Question: hi there, i need help with this question, i need it done asap. please make sure to answer all the parts ABC and also make

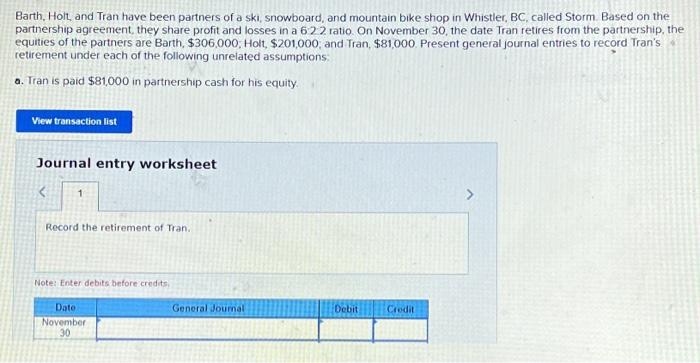

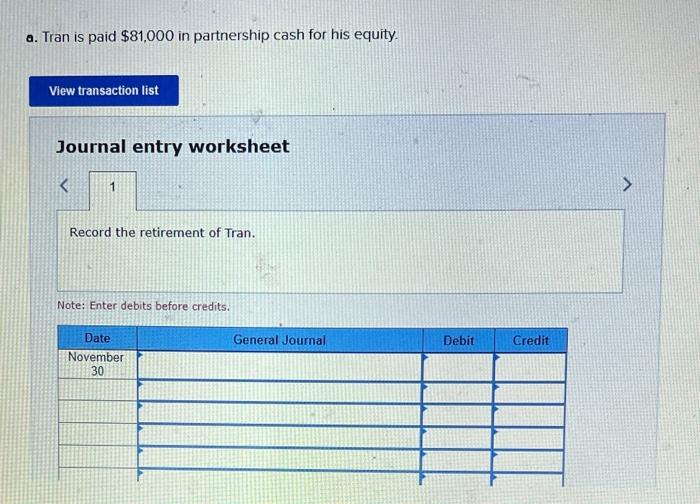

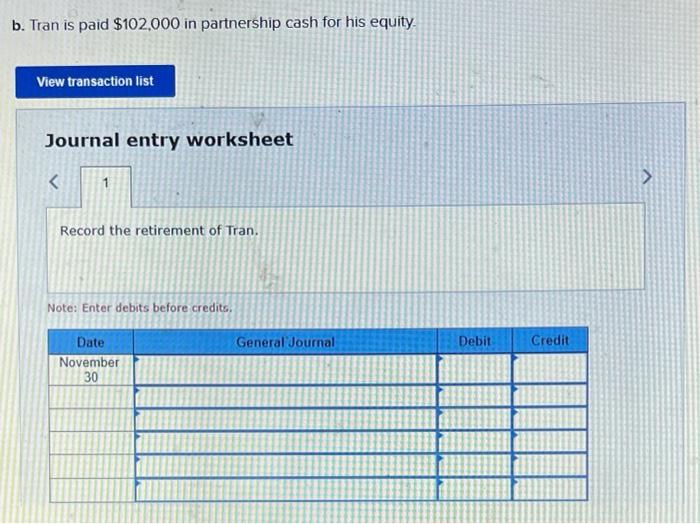

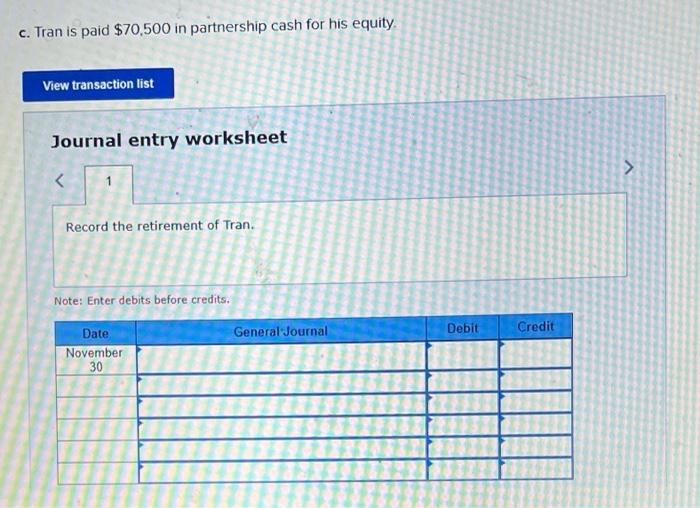

Barth. Holt, and Tran have been partners of a ski, snowboard, and mountain bike shop in Whistler, BC, called Storm. Based on the partnership agreement, they share profit and losses in a 622 ratio. On November 30 , the date Tran retires from the partnership, the equities of the partners are Barth, $306,000; Holt, $201,000, and Iran, $81,000. Present general journal entries to record Tran's retirement under each of the following unrelated assumptions: a. Tran is paid $81,000 in partnership cash for his equity. Journal entry worksheet a. Tran is paid $81,000 in partnership cash for his equity. Journal entry worksheet Note: Enter debits before credits. b. Tran is paid $102,000 in partnership cash for his equity. Journal entry worksheet Record the retirement of Tran. Note: Enter debits before credito. c. Tran is paid $70.500 in partnership cash for his equity. Journal entry worksheet Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts