Question: hi , there! : ) ) Pls help me solve this question with detailed solutions. If you do not know the answers, please save it

hi there! : Pls help me solve this question with detailed solutions. If you do not know the answers, please save it for someone else to solve :) Thank you :

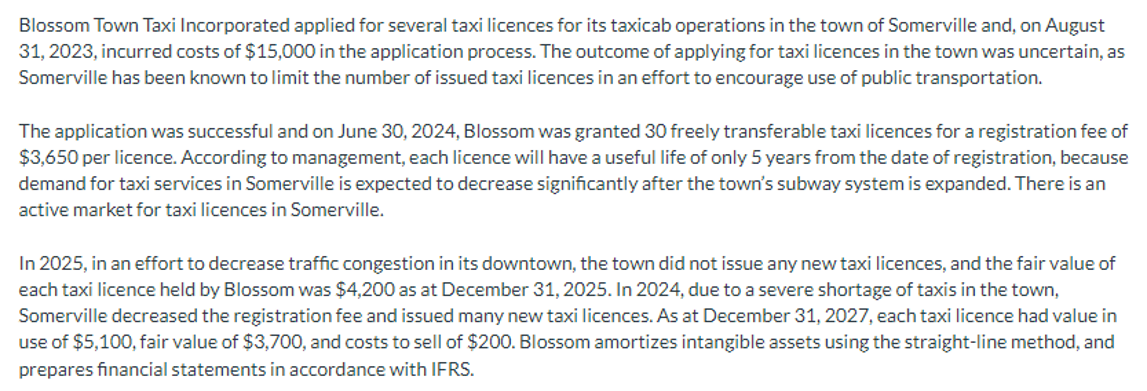

Assume that after initial recognition, Blossom uses the revaluation model asset adjustment method to measure its intangible

assets. Prepare the entries required on December December and December and calculate the

carrying amount of the intangible asset, if any, as at December Assume revaluation adjustments are made on December

and December Credit account titles are automatically indented when the amount is entered. Do not indent

manually. If no entry is required, select No entry" for the account titles and enter for the amounts. Record journal entries in the order

presented in the problem. List all debit entries before credit entries. Accumulated Amortization Licences

To record amortization expense

Accumulated Amortization Llcences

Intanglble AssetsLlcences

To eliminate accumulated

amortizationlicences balance

Intanglble AssetsLlcences

Revaluatlon Surplus OCI

To adjust Intangible Assets Licences

account to fair value

Accumulated Amortlzatlon Llcences

To record amortization expense

Accumulated Amortization Licences

To record amortization expense

Accumulated Amortizatlon Licences

To eliminate accumulated

amortizationlicences balance

To adjust Intangible Assets Licences

account to fair value

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock