Question: Hint use the Thomson Lumber example from chapter 3 pg 34. - The model under uncertainty Please answer the following questions and submit What are

Hint use the Thomson Lumber example from chapter 3 pg 34. - The model under uncertainty

Please answer the following questions and submit

What are your answers under: Maximax?

Maximin?

Equally Likely?

Hurwicz?

Regret/Minimax?

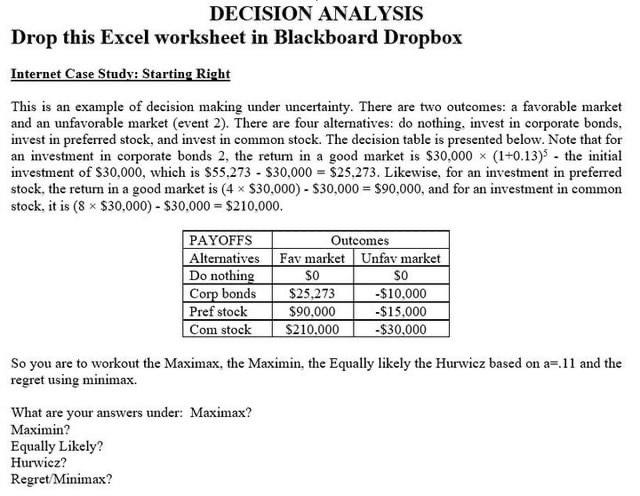

DECISION ANALYSIS Drop this Excel worksheet in Blackboard Dropbox Internet Case Study: Starting Right This is an example of decision making under uncertainty. There are two outcomes: a favorable market and an unfavorable market (event 2). There are four alternatives: do nothing. invest in corporate bonds. invest in preferred stock, and invest in common stock. The decision table is presented below. Note that for an investment in corporate bonds 2, the return in a good market is $30.000 X (1+0.13) - the initial investment of $30,000, which is $55.273 - $30.000 = $25,273. Likewise, for an investment in preferred stock, the return in a good market is (4 $30,000) - $30,000 = $90,000, and for an investment in common stock, it is (8 * $30.000) - $30.000 = $210.000. PAYOFFS Outcomes Alternatives Fav market Unfav market Do nothing SO SO Corp bonds $25.273 -$10,000 Pref stock $90.000 -$15.000 Com stock $210.000 -$30,000 So you are to workout the Maximax, the Maximin, the Equally likely the Hurwicz based on a=.11 and the regret using minimax. What are your answers under: Maximax? Maximin? Equally Likely? Hurwicz? Regret/Minimax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts