Question: QUESTIONS Hint: This problem has some liquidating dividends. S started a new business on Jan 1, 2018. P purchased 30 stock of Son Jan 1

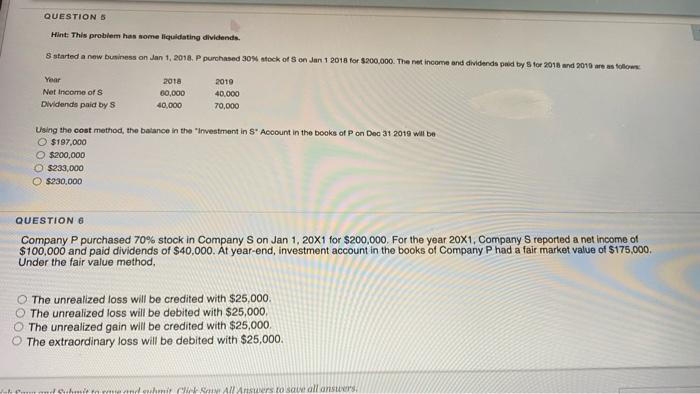

QUESTIONS Hint: This problem has some liquidating dividends. S started a new business on Jan 1, 2018. P purchased 30 stock of Son Jan 1 2018 for $200,000. The net income and dividenda paid by Stor 2013 and 2016 are as follows: Year Net Income of Dividends paid by s 2018 60,000 40,000 2010 40.000 70,000 Using the cost method, the balance in the "Investment in S" Account in the books of P on Dec 31 2018 will be $197.000 $200,000 5233,000 $230,000 QUESTION 6 Company P purchased 70% stock in Company Son Jan 1, 20x1 for $200,000. For the year 20X1. Company S reported a net income of $100,000 and paid dividends of $40,000. At year-end, investment account in the books of Company Phad a fair market value of $175,000. Under the fair value method. The unrealized loss will be credited with $25,000 The unrealized loss will be debited with $25,000. The unrealized gain will be credited with $25,000 The extraordinary loss will be debited with $25,000. found mit dem Alters to save all answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts