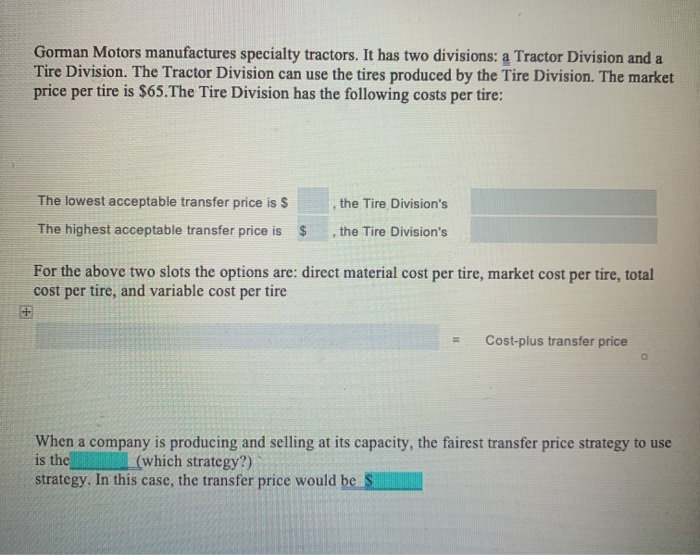

Question: Highlighted what needs to be filled in w boxes light and bright blue thank u ! Gorman Motors manufactures specialty tractors. It has two divisions:

Highlighted what needs to be filled in w boxes light and bright blue thank u !

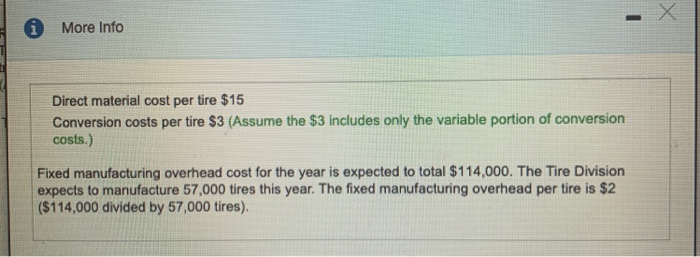

Highlighted what needs to be filled in w boxes light and bright blue thank u ! Gorman Motors manufactures specialty tractors. It has two divisions: a Tractor Division and a Tire Division. The Tractor Division can use the tires produced by the Tire Division. The market price per tire is $65. The Tire Division has the following costs per tire: The lowest acceptable transfer price is $ the Tire Division's The highest acceptable transfer price is $ the Tire Division's For the above two slots the options are: direct material cost per tire, market cost per tire, total cost per tire, and variable cost per tire Cost-plus transfer price When a company is producing and selling at its capacity, the fairest transfer price strategy to use is the (which strategy?) strategy. In this case, the transfer price would be S More Info Direct material cost per tire $15 Conversion costs per tire $3 (Assume the $3 includes only the variable portion of conversion costs.) Fixed manufacturing overhead cost for the year is expected to total $114,000. The Tire Division expects to manufacture 57,000 tires this year. The fixed manufacturing overhead per tire is $2 ($114,000 divided by 57,000 tires)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts