Question: Hi please use excel to solve and allow copynpaste and formulas A pension fund manager is considering two risky mutual funds. The first is a

Hi please use excel to solve and allow copynpaste and formulas

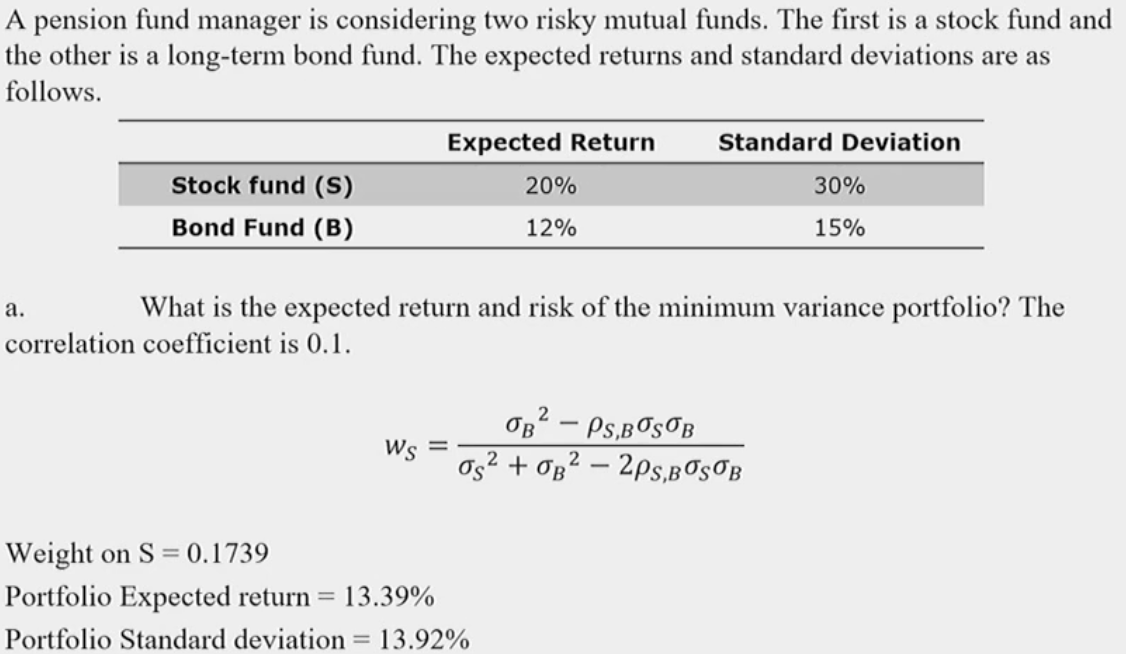

A pension fund manager is considering two risky mutual funds. The first is a stock fund and the other is a long-term bond fund. The expected returns and standard deviations are as follows. a. What is the expected return and risk of the minimum variance portfolio? The correlation coefficient is 0.1. wS=S2+B22S,BSBB2S,BSB Weight on S=0.1739 Portfolio Expected return =13.39% Portfolio Standard deviation =13.92%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts