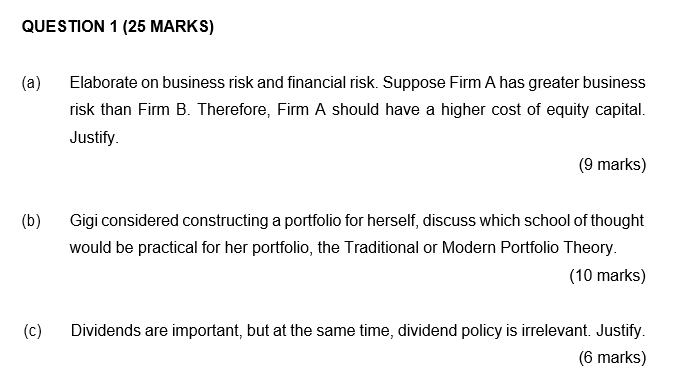

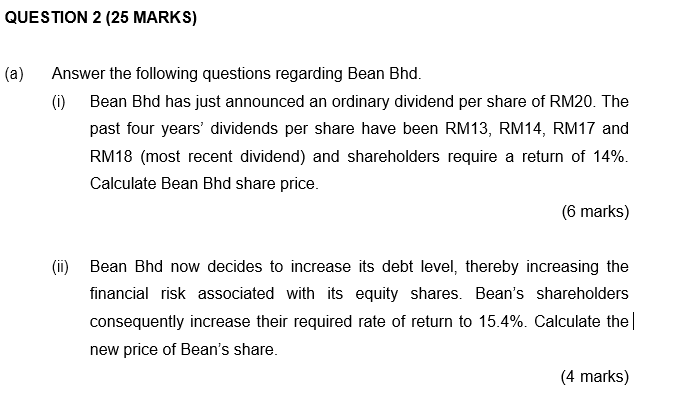

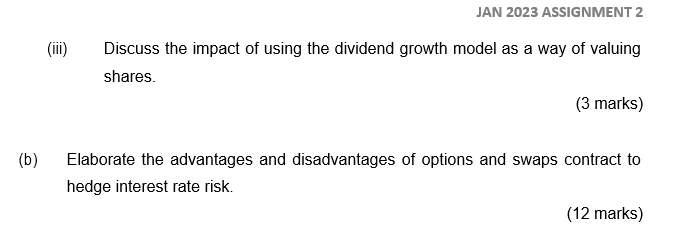

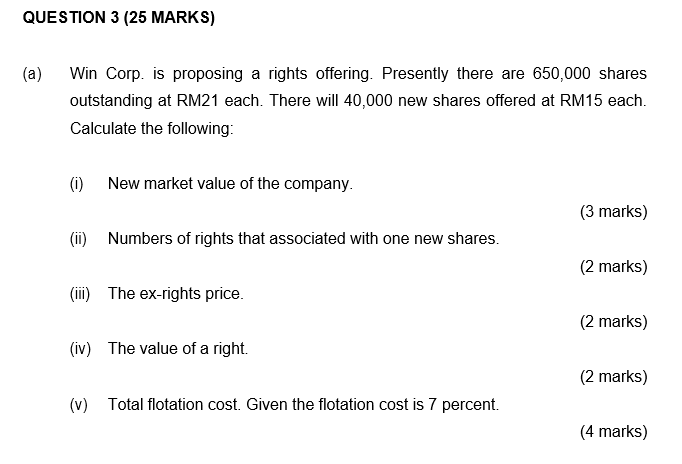

Question: Hi tutor! Please give accurate answer. Do not copy from other app. QUESTION 1 (25 MARKS) (a) Elaborate on business risk and financial risk. Suppose

Hi tutor! Please give accurate answer. Do not copy from other app.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock