Question: Highlight Address Greeting Insert Merge Serge Fields Block Field Match Fields Budito Lobels ABC al find Recipient Preview Results Check for Errats Preview Results Finish

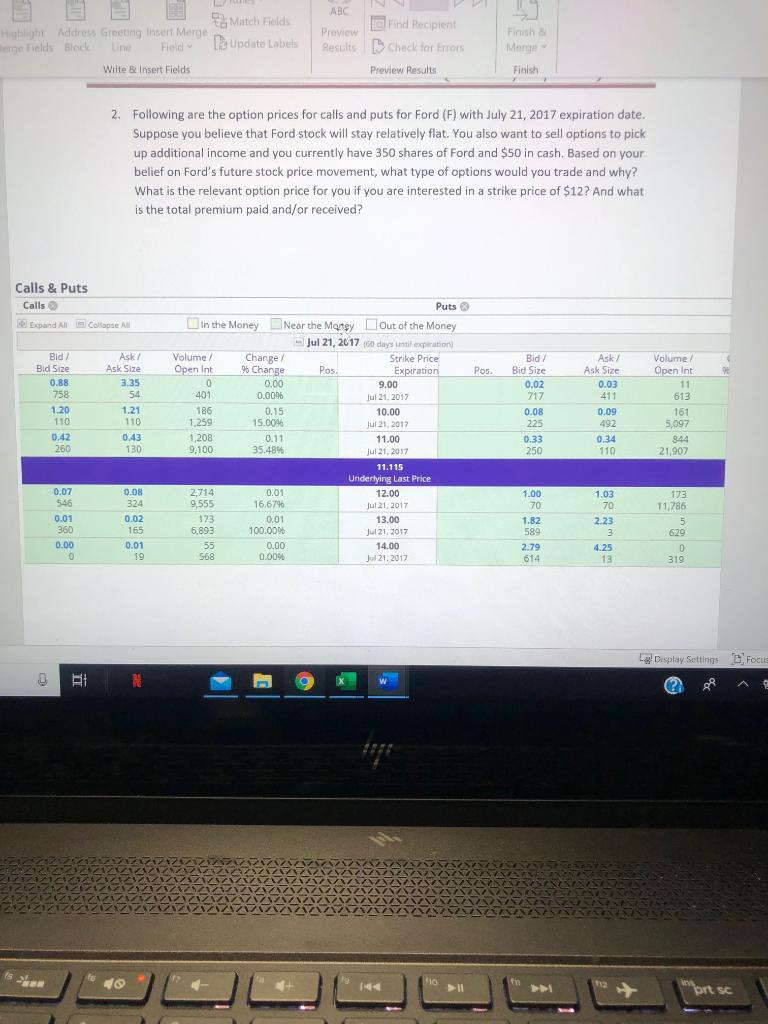

Highlight Address Greeting Insert Merge Serge Fields Block Field Match Fields Budito Lobels ABC al find Recipient Preview Results Check for Errats Preview Results Finish Merge Write & Insert Fields Finish 2. Following are the option prices for calls and puts for Ford (F) with July 21, 2017 expiration date. Suppose you believe that Ford stock will stay relatively flat. You also want to sell options to pick up additional income and you currently have 350 shares of Ford and $50 in cash. Based on your belief on Ford's future stock price movement, what type of options would you trade and why? What is the relevant option price for you if you are interested in a strike price of $12? And what is the total premium paid and/or received? Calls & Puts Calls Expand All Collapse All Pos. Bid/ Bid Size 0.88 758 1.20 110 0.42 260 Ask/ Ask Size 3.35 54 1.21 110 0.43 130 Puts In the Money Near the Martey out of the Money Jul 21, 2017 days until expiration Volume/ Change / Strike Price Open Int 96 Change Pos Expiration 0 0.00 9.00 401 0.0096 Jul 21, 2017 186 0.15 10.00 1,259 15.00% Jul 21, 2017 1,208 0.11 11.00 9,100 35.489 Jul 21. 2017 11.115 Underlying Last Price 2,714 0.01 9.555 16,6790 Jul 21, 2017 173 0.01 13.00 6,893 100.0096 Jul 21, 2017 55 0.00 14.00 568 0.00% Jul 21, 2017 Bid / Bid Size 0.02 717 0.08 225 0.33 250 Ask/ Ask Size 0.03 411 0.09 492 0.34 110 Volume Open Int 11 613 161 5,097 844 21,907 0.08 324 12.00 0.07 546 0.01 360 0.00 0 0.02 165 0.01 19 1.00 70 1.82 589 2.79 614 1.03 70 2.23 3 3 4.25 13 173 11,786 5 629 0 0 319 La Display Settings Focus Bi E 0 te 1 ta prt sc Highlight Address Greeting Insert Merge Serge Fields Block Field Match Fields Budito Lobels ABC al find Recipient Preview Results Check for Errats Preview Results Finish Merge Write & Insert Fields Finish 2. Following are the option prices for calls and puts for Ford (F) with July 21, 2017 expiration date. Suppose you believe that Ford stock will stay relatively flat. You also want to sell options to pick up additional income and you currently have 350 shares of Ford and $50 in cash. Based on your belief on Ford's future stock price movement, what type of options would you trade and why? What is the relevant option price for you if you are interested in a strike price of $12? And what is the total premium paid and/or received? Calls & Puts Calls Expand All Collapse All Pos. Bid/ Bid Size 0.88 758 1.20 110 0.42 260 Ask/ Ask Size 3.35 54 1.21 110 0.43 130 Puts In the Money Near the Martey out of the Money Jul 21, 2017 days until expiration Volume/ Change / Strike Price Open Int 96 Change Pos Expiration 0 0.00 9.00 401 0.0096 Jul 21, 2017 186 0.15 10.00 1,259 15.00% Jul 21, 2017 1,208 0.11 11.00 9,100 35.489 Jul 21. 2017 11.115 Underlying Last Price 2,714 0.01 9.555 16,6790 Jul 21, 2017 173 0.01 13.00 6,893 100.0096 Jul 21, 2017 55 0.00 14.00 568 0.00% Jul 21, 2017 Bid / Bid Size 0.02 717 0.08 225 0.33 250 Ask/ Ask Size 0.03 411 0.09 492 0.34 110 Volume Open Int 11 613 161 5,097 844 21,907 0.08 324 12.00 0.07 546 0.01 360 0.00 0 0.02 165 0.01 19 1.00 70 1.82 589 2.79 614 1.03 70 2.23 3 3 4.25 13 173 11,786 5 629 0 0 319 La Display Settings Focus Bi E 0 te 1 ta prt sc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts