Question: Please Read!!! Please DO NOT copy and past from internet or another student or somewhere else, there is a safe assign program will find any

Please Read!!!

Please DO NOT copy and past from internet or another student or somewhere else, there is a safe assign program will find any plagiarism...please read the book and write an assignment with at least 500 words .its very easy for marketing management...Thank you there is same question published but as I said we can not take it from some where else.!!! so please if you CAN NOT WRITE let someone else do it...thank you

After reading the companion article (Can Old Media Enhance New Media?); provide a recommendation to a group of executives regarding how a firm can benefit from the balance of traditional advertising and the SEM and SEO generated content.

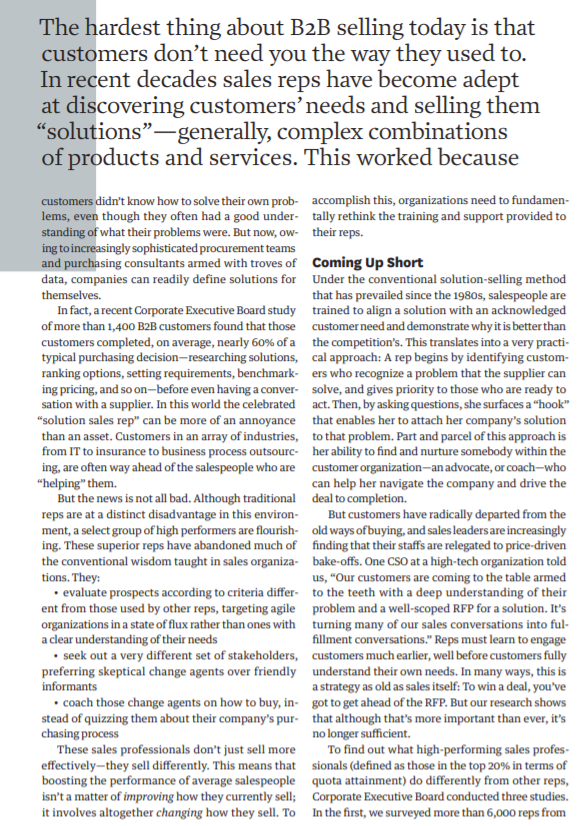

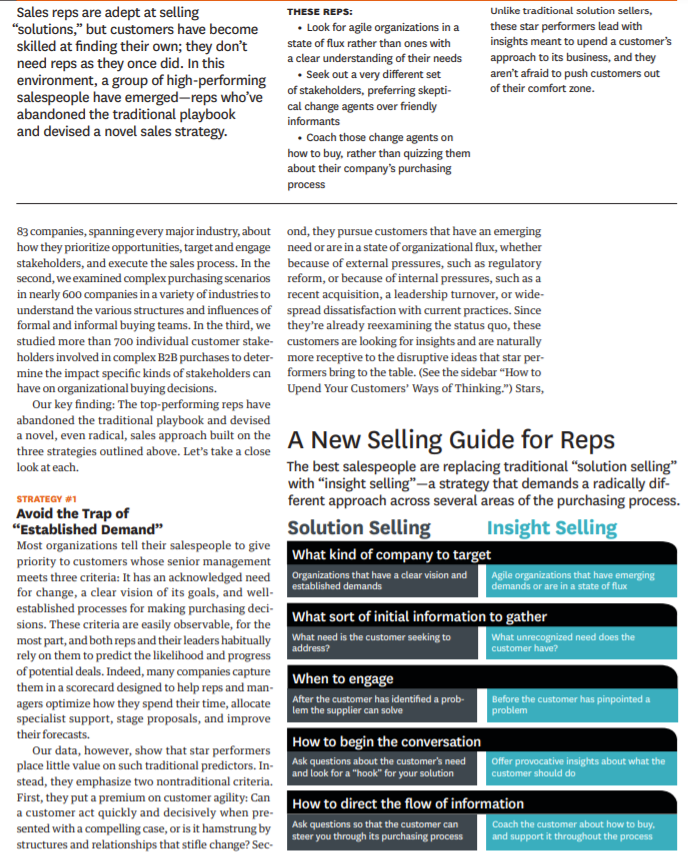

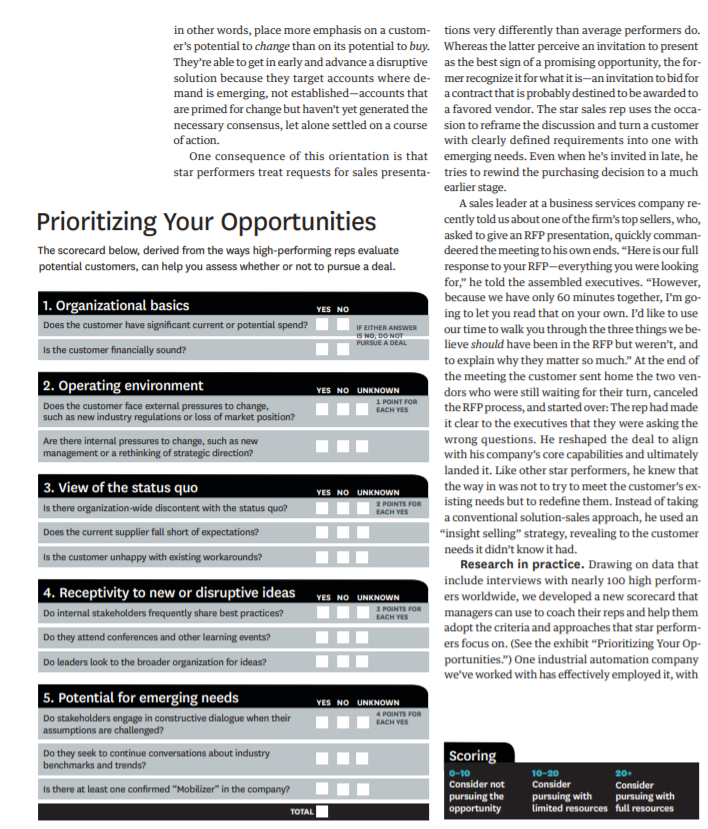

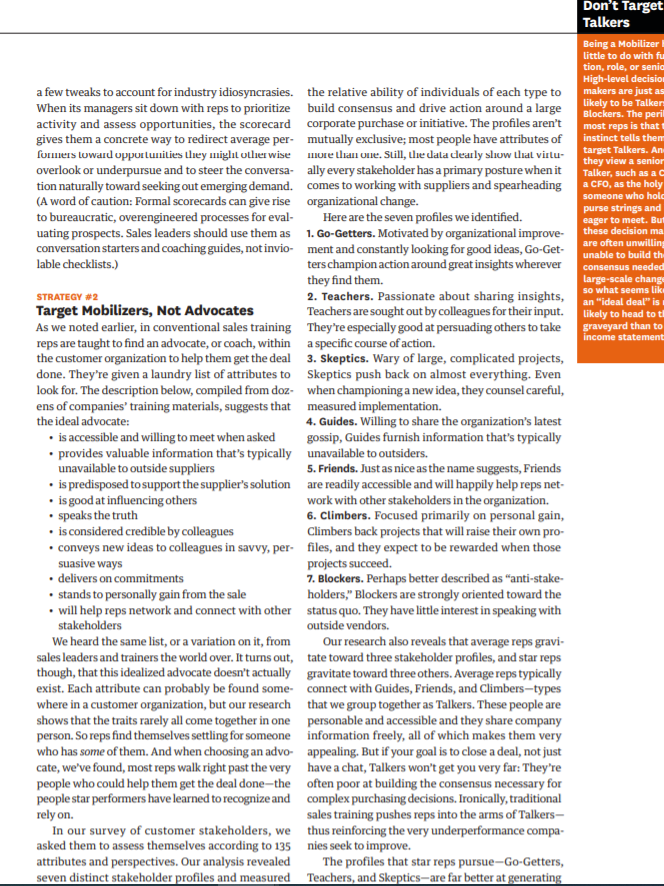

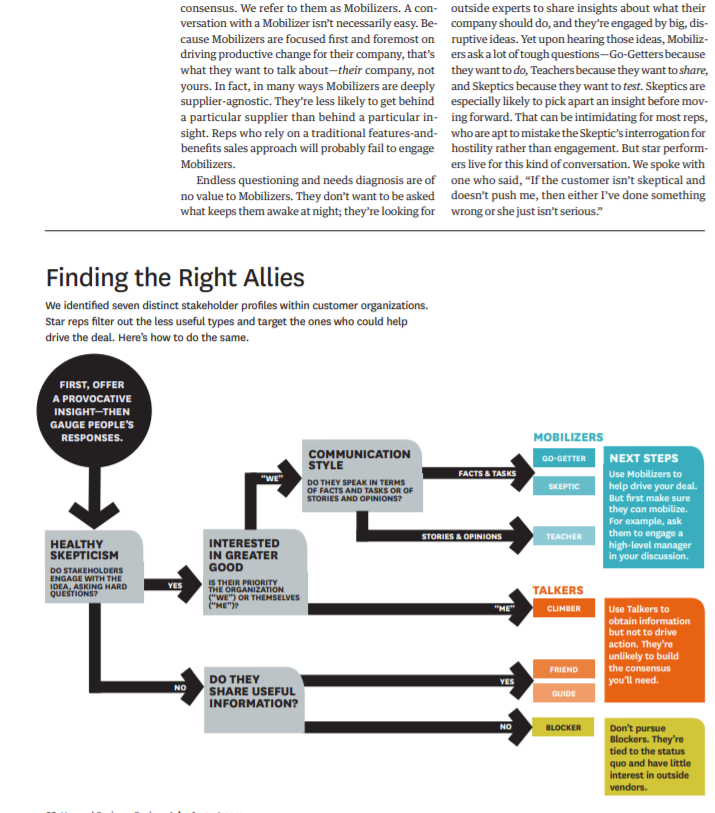

The hardest thing about B2B selling today is that customers don't need you the way they used to. In recent decades sales reps have become adept at discovering customers' needs and selling them "solutions-generally, complex combinations of products and services. This worked because customers didn't know how to solve their own prob- accomplish this, organizations need to fundamen- lems, even though they often had a good under- tally rethink the training and support provided to standing of what their problems were. But now, ow- their reps. ing to increasingly sophisticated procurement teams and purchasing consultants armed with troves of Coming Up Short data, companies can readily define solutions for Under the conventional solution-selling method themselves. that has prevailed since the 1980s, salespeople are In fact, a recent Corporate Executive Board study trained to align a solution with an acknowledged of more than 1,400 B2B customers found that those customer need and demonstrate why it is better than customers completed, on average, nearly 60% of the competition's. This translates into a very practi- typical purchasing decision-researching solutions, cal approach: A rep begins by identifying custom- ranking options, setting requirements, benchmark- ers who recognize a problem that the supplier can ing pricing, and so on-before even having a conver- solve, and gives priority to those who are ready to sation with a supplier. In this world the celebrated act. Then, by asking questions, she surfaces a "hook" "solution sales rep" can be more of an annoyance that enables her to attach her company's solution than an asset. Customers in an array of industries, to that problem. Part and parcel of this approach is from IT to insurance to business process outsourc- her ability to find and nurture somebody within the ing, are often way ahead of the salespeople who are customer organization-an advocate, or coach-who "helping" them. can help her navigate the company and drive the But the news is not all bad. Although traditional deal to completion. reps are at a distinct disadvantage in this environ But customers have radically departed from the ment, a select group of high performers are flourish- old ways of buying, and sales leaders are increasingly ing. These superior reps have abandoned much of finding that their staffs are relegated to price-driven the conventional wisdom taught in sales organiza- bake-offs. One CSO at a high-tech organization told tions. They: us, Our customers are coming to the table armed evaluate prospects according to criteria differ to the teeth with a deep understanding of their ent from those used by other reps, targeting agile problem and a well-scoped RFP for a solution. It's organizations in a state of flux rather than ones with turning many of our sales conversations into ful- a clear understanding of their needs fillment conversations." Reps must learn to engage seek out a very different set of stakeholders, customers much earlier, well before customers fully preferring skeptical change agents over friendly understand their own needs. In many ways, this is informants a strategy as old as sales itself: To win a deal, you've coach those change agents on how to buy, in- got to get ahead of the RFP. But our research shows stead of quizzing them about their company's pur that although that's more important than ever, it's chasing process no longer sufficient. These sales professionals don't just sell more To find out what high-performing sales profes- effectively-they sell differently. This means that sionals (defined as those in the top 20% in terms of boosting the performance of average salespeople quota attainment) do differently from other reps, isn't a matter of improving how they currently sell; Corporate Executive Board conducted three studies. it involves altogether changing how they sell. To In the first, we surveyed more than 6,000 reps from Sales reps are adept at selling "solutions," but customers have become skilled at finding their own; they don't need reps as they once did. In this environment, a group of high-performing salespeople have emerged-reps who've abandoned the traditional playbook and devised a novel sales strategy. Unlike traditional solution sellers, these star performers lead with insights meant to upend a customer's approach to its business, and they aren't afraid to push customers out of their comfort zone. THESE REPS: . Look for agile organizations in a state of flux rather than ones with a clear understanding of their needs Seek out a very different set of stakeholders, preferring skepti- cal change agents over friendly informants . Coach those change agents on how to buy, rather than quizzing them about their company's purchasing process 83 companies, spanning every major industry, about ond, they pursue customers that have an emerging how they prioritize opportunities, target and engage need or are in a state of organizational flux, whether stakeholders, and execute the sales process. In the because of external pressures, such as regulatory second, we examined complex purchasing scenarios reform, or because of internal pressures, such as a in nearly 600 companies in a variety of industries to recent acquisition, a leadership turnover, or wide- understand the various structures and influences of spread dissatisfaction with current practices. Since formal and informal buying teams. In the third, we they're already reexamining the status quo, these studied more than 700 individual customer stake customers are looking for insights and are naturally holders involved in complex B2B purchases to deter- more receptive to the disruptive ideas that star per- mine the impact specific kinds of stakeholders can formers bring to the table. (See the sidebar "How to have on organizational buying decisions. Upend Your Customers' Ways of Thinking.") Stars, Our key finding: The top-performing reps have abandoned the traditional playbook and devised a novel, even radical, sales approach built on the A New Selling Guide for Reps three strategies outlined above. Let's take a close look at each. The best salespeople are replacing traditional "solution selling" with "insight selling"-a strategy that demands a radically dif- STRATEGY #1 ferent approach across several areas of the purchasing process. Avoid the Trap of "Established Demand Solution Selling Insight Selling Most organizations tell their salespeople to give what kind of company to target priority to customers whose senior management meets three criteria: It has an acknowledged need Organizations that have a clear vision and Agile organizations that have emerging for change, a clear vision of its goals, and well-established demands demands or are in a state of flux established processes for making purchasing deci. What sort of initial information to gather sions. These criteria are easily observable, for the most part, and both reps and their leaders habitually what need is the customer seeking to What unrecognized need does the rely on them to predict the likelihood and progress of potential deals. Indeed, many companies capture When to engage them in a scorecard designed to help reps and man- agers optimize how they spend their time, allocate after the customer has identified a prob Before the customer has pinpointed a problem specialist support, stage proposals, and improve lem the supplier can solve their forecasts. Our data, however, show that star performers How to begin the conversation place little value on such traditional predictors. In- Ask questions about the customer's need Offer provocative insights about what the customer should do stead, they emphasize two nontraditional criteria. and look for a "hook" for your solution First, they put a premium on customer agility: Can How to direct the flow of information a customer act quickly and decisively when pre- sented with a compelling case, or is it hamstrung by Ask questions so that the customer can and support it throughout the process structures and relationships that stifle change? Sec steer you through its purchasing process address? customer have? Coach the customer about how to buy Prioritizing Your Opportunities IS NO, DO NOT in other words, place more emphasis on a custom- tions very differently than average performers do. er's potential to change than on its potential to buy. Whereas the latter perceive an invitation to present They're able to get in early and advance a disruptive as the best sign of a promising opportunity, the for- solution because they target accounts where de- mer recognize it for what it is an invitation to bid for mand is emerging, not established-accounts that a contract that is probably destined to be awarded to are primed for change but haven't yet generated the a favored vendor. The star sales rep uses the occa- necessary consensus, let alone settled on a course sion to reframe the discussion and turn a customer of action. with clearly defined requirements into one with One consequence of this orientation is that emerging needs. Even when he's invited in late, he star performers treat requests for sales presenta- tries to rewind the purchasing decision to a much earlier stage. A sales leader at a business services company re- cently told us about one of the firm's top sellers, who, asked to give an RFP presentation, quickly comman- The scorecard below, derived from the ways high-performing reps evaluate deered the meeting to his own ends. "Here is our full potential customers, can help you assess whether or not to pursue a deal. response to your RFP-everything you were looking for," he told the assembled executives. "However, 1. Organizational basics because we have only 60 minutes together, I'm go- YES NO ing to let you read that on your own. I'd like to use Does the customer have significant current or potential spend? IF EITHER ANSWER our time to walk you through the three things we be- PURSUE A DEAL Is the customer financially sound? lieve should have been in the RFP but weren't, and to explain why they matter so much." At the end of the meeting the customer sent home the two ven- 2. Operating environment YES NO UNKNOWN dors who were still waiting for their turn, canceled Does the customer face external pressures to change. 1 POINT FOR EACH YES the RFP process, and started over: The rep had made such as new industry regulations or loss of market position? it clear to the executives that they were asking the Are there internal pressures to change, such as new wrong questions. He reshaped the deal to align management or a rethinking of strategic direction? with his company's core capabilities and ultimately landed it. Like other star performers, he knew that 3. View of the status quo YES NO UNKNOWN the way in was not to try to meet the customer's ex- Is there organization-wide discontent with the status quo? 2 POINTS FOR isting needs but to redefine them. Instead of taking a conventional solution-sales approach, he used an Does the current supplier fall short of expectations? "insight selling" strategy, revealing to the customer needs it didn't know it had. Is the customer unhappy with existing workarounds? Research in practice. Drawing on data that include interviews with nearly 100 high perform- 4. Receptivity to new or disruptive ideas YES NO UNKNOWN ers worldwide, we developed a new scorecard that Do internal stakeholders frequently share best practices? managers can use to coach their reps and help them adopt the criteria and approaches that star perform- Do they attend conferences and other learning events? ers focus on. (See the exhibit Prioritizing Your Op- Do leaders look to the broader organization for ideas? portunities.") One industrial automation company we've worked with has effectively employed it, with 5. Potential for emerging needs YES NO UNKNOWN 4 POINTS FOR Do stakeholders engage in constructive dialogue when their assumptions are challenged? Do they seek to continue conversations about industry benchmarks and trends? Scoring 0-10 10-20 Consider not Consider Consider Is there at least one confirmed "Mobilizer" in the company? pursuing the pursuing with pursuing with opportunity Limited resources full resources EACH YES 3 POINTS FOR EACH YES EACH YES 20 TOTAL Don't Target Talkers Being a Mobilizer little to do with fu tion, role, or senia High-level decision makers are just as likely to be Talker Blockers. The peril most reps is that instinct tells them target Talkers. An they view a senior Talker, such as a c a CFO, as the holy someone who holc purse strings and eager to meet. But these decision ma are often unwillin unable to build th consensus needed large-scale chang so what seems like an "ideal deal" is likely to head to th graveyard than to income statement a few tweaks to account for industry idiosyncrasies. the relative ability of individuals of each type to When its managers sit down with reps to prioritize build consensus and drive action around a large activity and assess opportunities, the scorecard corporate purchase or initiative. The profiles aren't gives them a concrete way to redirect average per- mutually exclusive; most people have attributes of formers toward opportunities they miylitollier wise more than one. Still, lle dala clearly slow tial vitlu- overlook or underpursue and to steer the conversa ally every stakeholder has a primary posture when it tion naturally toward seeking out emerging demand comes to working with suppliers and spearheading (A word of caution: Formal scorecards can give rise organizational change. to bureaucratic, overengineered processes for eval Here are the seven profiles we identified. uating prospects. Sales leaders should use them as 1. Go-Getters. Motivated by organizational improve conversation starters and coaching guides, notinvio- ment and constantly looking for good ideas, Go-Get- lable checklists.) terschampion action around great insights wherever they find them. STRATEGY #2 2. Teachers. Passionate about sharing insights, Target Mobilizers, Not Advocates Teachers are sought out by colleagues for their input. As we noted earlier, in conventional sales training They're especially good at persuading others to take reps are taught to find an advocate, or coach, within a specific course of action. the customer organization to help them get the deal 3. Skeptics. Wary of large, complicated projects, done. They're given a laundry list of attributes to Skeptics push back on almost everything. Even look for. The description below, compiled from doz- when championing a new idea, they counsel careful, ens of companies' training materials, suggests that measured implementation. the ideal advocate: 4. Guides. Willing to share the organization's latest is accessible and willing to meet when asked gossip, Guides furnish information that's typically provides valuable information that's typically unavailable to outsiders. unavailable to outside suppliers 5. Friends. Just as nice as the name suggests, Friends . is predisposed to support the supplier's solution are readily accessible and will happily help reps net- is good at influencing others work with other stakeholders in the organization. speaks the truth 6. Climbers. Focused primarily on personal gain, is considered credible by colleagues Climbers back projects that will raise their own pro- conveys new ideas to colleagues in savvy, per files, and they expect to be rewarded when those suasive ways projects succeed. . delivers on commitments 7. Blockers. Perhaps better described as "anti-stake- stands to personally gain from the sale holders," Blockers are strongly oriented toward the will help reps network and connect with other status quo. They have little interest in speaking with stakeholders outside vendors. We heard the same list, or a variation on it, from Our research also reveals that average reps gravi- sales leaders and trainers the world over. It turns out, tate toward three stakeholder profiles, and star reps though, that this idealized advocate doesn't actually gravitate toward three others. Average reps typically exist. Each attribute can probably be found some connect with Guides, Friends, and Climbers-types where in a customer organization, but our research that we group together as Talkers. These people are shows that the traits rarely all come together in one personable and accessible and they share company person. So reps find themselves settling for someone information freely, all of which makes them very who has some of them. And when choosing an advo- appealing. But if your goal is to close a deal, not just cate, we've found, most reps walk right past the very have a chat, Talkers won't get you very far: They're people who could help them get the deal done-the often poor at building the consensus necessary for people star performers have learned to recognize and complex purchasing decisions. Ironically, traditional rely on. sales training pushes reps into the arms of Talkers- In our survey of customer stakeholders, we thus reinforcing the very underperformance compa- asked them to assess themselves according to 135 nies seek to improve. attributes and perspectives. Our analysis revealed The profiles that star reps pursue-Go-Getters, seven distinct stakeholder profiles and measured Teachers, and Skeptics-are far better at generating consensus. We refer to them as Mobilizers. A con- outside experts to share insights about what their versation with a Mobilizer isn't necessarily easy. Be- company should do, and they're engaged by big, dis- cause Mobilizers are focused first and foremost on ruptive ideas. Yet upon hearing those ideas, Mobiliz- driving productive change for their company, that's ers ask a lot of tough questions-Go-Getters because what they want to talk about-their company, not they want to do, Teachers because they want to share, yours. In fact, in many ways Mobilizers are deeply and Skeptics because they want to test. Skeptics are supplier-agnostic. They're less likely to get behind especially likely to pick apart an insight before mov- a particular supplier than behind a particular in- ing forward. That can be intimidating for most reps, sight. Reps who rely on a traditional features-and- who are apt to mistake the Skeptic's interrogation for benefits sales approach will probably fail to engage hostility rather than engagement. But star perform- Mobilizers. ers live for this kind of conversation. We spoke with Endless questioning and needs diagnosis are of one who said, If the customer isn't skeptical and no value to Mobilizers. They don't want to be asked doesn't push me, then either I've done something what keeps them awake at night; they're looking for wrong or she just isn't serious." Finding the Right Allies We identified seven distinct stakeholder profiles within customer organizations. Star reps filter out the less useful types and target the ones who could help drive the deal. Here's how to do the same. FIRST, OFFER A PROVOCATIVE INSIGHT-THEN GAUGE PEOPLE'S RESPONSES. MOBILIZERS GO-GETTER "WE" COMMUNICATION STYLE DO THEY SPEAK IN TERMS OF FACTS AND TASKS OR OF STORIES AND OPINIONS? FACTS & TASKS SKEPTIC NEXT STEPS Use Mobilizers to help drive your deal. But first make sure they can mobilize. For example, ask them to engage a high-level manager in your discussion STORIES & OPINIONS TEACHER HEALTHY SKEPTICISM DO STAKEHOLDERS ENGAGE WITH THE IDEA, ASKING HARD QUESTIONS? INTERESTED IN GREATER GOOD IS THEIR PRIORITY THE ORGANIZATION WE") OR THEMSELVES (ME)? YES TALKERS CLIMBER L Use Talkers to obtain information but not to drive action. They're unlikely to build the consensus you'll need. FRIEND VES NO DO THEY SHARE USEFUL INFORMATION? GUIDE NO BLOCKER Don't pursue Blockers. They're tied to the status quo and have little interest in outside vendors. How to Upend Your Customers' Ways of Thinking Traditional solution selling is based on the premise that salespeople should lead with Research in practice. We worked with star open-ended questions designed to surface to identifying Mobilizers . (See the exhibit Finding recognized customer needs. Insight-based the Right Allies.") The first step is to gauge a custom selling rests on the belief that salespeople er's reaction to a provocative insight. (For instance, must lead with disruptive ideas that will make reps at the industrial supply company Grainger start customers aware of unknown needs. their conversations by citing data showing that a shockingly high share -40%-of companies' spend on maintenance, repair, and operations goes to un- In The Challenger Sale (Portfolio/ The Challenger approach is be- planned purchases.) Does the customer dismiss the Penguin, 2011), we draw on data coming standard operating proce insight out of hand, accept it at face value, or test it from more than 6,000 salespeople dure in top sales organizations. Reps with hard questions? Contrary to conventional wis- around the world to show that all for Dentsply International, a global dom, hard questions are a good sign; they suggest reps fall into one of five profiles-the provider of dental products and ser- that the contact has the healthy skepticism of a Mo Relationship Builder, the Reactive vices, talk to dentists about hygien- bilizer. If the customer accepts the assertion without Problem Solver, the Hard Worker, the ists' absences from work related to question, you've got a Talker ora Blocker--the differ Lone Wolf, and the Challenger. Star carpal tunnel syndrome and similar ence being that a Talker will at least offer useful in performers are far more likely to injuries. They demonstrate how formation about his organization, whereas a Blocker be Challengers than any other type. Dentsply's lighter, cordless hygiene will not engage in dialogue at all. Why? Challengers are the debaters equipment may reduce wrist stress. Next, the rep must listen carefully to how the on the sales team. They've got a pro Salespeople for the agricultural prod. customer discusses the insight as the conversation vocative point of view that can upend ucts and services firm Cargill discuss progresses. Watch out for the customer who says a customer's current practices, and how price volatility in international something like "You're preaching to the converted they're not afraid to push custom markets causes farmers to waste I've been lobbying for this sort of thing for years!" If ers outside their comfort zone. (This time trying to predict commodity he sees the idea as a means of advancing his personal idea was explored by Philip Lay, Todd price shifts. The subject naturally agenda-speaking mainly in terms of "me" versus Hewlin, and Geoffrey Moore in the leads to a pitch for grain pricing "we"-that's a strong signal that he's a Climber. And March 2009 HBR article "In a Down services, which help farmers mitigate Climbers can be dangerous. A number of star reps turn, Provoke Your Customers.") their exposure to price fluctuations. told us that Climbers aren't obvious just to them; Challengers accounted for nearly Instead of leading with a discus they're obvious to colleagues and often cause wide- 40% of the high performers in our sion about the technical benefits of spread resentment and distrust. study--and the number jumps to their products, account teams at Star performers never assume they've identified 54% in complex, insight-driven envi Ciena, a global provider of telecom a Mobilizer until that person has proved it with her ronments. Customers value the Chal munications equipment, software, actions. Stars usually ask stakeholders they believe lenger approach; in a corollary study, and services, focus the conversa might be Mobilizers to set up a meeting with key de we found that the biggest driver of tion on the business benefits, such cision makers or to provide information obtainable B2B customer loyalty is a supplier's as reducing operational inefficien only by actively investigating an issue or conferring ability to deliver new insights. cies in networks. For example, they with colleagues. One star performer from a global Getting the Challenger approach talk about how much money the telecommunications company explained to us that right requires organizational capabili customer could save by eliminating she always tests what her customer contacts tell her ties as well as individual skills. While unnecessary service calls through they can do. In particular, she asks them to invite se salespeople need to be comfort improved network automation. And nior decision makers, often from other functions, to able with the tension inherent in a reps for the food services company follow-on meetings. If they fail to get the right peo teaching-oriented sales conversation. Aramark use insights gleaned from ple to attend, she knows that although they may as: sales and marketing leaders must serving one consumer segment (say, pire to mobilize, they probably lack the connections create teachable insights for them college students) to change the way or the clout to actually do so. to deliver in the first place. When prospective customers in other seg handled skillfully, those insights ments think about managing their STRATEGY 3 guide the conversation toward areas business (for example, how Coach Customers on How to Buy where the supplier outperforms its the military feeds its members). Sales leaders often overlook the fact that as hard as competitors. -B.A. and M.D. it is for most suppliers to sell complex solutions, it's Most reps rely on a customer to coach them through a sale; star reps coach the customer. even harder for most customers to buy them. This vision internally, but it's my job to help them get the is especially true when Mobilizers take the lead, be deal done." cause they're "idea people who tend to be far less Research in practice. Automatic Data Process- familiar than Talkers with the ins and outs of inter-ing (ADP), a global leader in business outsourcing nal purchasing processes. solutions, recently introduced a methodology de- Having watched similar deals go off the rails in signed to reorient its sales reps-and the entire com- other organizations, suppliers are frequently better pany-around its customers' purchasing processes. positioned than the customer to steer a purchase It's called Buying Made Easy. through the organization. Suppliers can foresee The goal is to reduce the burden on the customer likely objections. They can anticipate cross-silo by having sales reps follow prescribed steps, each politicking. And in many cases they can head off with its own tools and documents to support cus- problems before they arise. The process is part of tomers throughout the process. Instead of represent- the overarching strategy of providing insight rathering a set of sales activities, as in traditional programs, the steps represent a set of buying activities ("recog. nize need," "evaluate options," "validate and select a solution) along with recommended actions that will help salespeople guide the customer. Any con- versation at ADP about the status of a deal takes into account what the customer has to do next and how ADP can help make that happen. In addition, ADP has created verification steps to ensure that reps can accurately and fully document the customer's purchasing progress. One verifier, for example, is the customer's written commitment to run a presales diagnostic assessing the company's exposure to risk and its readiness to move to an out- sourced solution. Each verifier is a clear, objective than extracting it. Whereas most reps rely on a cus indicator of exactly where a customer is in the pur- tomer to coach them through a sale, stars coach the chasing process. customer. In light of this fact, it's instructive to reflect on IT'S THE END of traditional solution selling. Custom how much time and effort sales organizations investers are increasingly circumventing reps; they're using in equipping their reps to discover" the customer's publicly available information to diagnose their own purchasing process. Most carefully train them to ask needs and turning to sophisticated procurement de a host of questions about how decisions are made partments and third-party purchasing consultants to and how the deal is likely to progress, assuming that help them extract the best possible deals from sup the customer will have accurate answers. That's a pliers. The trend will only accelerate. For sales, this poor strategy isn't just another long, hot summer; it's wholesale Sales leaders find this notion deeply unsettling climate change. How can a rep guide a customer through the pur. Many reps will simply ignore the upheaval and chasing process when he probably doesn't under stick with solution selling, and their customers will stand the idiosyncrasies of the customer's organiza: increasingly rebuff them. But adaptive reps, who tion? Isn't each customer's buying process unique? seek out customers that are primed for change, In a word, no. One star rep we interviewed explained, challenge them with provocative insights, and "I don't waste a lot of time asking my customers coach them on how to buy, will become indispens about who has to be involved in the vetting process, able. They may still be selling solutions-but more whose buy-in we need to obtain, or who holds the broadly, they're selling insights. And in this new purse strings. The customers won't know they're world, that makes the difference between a pitch new to this kind of purchase. In the majority of my that goes nowhere and one that secures the custom- deals, I know more about how the purchase will un er's business. fold than the customers do. I let them champion the HBR Reprint R12070

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts