Question: Hi, This is my 2nd time posting the same question. I hope you had the ability to see the previous answer. I do need help

Hi, This is my 2nd time posting the same question. I hope you had the ability to see the previous answer. I do need help figuring out which numbers provided from the financial statement are used in the formulas in step 2 to come up with dollar amounts for each of the 10 parts. (For example the weighted-ave common shares outstanding, what is the value) Thank you

Disregard the first two ration and the free cash flow since the information is not provided. Thank you

To clarify more :

The first part-question is asking for earning per share EPS

Formula is

(New income - preferred dividends ) / weighted- ave common shares outstanding

I need help identifying each dollar amount number for

Net income ?

Preferred dividends ?

Weighted-ave common shares outstanding ?

Etc.

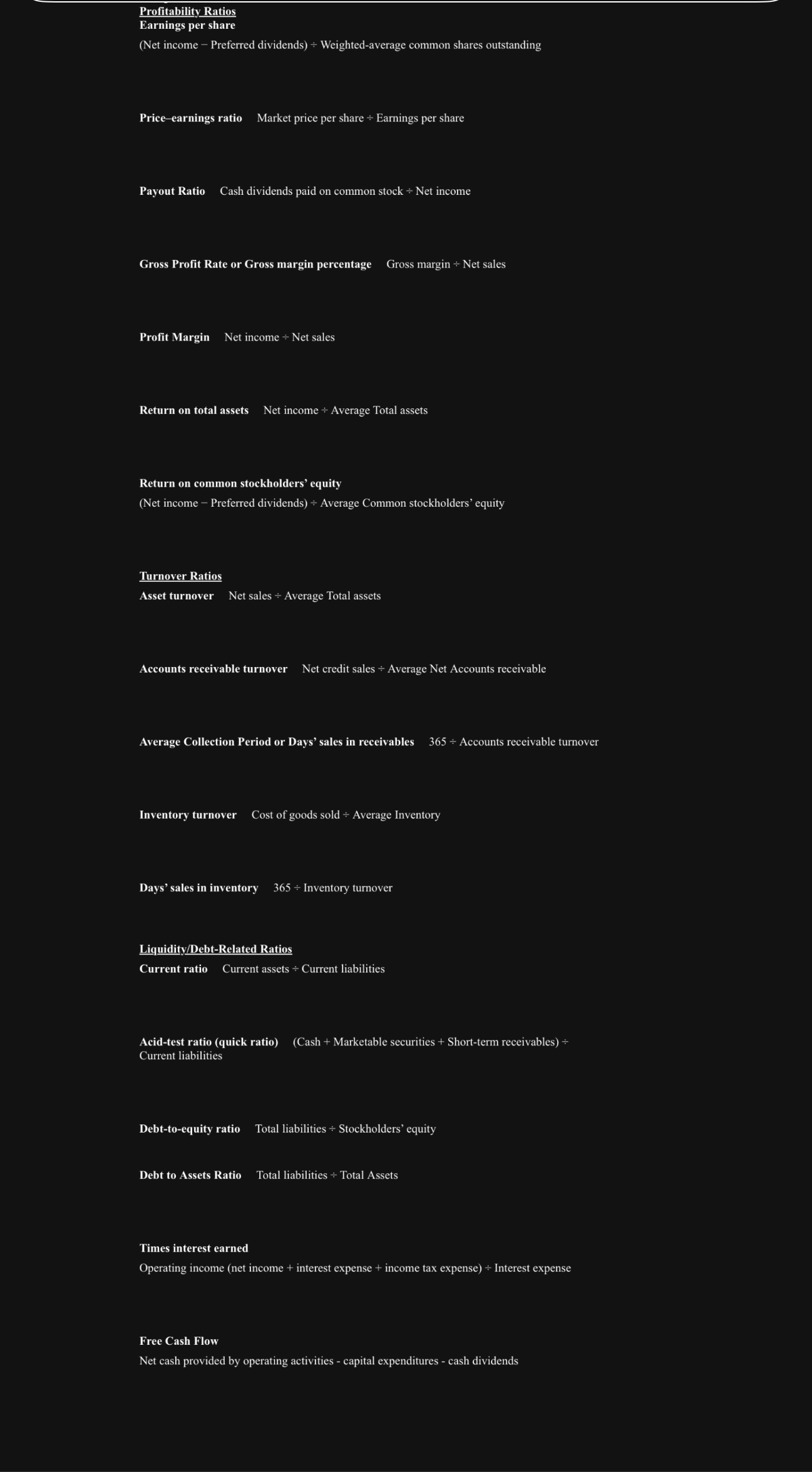

COMPARATIVE FINANCIALSTTATEMENTS FOR MELBOURNE INC. ARE SHOWN BELOW: Profitability Ratios Earnings per share (Net income - Preferred dividends) Weighted-average common shares outstanding Price-earnings ratio Market price per share Earnings per share Payout Ratio Cash dividends paid on common stock Net income Gross Profit Rate or Gross margin percentage Gross margin Net sales Profit Margin Net income Net sales Return on total assets Net income Average Total assets Return on common stockholders' equity (Net income - Preferred dividends) Average Common stockholders' equity Turnover Ratios Asset turnover Net sales Average Total assets Accounts receivable turnover Net credit sales Average Net Accounts receivable Average Collection Period or Days' sales in receivables 365 Accounts receivable turnover Inventory turnover Cost of goods sold Average Inventory Days' sales in inventory 365 Inventory turnover Liquidity/Debt-Related Ratios Current ratio Current assets Current liabilities Acid-test ratio (quick ratio) (Cash + Marketable securities + Short-term receivables) Current liabilities Debt-to-equity ratio Total liabilities Stockholders' equity Debt to Assets Ratio Total liabilities Total Assets Times interest earned Operating income (net income + interest expense + income tax expense ) Interest expense Free Cash Flow Net cash provided by operating activities - capital expenditures - cash dividends

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts