Question: Hi , please help to solve step by step;Glass Package SARL: Expansion Project Analysis Glass Package SARL ( GPS ) is a small glass bottle

Hi please help to solve step by step;Glass Package SARL: Expansion Project Analysis

Glass Package SARL GPS is a small glass bottle manufacturing

firm in the Burgundy region of France. The firm specializes in

designer glass bottles for wine producers in Burgundy as well

as other parts of France and Italy. The design, shape, size, and

engraving are customized to the needs of wine producers, who

want their brands to be premium. The bottle size ranges from

for individual serving to liters for restaurant supplies. The

firm has a wellestablished customer base and is a wellrecognized

name in the winemaking industries of France and Italy. The

firm has been running a single production line since its inception

but, with growing demand, it is now considering adding a new

production facility Grenoble, a town near the Italian border, to

help in minimizing logistics costs for Italian customers. The new

factory is expected to increase production capacity by percent

as the new equipment requires a much shorter downtime between

batches and is mostly controlled by automated computer systems,

making it easy to switch production from one product to another.

After each production run, the furnace needs to cool down and the

glass mixture needs to be prepared for each client separately as the

color of the glass depends on the design provided by the client.

The stamping machine for engravings also needs to be refitted and

recalibrated for different sizes of bottles and design of engravings.

The new production line is expected to complete the process in a

matter of hours due to automation and computerization.

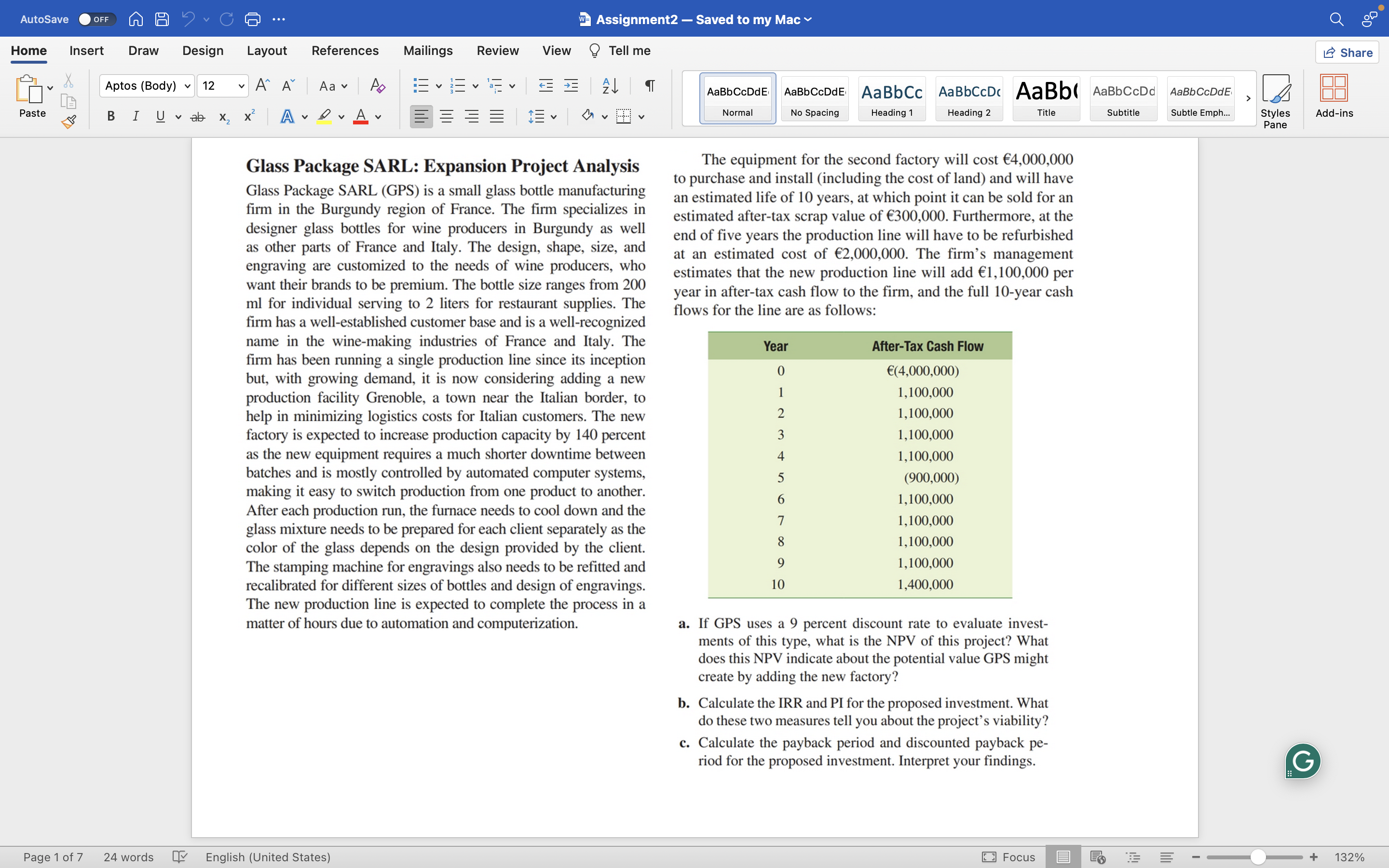

The equipment for the second factory will cost

to purchase and install including the cost of land and will have

an estimated life of years, at which point it can be sold for an

estimated aftertax scrap value of Furthermore, at the

end of five years the production line will have to be refurbished

at an estimated cost of The firm's management

estimates that the new production line will add per

year in aftertax cash flow to the firm, and the full year cash

flows for the line are as follows:

a If GPS uses a percent discount rate to evaluate invest

ments of this type, what is the NPV of this project? What

does this NPV indicate about the potential value GPS might

create by adding the new factory?

b Calculate the IRR and PI for the proposed investment. What

do these two measures tell you about the project's viability?

c Calculate the payback period and discounted payback pe

riod for the proposed investment. Interpret your findings.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock