Question: Hi, this is one big question. I couldn't post it separately because it's all related. I've already solved the first 5 images, I just need

Hi, this is one big question. I couldn't post it separately because it's all related. I've already solved the first 5 images, I just need help with the last image. The four questions are together. Thanks for all the help:)

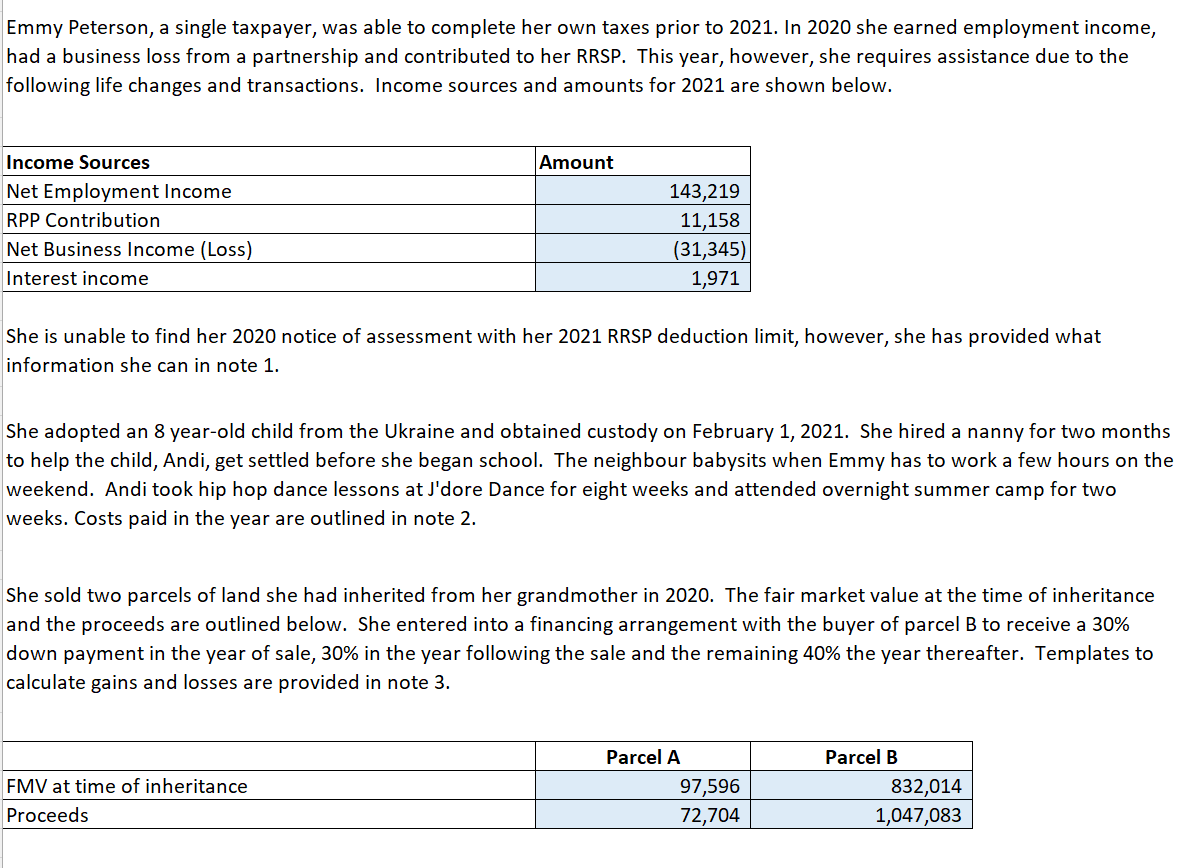

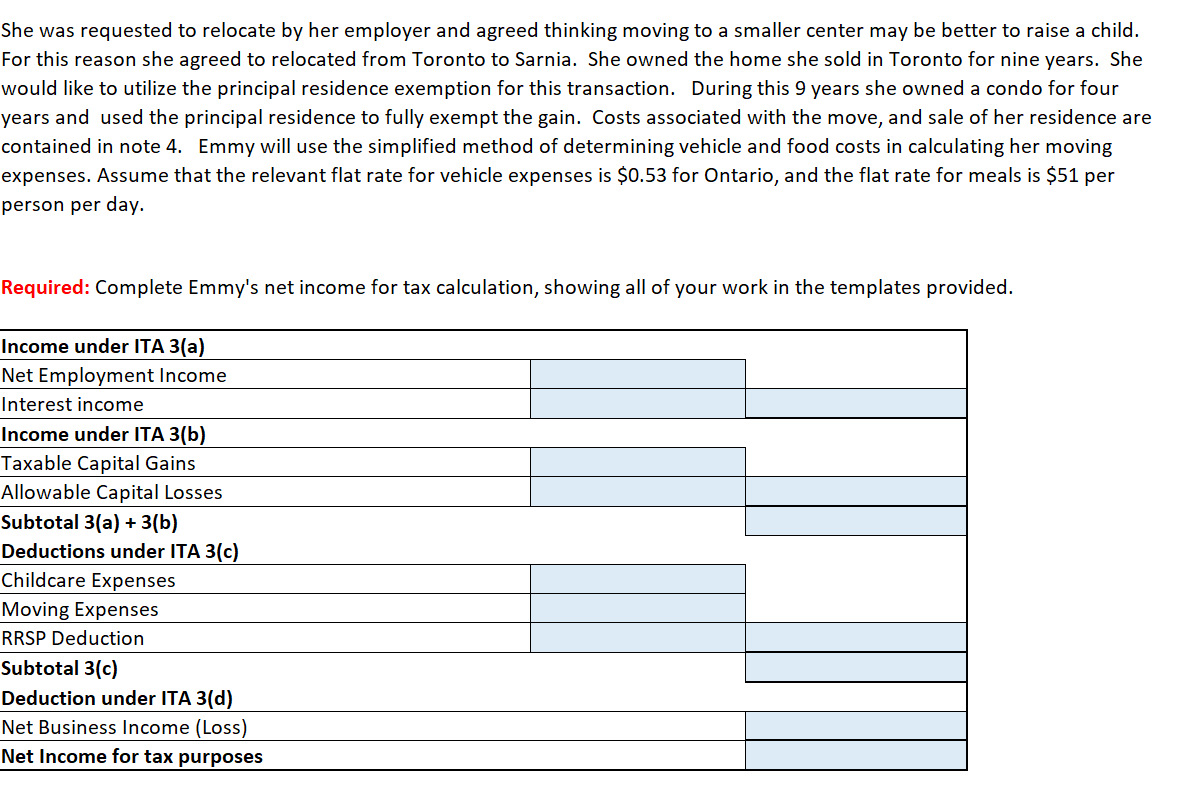

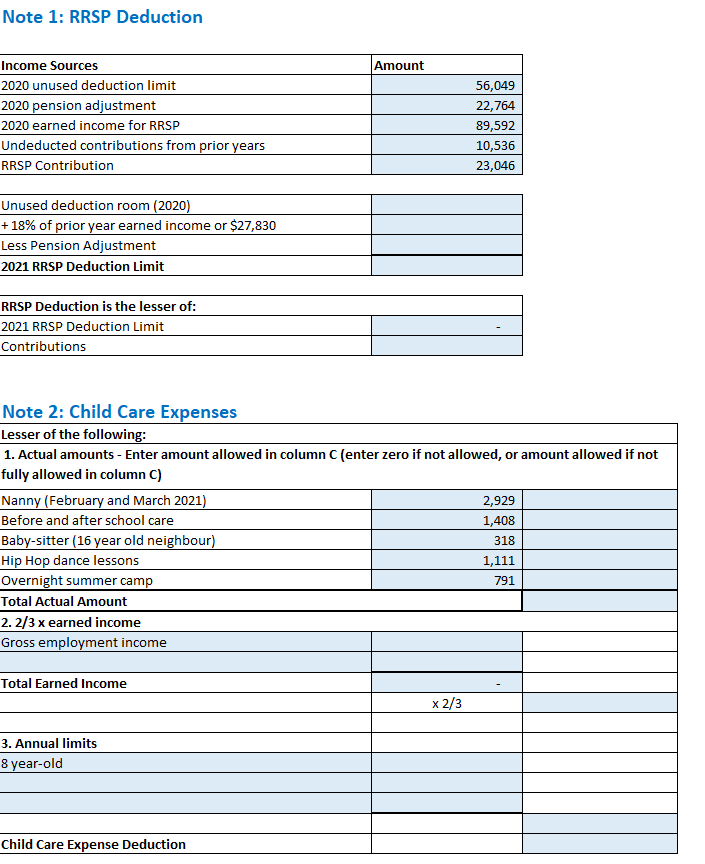

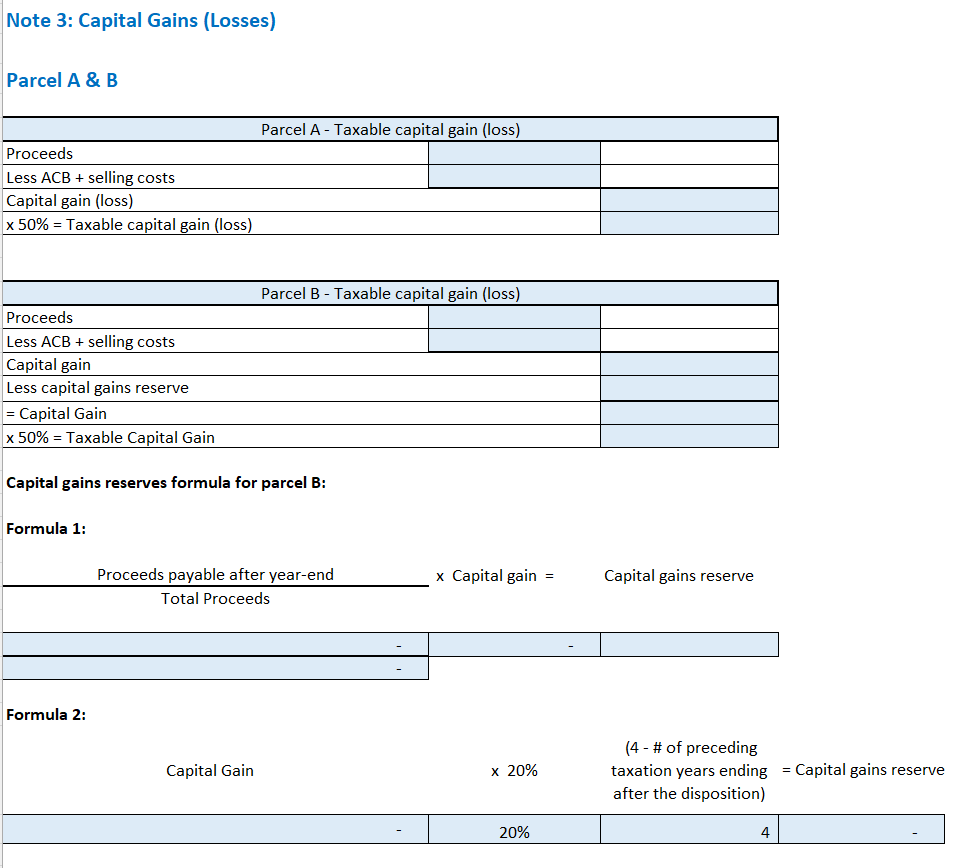

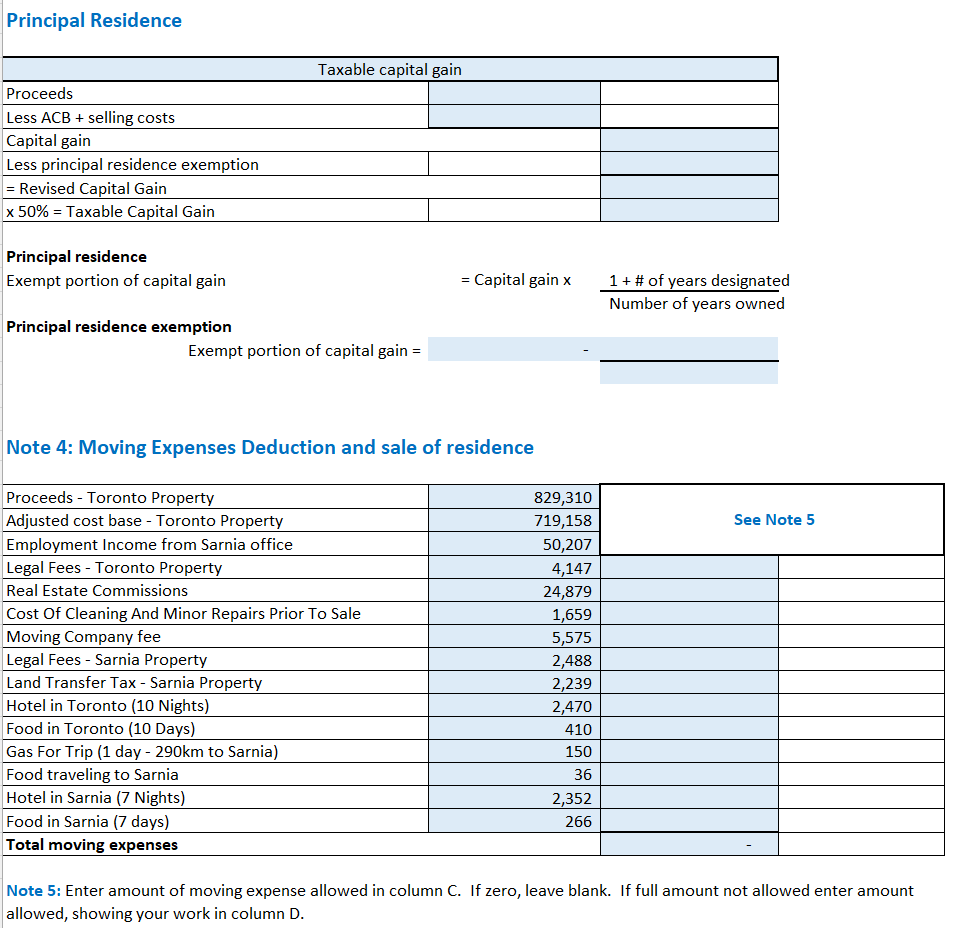

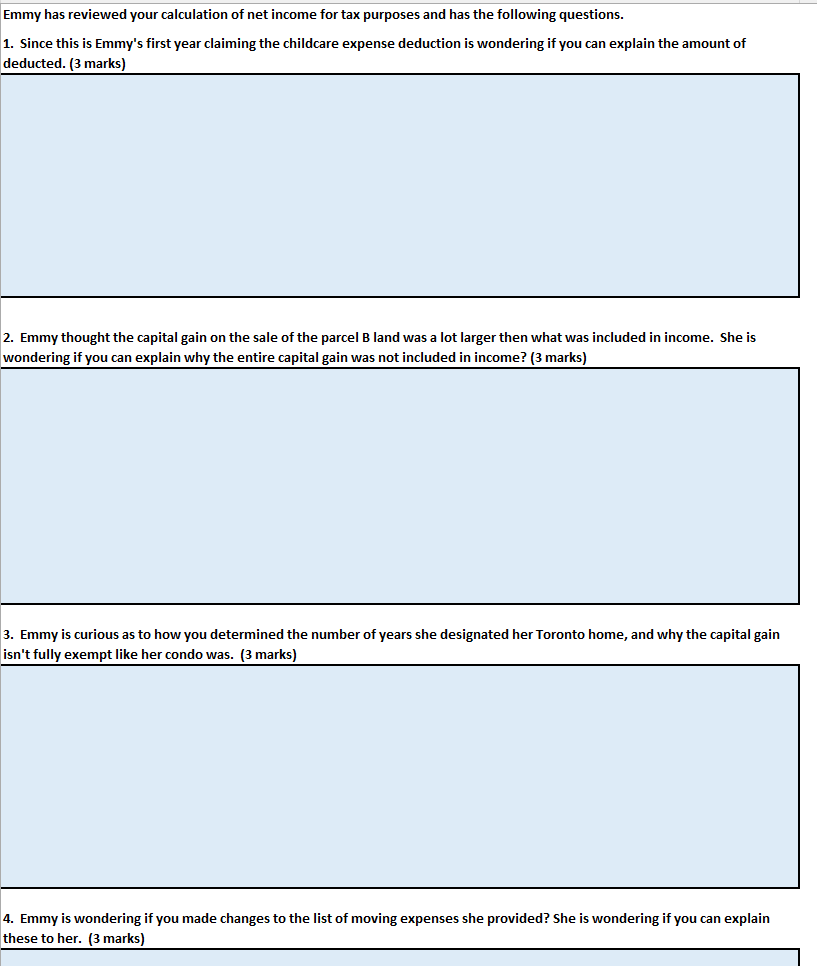

Emmy Peterson, a single taxpayer, was able to complete her own taxes prior to 2021 . In 2020 she earned employment income, had a business loss from a partnership and contributed to her RRSP. This year, however, she requires assistance due to the following life changes and transactions. Income sources and amounts for 2021 are shown below. She is unable to find her 2020 notice of assessment with her 2021 RRSP deduction limit, however, she has provided what information she can in note 1. She adopted an 8 year-old child from the Ukraine and obtained custody on February 1, 2021. She hired a nanny for two months to help the child, Andi, get settled before she began school. The neighbour babysits when Emmy has to work a few hours on the weekend. Andi took hip hop dance lessons at J'dore Dance for eight weeks and attended overnight summer camp for two weeks. Costs paid in the year are outlined in note 2. She sold two parcels of land she had inherited from her grandmother in 2020. The fair market value at the time of inheritance and the proceeds are outlined below. She entered into a financing arrangement with the buyer of parcel B to receive a 30% down payment in the year of sale, 30% in the year following the sale and the remaining 40% the year thereafter. Templates to calculate gains and losses are provided in note 3. She was requested to relocate by her employer and agreed thinking moving to a smaller center may be better to raise a child. For this reason she agreed to relocated from Toronto to Sarnia. She owned the home she sold in Toronto for nine years. She would like to utilize the principal residence exemption for this transaction. During this 9 years she owned a condo for four years and used the principal residence to fully exempt the gain. Costs associated with the move, and sale of her residence are contained in note 4. Emmy will use the simplified method of determining vehicle and food costs in calculating her moving expenses. Assume that the relevant flat rate for vehicle expenses is $0.53 for Ontario, and the flat rate for meals is $51 per person per day. Note 1: RRSP Deduction Note 3: Capital Gains (Losses) Parcel A \& B Principal Residence Principal residence Exempt portion of capital gain = Capital gain xNumberofyearsowned1+#ofyearsdesignated Principal residence exemption Exempt portion of capital gain = Note 4: Moving Expenses Deduction and sale of residence Note 5: Enter amount of moving expense allowed in column C. If zero, leave blank. If full amount not allowed enter amount allowed, showing your work in column D. Emmy has reviewed your calculation of net income for tax purposes and has the following questions. 2. Emmy thought the capital gain on the sale of the parcel B land was a lot larger then what was included in income. She is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts