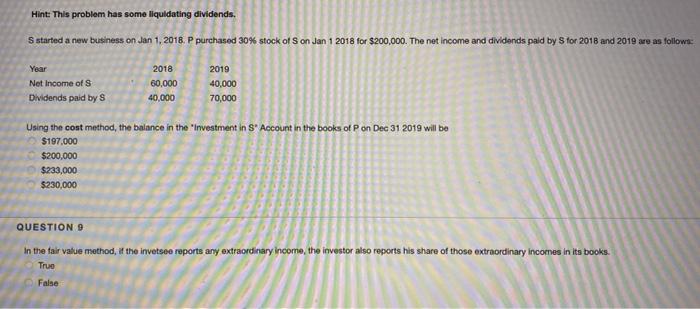

Question: Hint: This problem has some liquidating dividends. S started a new business on Jan 1, 2018. P purchased 30% stock of Son Jan 1 2018

Hint: This problem has some liquidating dividends. S started a new business on Jan 1, 2018. P purchased 30% stock of Son Jan 1 2018 for $200,000. The net income and dividends paid by S for 2018 and 2019 are as follows: Year Net Income of S Dividends paid by S 2018 60,000 40.000 2019 40,000 70,000 Using the cost method, the balance in the "Investment in S* Account in the books of P on Dec 31 2019 will be $197.000 $200,000 $233,000 $230,000 QUESTIONS In the fair value method, if the invetse reports any extraordinary income, the investor also reports his share of those extraordinary incomes in its books. True False

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock