Question: Hi teachers! Please help me with this based on the second pic (model)! Thanks! 8. Add the following calculations to the workbook: a. In cell

Hi teachers! Please help me with this based on the second pic (model)! Thanks!

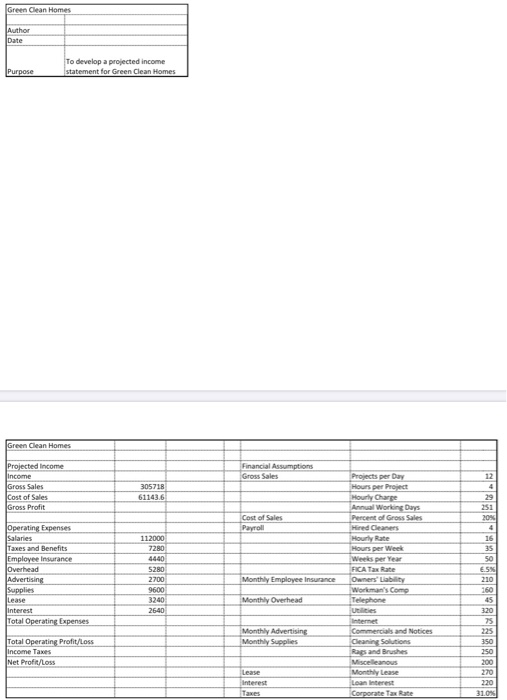

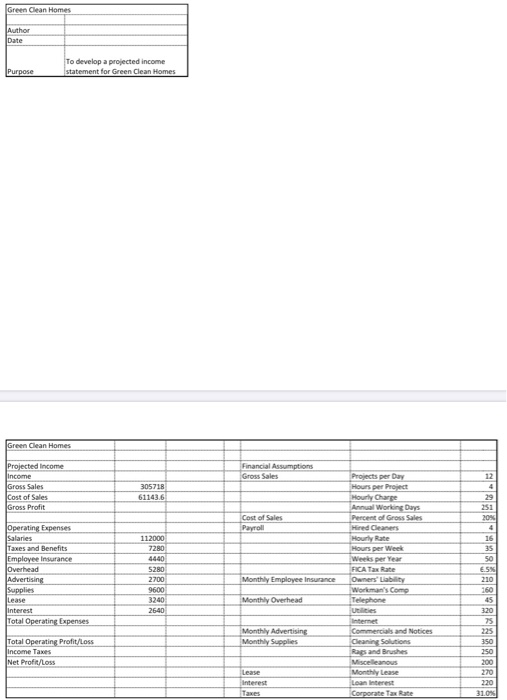

8. Add the following calculations to the workbook: a. In cell C7, calculate the gross profit, which is equal to the gross sales minus the cost of sales. b. In cell C18, calculate the company's total operating expenses, which is equal to the sum of the values in the range B10:B17. Format the value in the Accounting format with no decimal places. c. In cell C20, calculate the company's operating profit, which is equal to its gross profit minus its total operating expenses. d. In cell C21, calculate the company's incomes taxes by multiplying its total operating profit by the corporate tax rate (cell G25). Format the value in the Accounting format with no decimal places. e. In cell C22, calculate the company's net profit, which is equal to the total operating profit minus the income taxes. 9. Finalize the formatting of the Projected Income statement by adding the following: a. Add a bottom border to the ranges A6:06, A17:017, and A 20:C20. Add a single top border and a double bottom border to the range A22:C22. b. Indent the expenses categories in the range A10:117 twice. 10. Format the Financial Assumptions section as follows: a. Add borders around all of the cells in the range E4:G25. b. Format the range E3:63 with the Heading 1 cell style. c. Merge the cells in the ranges E4:E7, E9:E13, E14:E15, E16:E18, and E20:E22. d. Top-align and left-align the range E4:E25. e. Change the fill color of the range E4:F25 to Green, Accent 1, Lighter 60%. Green Clean Homes Author Date To develop a projected income statement for Green Clean Homes Purpose Green Clean Homes Financial Assumptions Gross Sales Projected Income Income Gross Sales Cost of Sales Gross Profit 12 4 305718 611436 Cost of Sales Payroll Operating Expenses Salaries Taxes and Benefits Employee Insurance Overhead Advertising Supplies Lease interest Total Operating Expenses 112000 7280 4440 5280 2700 9600 3240 2640 251 20% 4 16 35 50 E5% 210 Monthly Employee Insurance Projects per Day Hours per Project Hourly Charte Annual Working Days Percent of Gross Sales Hired Cleaners Hourly Rate Hours per week WeeksperYear FICA Tax Rate Owners' Liability Workman's Comp Telephone Utilities Internet Commercials and Notices Cleaning Solutions Raps and Brushes Miscellenous Monthly Lease Lean interest Corporate Tax Rate Monthly Overhead 320 Monthly Advertising Monthly Supplies Total Operating Profit/Loss income Taxes Net Profit/Loss 25 225 350 250 200 270 Lease interest Taxes 31.0%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock