T has value Cr (ST-K)+ at time T. A European put option with the same strike price and expiration date has value Pr = (K-Sr)+ at time T. Note that CT-Pr = ST-K. Let(G, t = 0, 1, . . . ,7-1) and {R, t = 0, 1, . . . ,7-1} denote the arbitrage free price processes for the call and put options, respectively (cf. Exercise 4). Show that the following call-put parity relation holds: Ct-R-St-K/(1 + r)T-t, t=0,1, ,T-1. (2.66)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts