Question: Hi , please help with questions 1 . 1 - 1 . 3 Read the case study below and answer the questions that follow. Case

Hi please help with questions

Read the case study below and answer the questions that follow.

Case study: HiTech

HiTech is the Cape Town office of an international technological gadgets business.

Management calculated that the majority of the company's revenue, costs and sources of

financing are denominated in Rands.

The management accounts and financial statements are reported in US Dollars the same

reporting currency as its Head Office in San Fransisco.

On December the company entered into a contract with RoyaleTech, a Saudibased

customer, in which RoyaleTech purchased specialised gadgets with a selling price of Saudi Riyal

SAR The full purchase price was settled on December while delivery of the

gadgets will take place on March

HiTech has a February yearend.

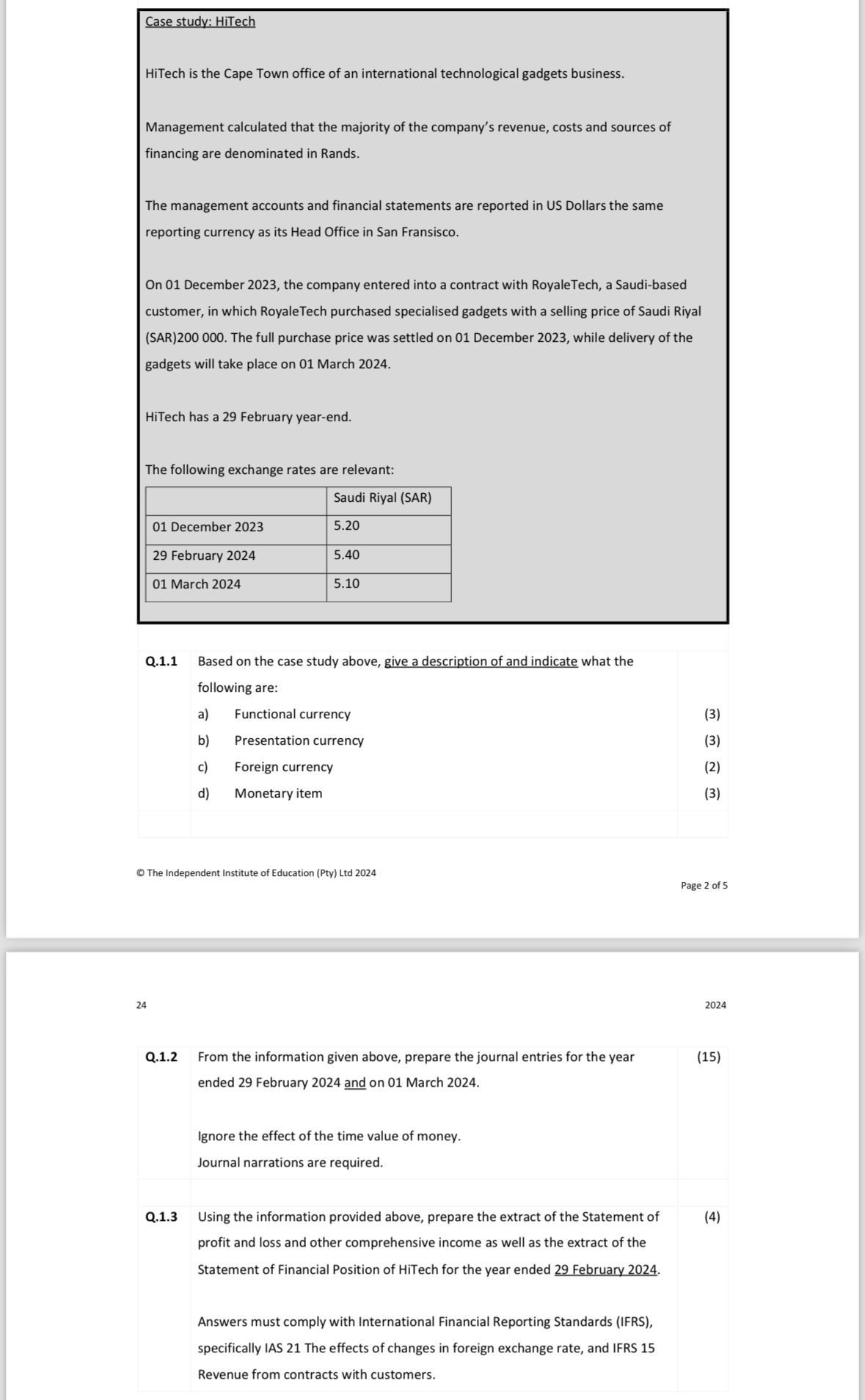

The following exchange rates are relevant:

Q Based on the case study above, give a description of and indicate what the

following are:

a Functional currency

b Presentation currency

c Foreign currency

d Monetary item

Q From the information given above, prepare the journal entries for the year

ended February and on March

Ignore the effect of the time value of money.

Journal narrations are required.

Q Using the information provided above, prepare the extract of the Statement of

profit and loss and other comprehensive income as well as the extract of the

Statement of Financial Position of HiTech for the year ended February

Answers must comply with International Financial Reporting Standards IFRS

specifically IAS The effects of changes in foreign exchange rate, and IFRS

Revenue from contracts with customers.

Case study: HiTech

HiTech is the Cape Town office of an international technological gadgets business.

Management calculated that the majority of the company's revenue, costs and sources of

financing are denominated in Rands.

The management accounts and financial statements are reported in US Dollars the same

reporting currency as its Head Office in San Fransisco.

On December the company entered into a contract with RoyaleTech, a Saudibased

customer, in which RoyaleTech purchased specialised gadgets with a selling price of Saudi Riyal

SAR The full purchase price was settled on December while delivery of the

gadgets will take place on March

HiTech has a February yearend.

The following exchange rates are relevant:

Q Based on the case study above, give a description of and indicate what the

following are:

a Functional currency

b Presentation currency

c Foreign currency

d Monetary item

Q From the information given above, prepare the journal entries for the year

ended February and on March

Ignore the effect of the time value of money.

Journal narrations are required.

Q Using the information provided above, prepare the extract of the Statement of

profit and loss and other comprehensive income as well as the extract of the

Statement of Financial Position of HiTech for the year ended February

Answers must comply with International Financial Reporting Standards IFRS

specifically IAS The effects of changes in foreign exchange rate, and IFRS

Revenue from contracts with customers.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock