Question: hi i need help with this question i need it done asap. also please make sure answers are correct Dallas and Weiss formed a partnership

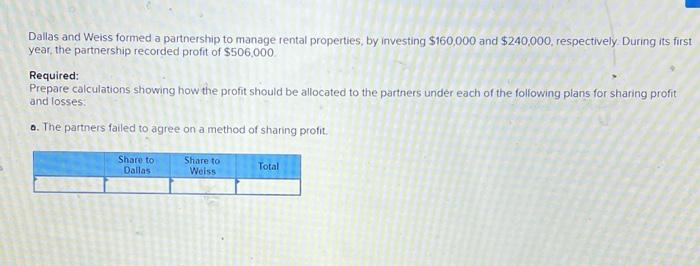

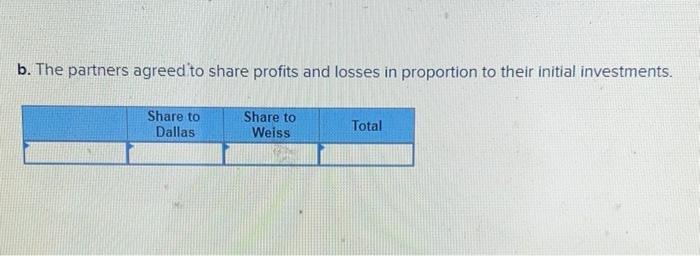

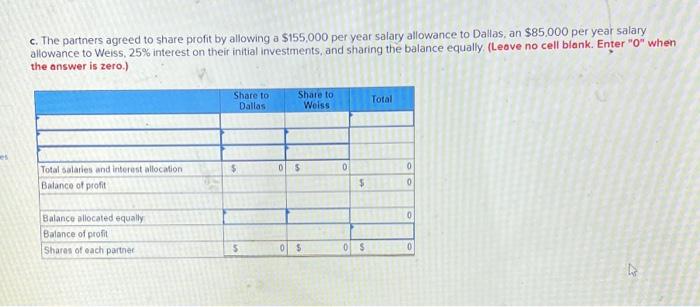

Dallas and Weiss formed a partnership to manage rental properties, by investing $160,000 and $240,000, respectively. During its first year, the partnership recorded profit of $506.000 Required: Prepare calculations showing how the profit should be allocated to the partners under each of the following plans for sharing profit and losses. o. The partners failed to agree on a method of sharing profit. b. The partners agreed to share profits and losses in proportion to their initial investments. c. The partners agreed to share profit by allowing a $155,000 per year salary allowance to Dallas, an $85,000 per year salary allowance to Weiss, 25% interest on their initial investments, and sharing the balance equally, (Leove no cell blank. Enter "0" when the answer is zero.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts