Question: Hi! someone please help me answer this question by 11pm today if possible!? below i will post the appendix for both stores. above is amazon

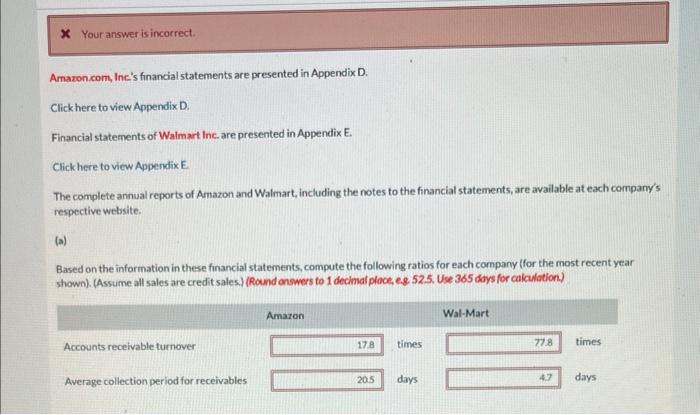

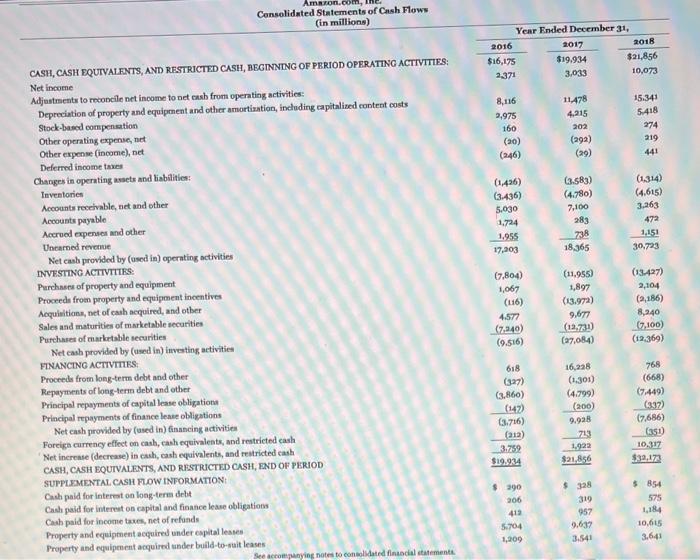

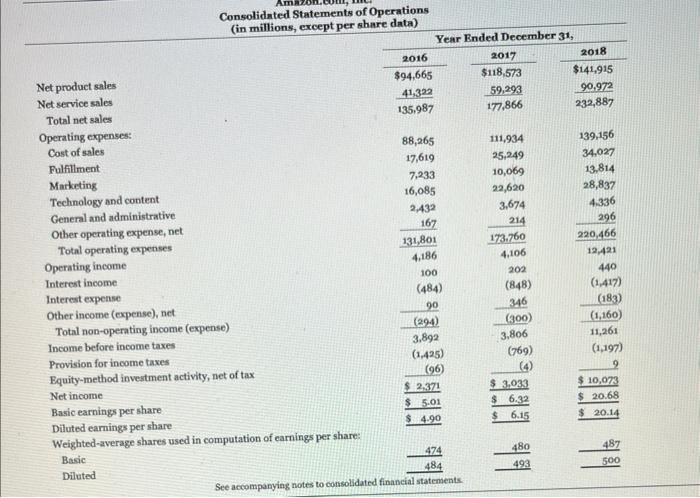

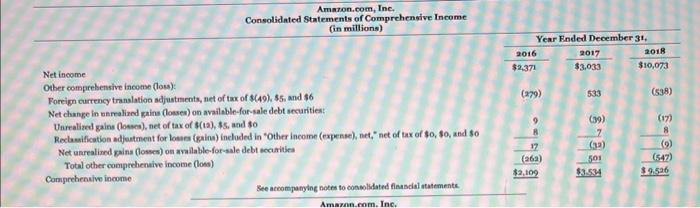

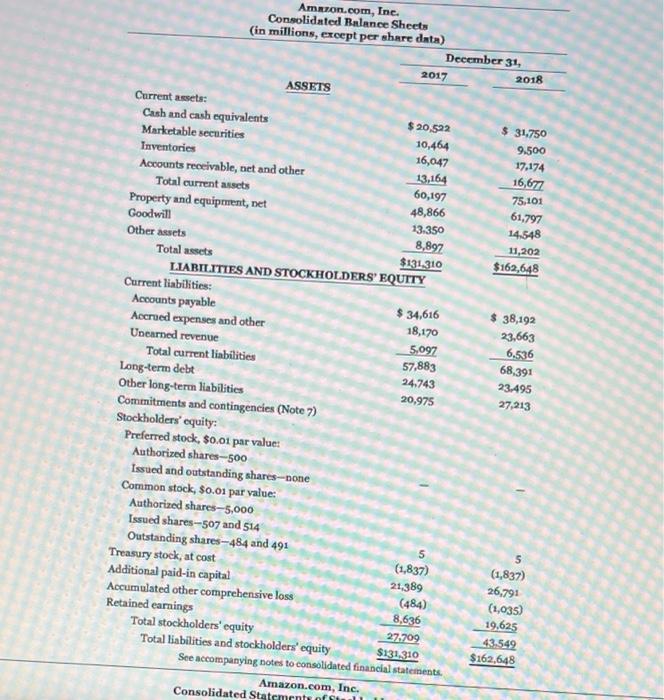

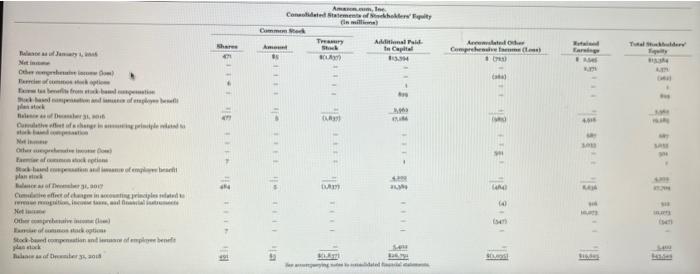

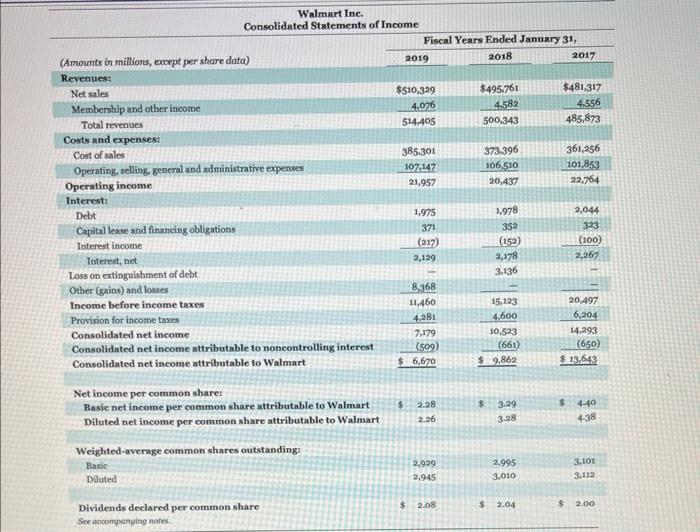

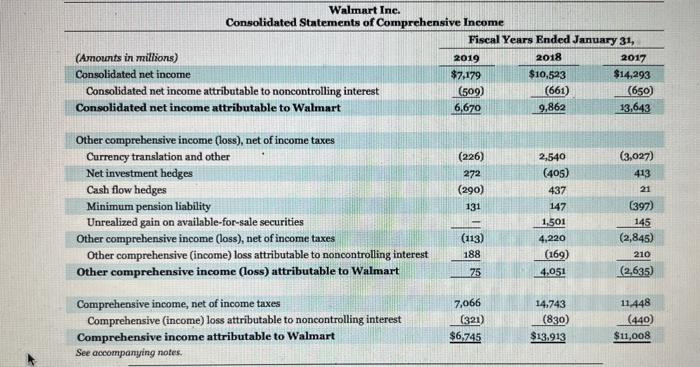

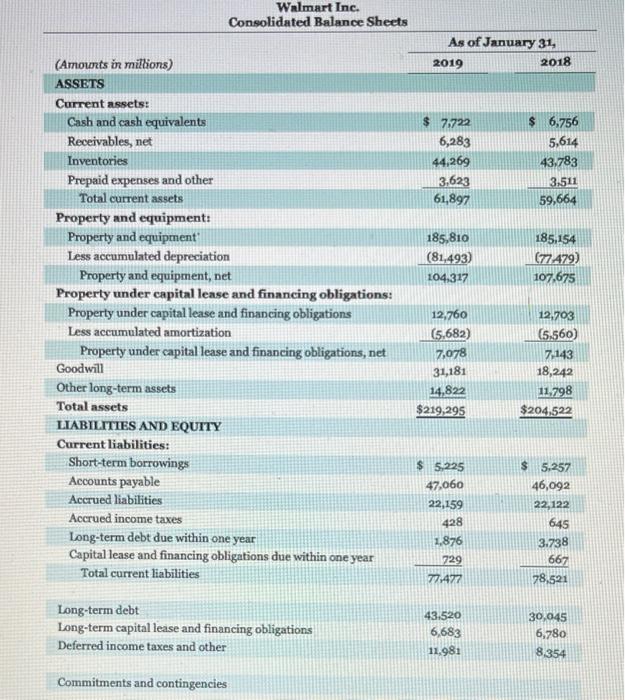

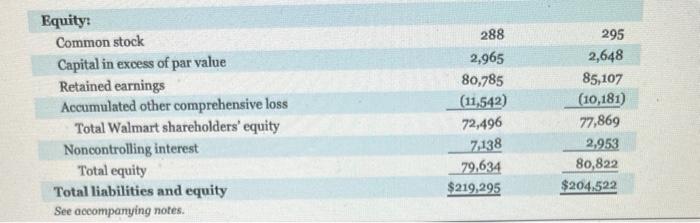

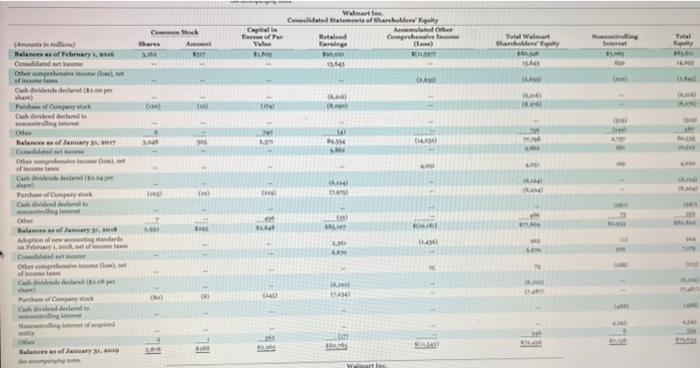

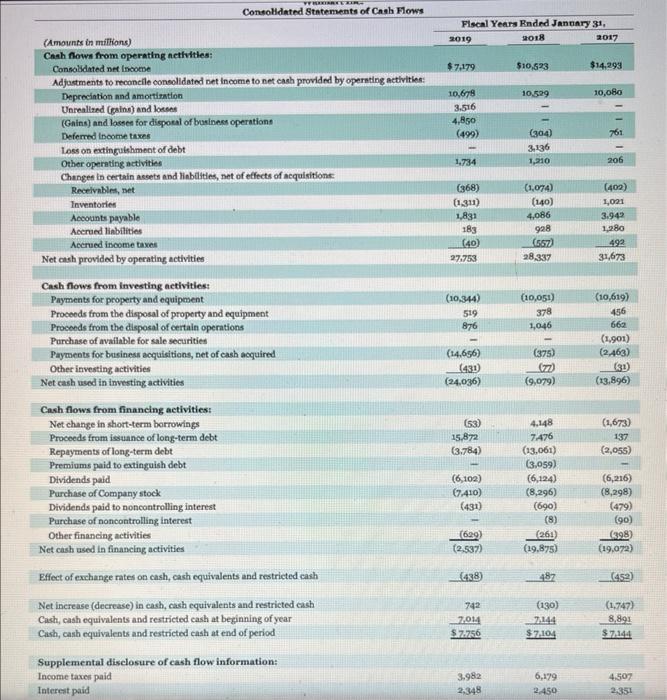

Amazon.com, Inc's financial statements are presented in Appendix D. Clickhere to view Appendix D. Financial statements of Walmart Inc. are presented in Appendix E. Clickhere to view Appendix E The complete annual reports of Amazon and Walmart, including the notes to the financial statements, are available at each company's respective website. (a) Based on the information in these financial statements, compute the following ratios for each company (for the most recent year shown). (Assume all sales are credit sales.) (Round onswers to 1 decimal ploce, e. 52.5 . Use 365 doys for cakalotion) Consolidnted Statements of Cush Flows (in millions) CASH, CASH EQUTVAIFNTS, AND RESTRICTED CASH, BEGINNTNG OF PERIOD OPERATING ACTIVTTES: Net incocne Adjustments to rowoccile net income to net eash from openating activities: Depreciation of property and equipment and other amortization, including capitalized content costs Stock-band compenation Other operating expense, net Other expense (income), net Deferned income taxes Changes in opernting assets and liabilities: Inventorien Acoounts receivable, net and other Accounts payable Accrued expenses and other Uncarned revenue. Net casb provided by (used in) operating activities INVESTTNC ACTVTTTS: Parchases of property and equipment Proceeds fron property and equipment incentives Acquisitions, net of cash acquired, and otber Sales and maturities of marketable securities Purchases of marketable securities Net cash provided by (ased in) inverting activities FTNANCTNG ACTVTTES: Proceeds from long-term debt and other Repayments of long-tern debt and other Principal repoyments of capital lease obligationa Principal repayments of finance leake obligations Net eash provided by (used in) tinancing activitiea Foreign currency effect on cash, cash equivalents, and restricted cash Net inerense (decrease) is eash, eash equivalents, and restricted cash CASH, CASH EQUTVALENTS, AND RASTRICTED CASH, END OF PERIOD SUPPLEMENTAL CASH FLOW INFORMATION: Cadi paid for interet on long-ters debt Cach paid for interest on capital and finance lease obligations Cash paid for income tases, net of refunds Property and rquipment acquired under copital lesses Property and equipenent acquired tuder build-to-nuit leases Consolidnted Statements of Operations Ammion,com, Inc. Consolidated Statements of Comprehengive Income (in millions) Net inoome Other comprebensive income (los): Foreign eurrency translation adjustancois, net of tax of $(49),$5 and $6 Net change in enrralired gains (losses) on available-for-sale debt securities: Unrealized gains (losse), net of tax of $(12), \$5, and 30 Reclasification adjestment for loaes (gaina) indoded in "Other income (expense), net," net of tax of \$o, so, and so. Net unrealined gains (losses) on avaliable for-sale debt sccantitea Total other comprechenive income (loss) Comprehensive income See acrompanying notes to consolilated finascial statemente. Ammion com, Ine. Consolidated Balance Sheets (in millions, ercept per share data) Walmart Inc. Consolidated Statements of Income Fiscal Years Ended January 31, (Amounts in millions, eccept per share data) Revenues: Net sales Membership and other income Total revenues \begin{tabular}{|rrr|} \hline$510,329 & $495,761 & $481,317 \\ \hline 4,076 & 4582 & 4,556 \\ \hline 514,405 & 500,343 & 485,873 \end{tabular} Costs and expenses: Cost of sales Operating, selling, general and administrative expenses Operating income 385,301107,14721,957 Interest: Debt Capital lease and financing obligations Interest income Ioterest, net Loss on extinguiahment of debt Other (gains) and losses Income before income taxes Provision for income taxes Consolidated net income Consolidnted net income attributable to noncontrolling interest Consolidated net income attributable to Walmart \begin{tabular}{rrr|} \hline 1,975 & 1,978 & 2,044 \\ 371 & 352 & 323 \\ (217) & (152) & (100) \\ \hline 2,129 & 2,178 & 2,267 \\ - & 3,136 & - \\ 8,368 & - & 20,497 \\ \hline 11,460 & 15,123 & 6,204 \\ 4,281 & 4,600 & 14,293 \\ \hline 7,179 & 10,523 & (650) \\ \hline(509) & (661) & $13,643 \\ \hline$6,670 & $9,862 & \\ \hline \end{tabular} Net income per common share: Basie net income per common share attributable to Walmart Diluted net income per common share attributable to Walmart Weighted-average common shares outstanding: Basic Diluted 2,9292,9452,9953,0103,1013,112 Dividends declared per common share $2.08$2.04$2.00 See ancompanying notre. Walmart Inc. Consolidated Statements of Comprehensive Income Other comprebensive income (loss), net of income taxes Currency translation and other Net investment hedges Cash flow hedges Minimum pension liability Unrealized gain on available-for-sale securities Other comprehensive income (loss), net of income taxes Other comprehensive (income) loss attributable to noncontrolling interest Other comprehensive income (loss) attributable to Walmart \begin{tabular}{rrr} \hline(226) & 2,540 & (3,027) \\ 272 & (405) & 413 \\ (290) & 437 & 21 \\ 131 & 147 & (397) \\ - & 1,501 & 145 \\ \hline(113) & 4,220 & (2,845) \\ 188 & (169) & (2,635)210 \\ \hline 75 & 4,051 & \\ \hline \end{tabular} Comprehensive income, net of income taxes Comprehensive (income) loss attributable to noncontrolling interest Comprehensive income attributable to Walmart See accompanying notes. Walmart Inc. Consolidated Balance Sheets Commitments and contingencies Rquity: See accompanying notes. Consoldated Statements of Cnah Flows Fiscal Years Rinded Jannary 31, (Amounts in mithions) Cnah flown from operating nethitles: Consolidated net lisocte Adjastments to reconeile consolidated net income to net eash provided by operating activities: Deprecintion and amortisation Unreallied (gains) and loeses (Gains) and lassee for dispoesl of businest operations Deferned inoome taxes Loss on extingutshment of debt Other operating activities Changen in certain assets and linbditiles, net of effects of acquiritions: Cash flows from investing aetivitiest Cash flows from financing activities: Net change in short-term berrowings Proceeds from issuance of long-term debt Repayments of long-term debt Premiums paid to eatinguish debt Dividends paid Purchase of Company stock Dividends paid to noncontrolling interest Purchase of noncontrolling interest Other financing activities Net cash used in financing activities \begin{tabular}{rrr} (53) & 4,148 & (1,673) \\ 15,872 & 7,476 & 137 \\ (3,784) & (13,061) & (2,055) \\ - & (3,059) & - \\ (6,102) & (6,124) & (6,216) \\ (7,410) & (8,296) & (8,298) \\ (431) & (690) & (479) \\ - & (8) & (90) \\ \hline(629) & (39,875)(261) & (19,072) \end{tabular} Effect of exchange rates on cash, cash equivalents and restricted cash (438)487=(452) Net increase (decrease) in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash at beginning of year Cash, cash equivalents and restricted cash at end of period \begin{tabular}{rrr} 742 & (190) & (1,747) \\ 7.044 & 8.8918.144 \\ \hline$7.756 & $7.104 & $7,144 \\ \hline \end{tabular} Supplemental disclosure of cash flow information: Income taxes paid Interest paid 3.9822,3486,1792,4504.5072,351

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts