Question: Hi please make a flowchart and write pseudo code for the flowchart thank you. I have gotten useless answers for this question you can check.

Hi please make a flowchart and write pseudo code for the flowchart thank you. I have gotten useless answers for this question you can check. please don't do that. otherwise I will have no other option but to cancel my account.

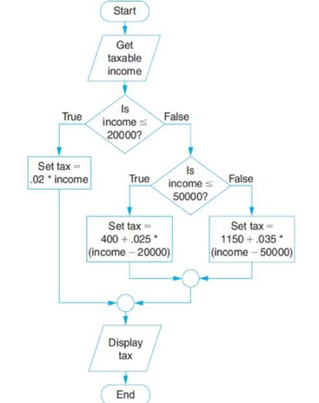

incomplete flowchart down below.

thank you

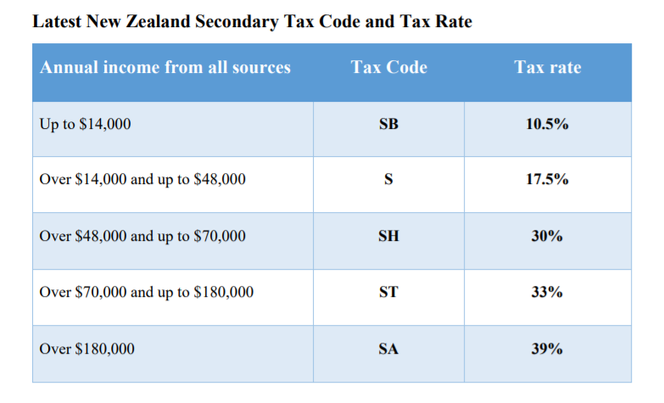

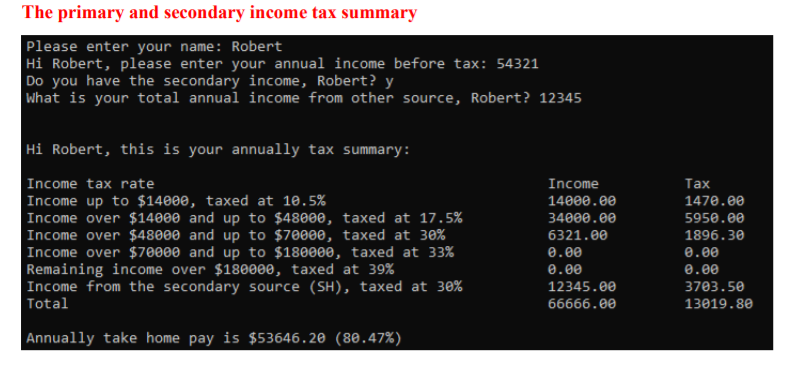

Latest New Zealand Secondary Tax Code and Tax Rate Annual income from all sources Tax Code Tax rate Up to $14,000 SB 10.5% Over $14,000 and up to $48,000 S 17.5% Over $48,000 and up to $70,000 SH 30% Over $70,000 and up to $180,000 ST 33% Over $180,000 SA 39% The primary and secondary income tax summary Please enter your name: Robert Hi Robert, please enter your annual income before tax: 54321 Do you have the secondary income, Robert? y What is your total annual income from other source, Robert? 12345 Hi Robert, this is your annually tax summary: Income tax rate Income up to $14000, taxed at 10.5% Income over $14000 and up to $48000, taxed at 17.5% Income over $48000 and up to $70000, taxed at 30% Income over $70000 and up to $180000, taxed at 33% Remaining income over $180000, taxed at 39% Income from the secondary source (SH), taxed at 30% Total Income 14000.00 34000.00 6321.00 0.00 0.00 12345.00 66666.00 Tax 1470.00 5950.00 1896.30 0.00 0.00 3703.50 13019.80 Annually take home pay is $53646.20 (80.47%) Start Get taxable income True Is incomes 20000? False Set tax- .02. income True False Is incomes 50000? Set tax- 400+.025 (income - 20000) Set tax 1150+.035 (income - 50000) Display tax End

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts