Question: Hie there, please explain the questions step by step, the answers are provided for your checking but please do not copy the answers step by

Hie there, please explain the questions step by step, the answers are provided for your checking but please do not copy the answers step by step. Please explain where did the theories and formulas coming from and please make any external references, the key points for these questions is the explanations part rather than the formulas part, thank you!

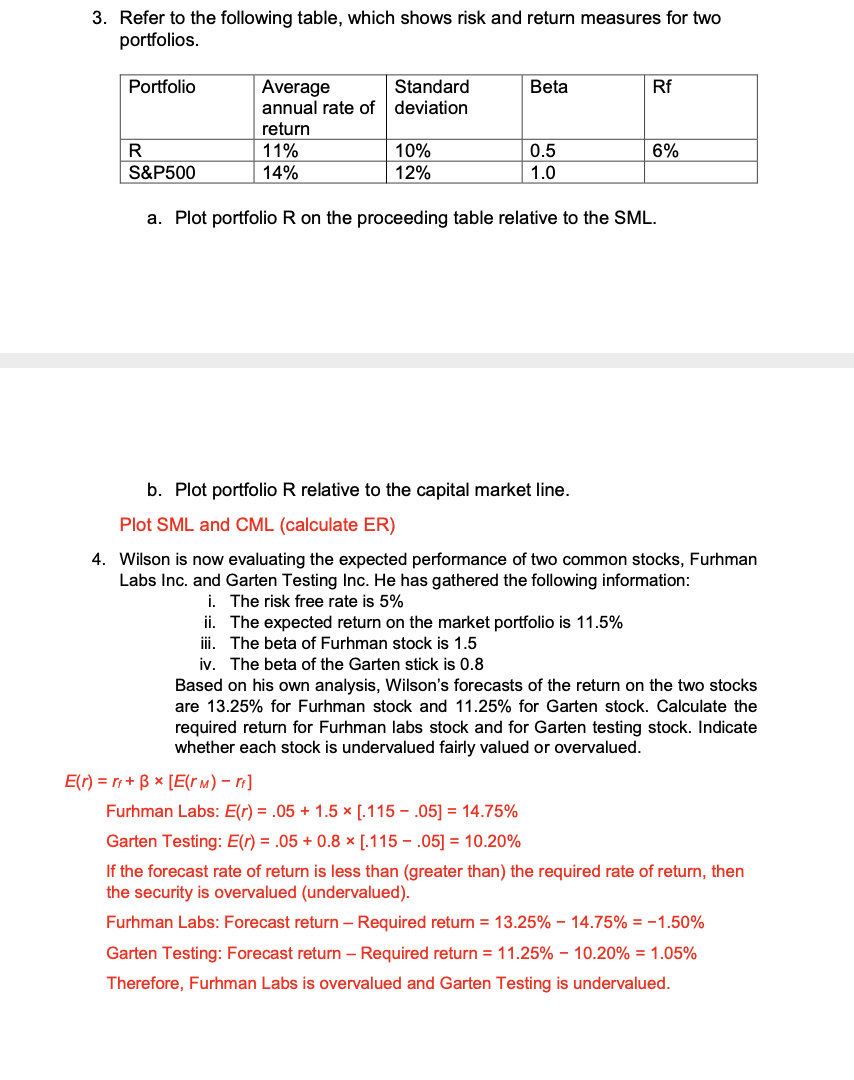

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts