Question: Hi please solve this question Question 1: Topic - Bank Reconciliation The 2020 June bank statement of Wheeler Ltd has just been received from its

Hi please solve this question

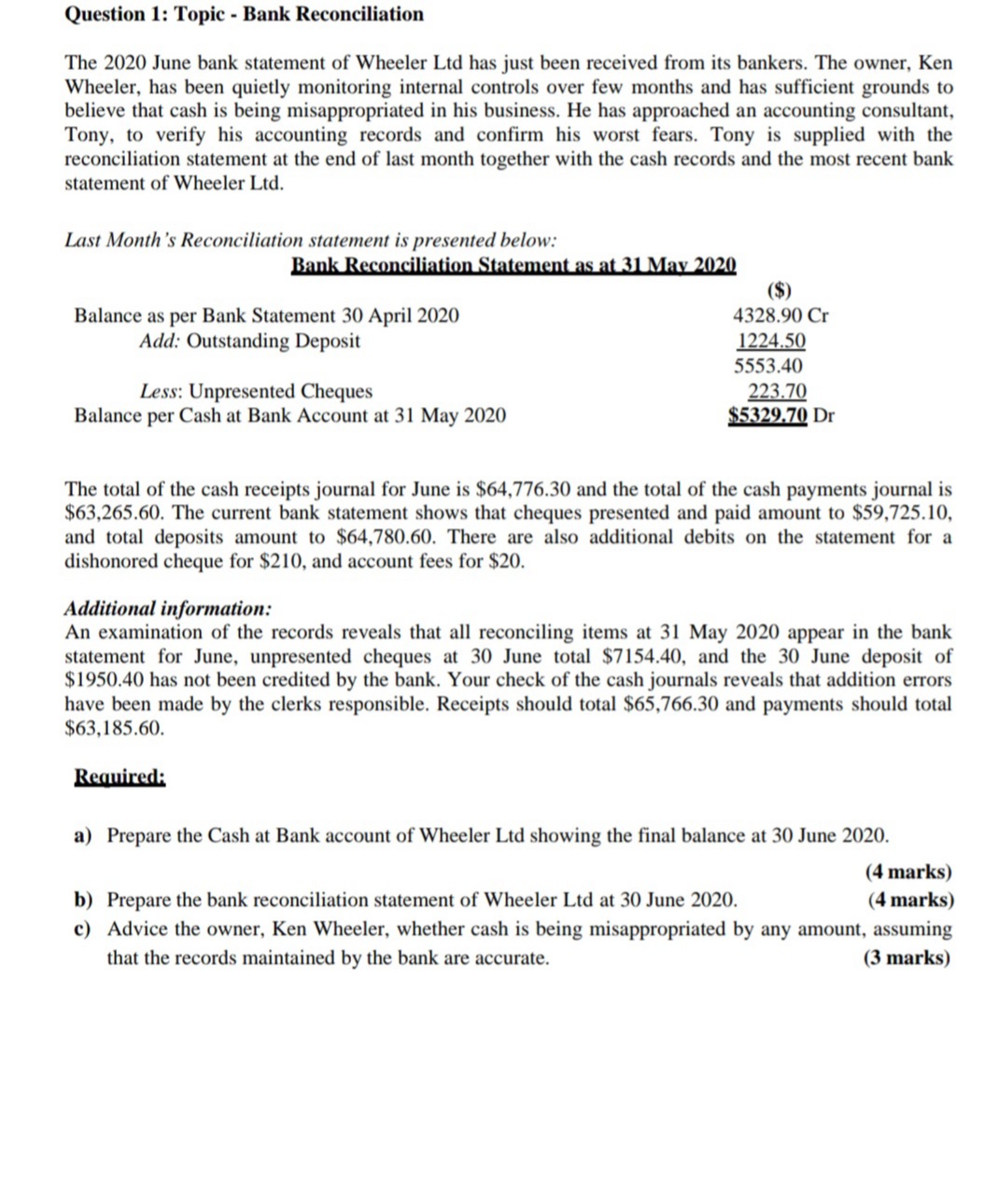

Question 1: Topic - Bank Reconciliation The 2020 June bank statement of Wheeler Ltd has just been received from its bankers. The owner. Ken Wheeler. has been quietly monitoring internal controls over few months and has sufcient grounds to believe that cash is being misappropriated in his business. He has approached an accounting consultant. Tony. to verify his accounting records and conrm his worst fears. Tony is supplied with the reconciliation statement at the end of last month together with the cash records and the most recent bank statement of Wheeler Ltd. Last Month is Reconciiiotion statement is presented below: W (5) Balance as per Bank Statement 30 April 2020 4328.90 Cr Add: Outstanding Deposit w 5553.40 less: Unpresented Cheques 22110 Balance per Cash at Bank Account at 31 May 2020 W Dr The total of the cash receiptsjournal for June is $64,776.30 and the total of the cash payments journal is $63,265.60. The current bank statement shows that cheques presented and paid amount to 559325.10. and total deposits amount to $64.780.60. There are also additional debits on the statement for a dishonored cheque for $210. and account fees for $20. Additionai information: An examination of the records reveals that all reconciling items at 31 May 2020 appear in the bank statement for June, unpresented cheques at 30 June total $7154.40. and the 30 June deposit of $1950.40 has not been credited by the bank. Your check of the cash journals reveals that addition errors have been made by the clerks responsible. Receipts should total 365.766.30 and payments should total $63.185.60. Bulimia a) Prepare the Cash at Bank account of Wheeler Ltd showing the nal balance at 30 June 2020. (4 marks} b) Prepare the bank reconciliation statement of Wheeler Ltd at 30.1une 2020. (4 marks) 1:) Advice the owner. Ken Wheeler. whether cash is being misappropriated by any amount. assuming that the records maintained by the bank are accurate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts