Question: Hi please help to answer this question and all its parts Question 5. Suppose that we have two stocks 1 and 2 with the following

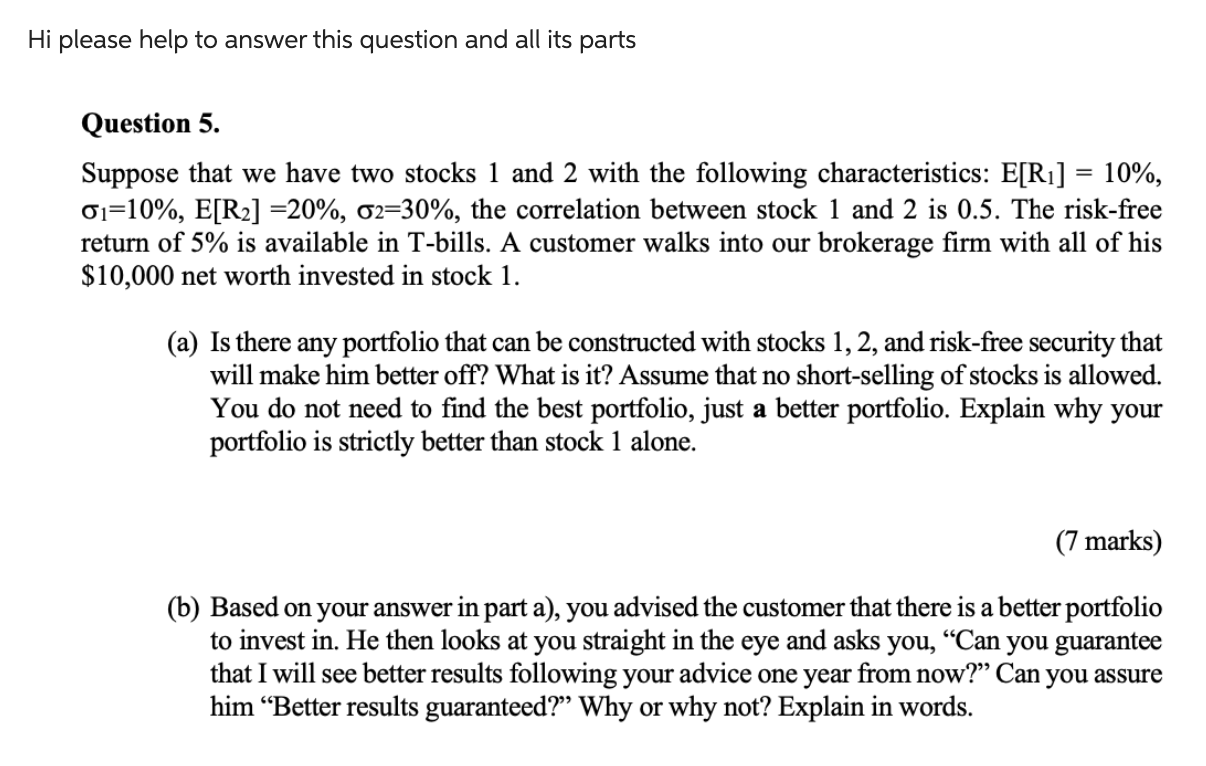

Hi please help to answer this question and all its parts Question 5. Suppose that we have two stocks 1 and 2 with the following characteristics: E[R1]=10%, 1=10%,E[R2]=20%,2=30%, the correlation between stock 1 and 2 is 0.5 . The risk-free return of 5% is available in T-bills. A customer walks into our brokerage firm with all of his $10,000 net worth invested in stock 1 . (a) Is there any portfolio that can be constructed with stocks 1,2 , and risk-free security that will make him better off? What is it? Assume that no short-selling of stocks is allowed. You do not need to find the best portfolio, just a better portfolio. Explain why your portfolio is strictly better than stock 1 alone. (7 marks) (b) Based on your answer in part a), you advised the customer that there is a better portfolio to invest in. He then looks at you straight in the eye and asks you, "Can you guarantee that I will see better results following your advice one year from now?" Can you assure him "Better results guaranteed?" Why or why not? Explain in words. Hi please help to answer this question and all its parts Question 5. Suppose that we have two stocks 1 and 2 with the following characteristics: E[R1]=10%, 1=10%,E[R2]=20%,2=30%, the correlation between stock 1 and 2 is 0.5 . The risk-free return of 5% is available in T-bills. A customer walks into our brokerage firm with all of his $10,000 net worth invested in stock 1 . (a) Is there any portfolio that can be constructed with stocks 1,2 , and risk-free security that will make him better off? What is it? Assume that no short-selling of stocks is allowed. You do not need to find the best portfolio, just a better portfolio. Explain why your portfolio is strictly better than stock 1 alone. (7 marks) (b) Based on your answer in part a), you advised the customer that there is a better portfolio to invest in. He then looks at you straight in the eye and asks you, "Can you guarantee that I will see better results following your advice one year from now?" Can you assure him "Better results guaranteed?" Why or why not? Explain in words

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts