Question: Hi, please teach me how to solve this problem step by step with the formula. Please be as understandable as possible, since I'm new to

Hi, please teach me how to solve this problem step by step with the formula. Please be as understandable as possible, since I'm new to this. Thank you!

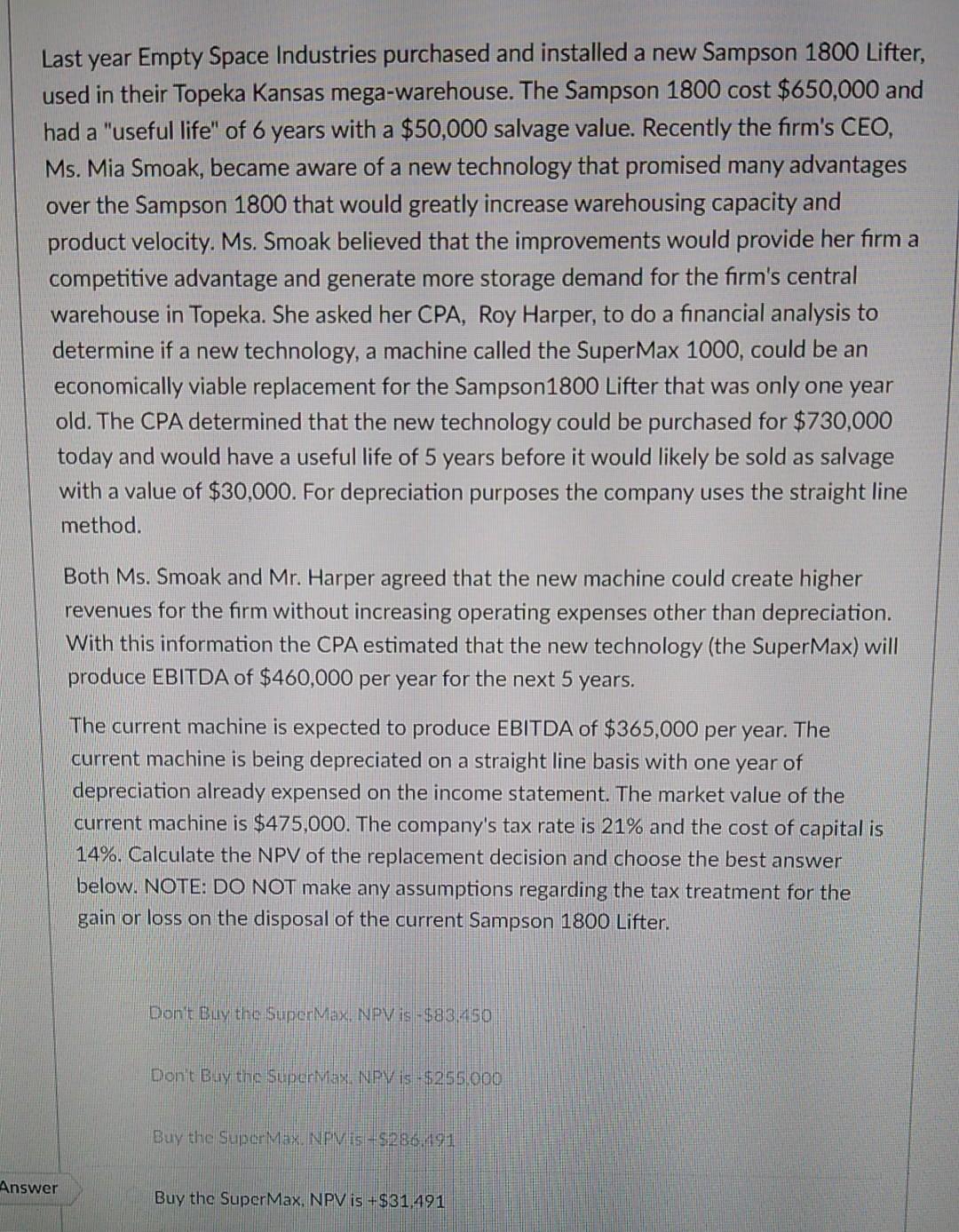

Last year Empty Space Industries purchased and installed a new Sampson 1800 Lifter, used in their Topeka Kansas mega-warehouse. The Sampson 1800 cost $650,000 and had a "useful life" of 6 years with a $50,000 salvage value. Recently the firm's CEO, Ms. Mia Smoak, became aware of a new technology that promised many advantages over the Sampson 1800 that would greatly increase warehousing capacity and product velocity. Ms. Smoak believed that the improvements would provide her firm a competitive advantage and generate more storage demand for the firm's central warehouse in Topeka. She asked her CPA, Roy Harper, to do a financial analysis to determine if a new technology, a machine called the SuperMax 1000, could be an economically viable replacement for the Sampson 1800 Lifter that was only one year old. The CPA determined that the new technology could be purchased for $730,000 today and would have a useful life of 5 years before it would likely be sold as salvage with a value of $30,000. For depreciation purposes the company uses the straight line method. Both Ms. Smoak and Mr. Harper agreed that the new machine could create higher revenues for the firm without increasing operating expenses other than depreciation. With this information the CPA estimated that the new technology (the SuperMax) will produce EBITDA of $460,000 per year for the next 5 years. The current machine is expected to produce EBITDA of $365,000 per year. The current machine is being depreciated on a straight line basis with one year of depreciation already expensed on the income statement. The market value of the current machine is $475,000. The company's tax rate is 21% and the cost of capital is 14%. Calculate the NPV of the replacement decision and choose the best answer below. NOTE: DO NOT make any assumptions regarding the tax treatment for the gain or loss on the disposal of the current Sampson 1800 Lifter. Don't Buy the SuperMax NPV is $83150 Don't Buy the supernias NBV is - 5255,000 Buy the SuporMax. NPV is 280 191 Answer Buy the SuperMax, NPV is +$31.491

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts