Question: Hi, please help with the question below. Answer the question only in the case you can make sure to answer them all and provide a

Hi, please help with the question below. Answer the question only in the case you can make sure to answer them all and provide a detailed solution of how you get these answers. Thanks!

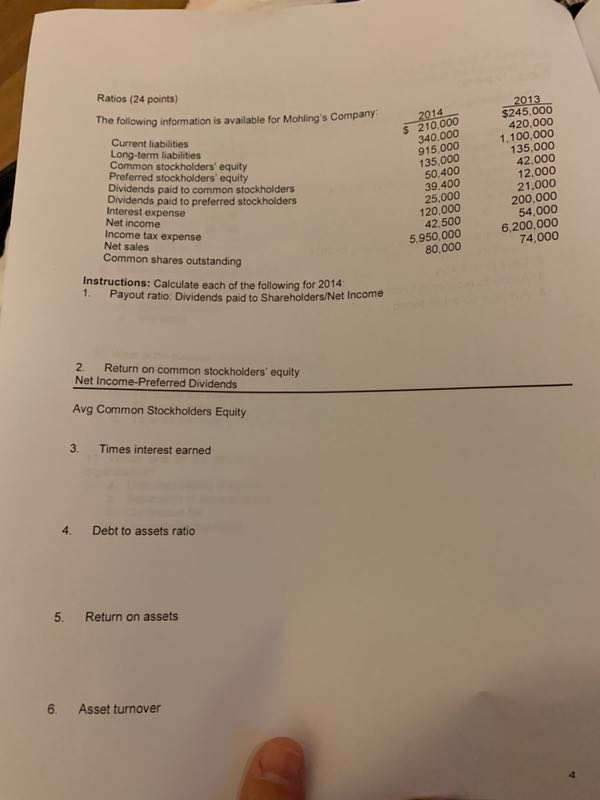

Ratios (24 points) The following information is available for Mohling's Company Current liabilities Long-term liabilities Common stockholders' equity Preferred stockholders' equity Dividends paid to common stockholders Dividends paid to preferred stockholders Interest expense Net income Income tax expense Net sales Common shares outstanding 2014 $ 210,000 340.000 915.000 135,000 50,400 39,400 25,000 120.000 42,500 5.950,000 2013 $245.000 420.000 1.100.000 135,000 42.000 12.000 21.000 200.000 54,000 6,200,000 74,000 80.000 Instructions: Calculate each of the following for 2014 1. Payout ratio: Dividends paid to Shareholders/Net Income 2. Return on common stockholders' equity Net Income-Preferred Dividends Avg Common Stockholders Equity 3. Times interest earned 4. Debt to assets ratio 5. Return on assets 6. Asset turnover

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts