Question: Hi Team , Here is my question below with five parts A,B,C,D & E I provided the answers for A,B& C I need help with

Hi Team , Here is my question below with five parts A,B,C,D & E

I provided the answers for A,B& C

I need help with parts d & E please ?

Thanks

Q.

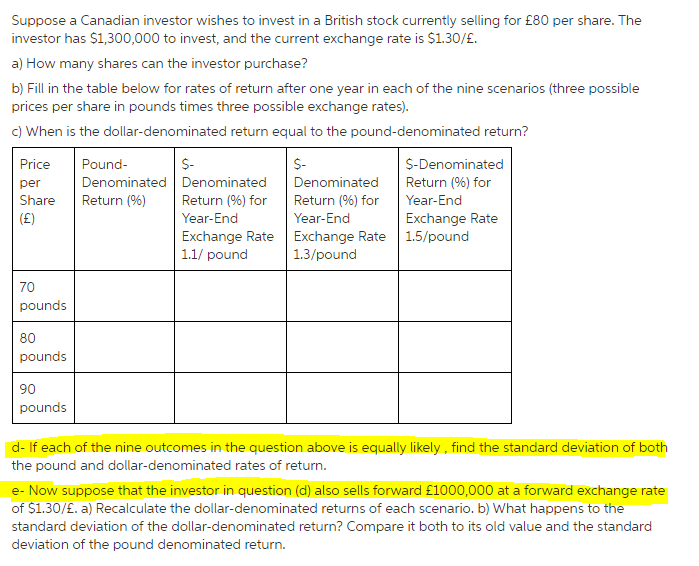

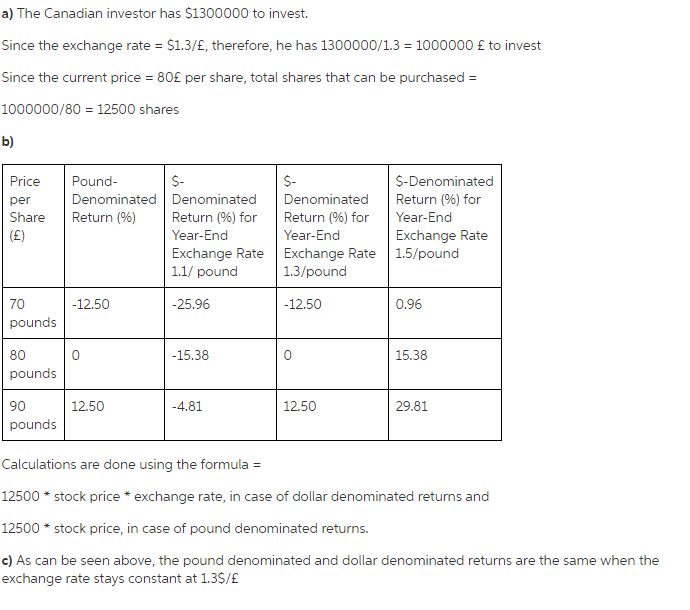

Suppose a Canadian investor wishes to invest in a British stock currently selling for 80 per share. The investor has $1,300,000 to invest, and the current exchange rate is $1.30/f. a) How many shares can the investor purchase? b) Fill in the table below for rates of return after one year in each of the nine scenarios (three possible prices per share in pounds times three possible exchange rates. c) When is the dollar-denominated return equal to the pound-denominated return? Price Pound S-Denominated per Denominated Denominated Denominated Return for Share Return Return for Return for Year-E nd Exchange Rate (f) Year-End Year-End Exchange Rate xchange Rate 1.5/pound 1.1/ pound 1.3/ /pound 70 pounds 80 pounds pounds d- If each of the nine outcomes in the question above is equally likely find the standard deviation of both the pound and dollar-denominated rates of return e- Now suppose that the investor in question (d) also sells forward f1000,000 at a forward exchange rate of $1.30/f. a) Recalculate the dollar-denominated returns of each scenario. b) What happens to the standard deviation of the dollar-denominated return? Compare it both to its old value and the standard deviation of the pound denominated return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts