Question: Hobbies1 due July 22, maximum 2 points This assignment refers to Gleim 5, question 9. 1. If a taxpayer has gains and losses from an

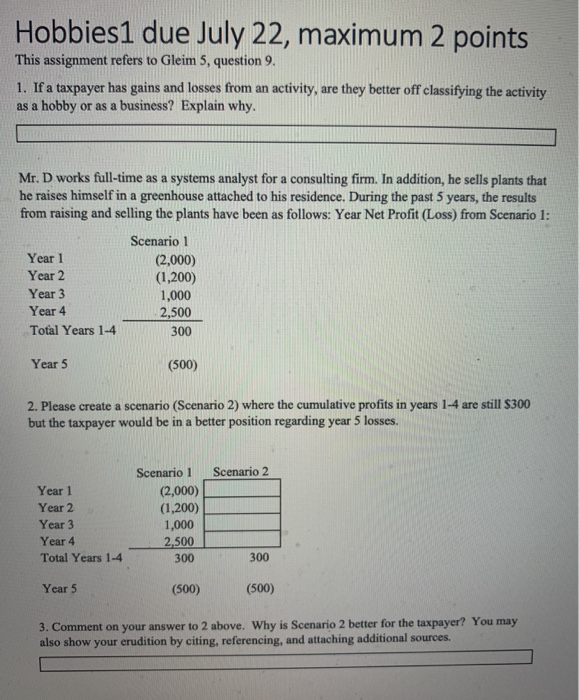

Hobbies1 due July 22, maximum 2 points This assignment refers to Gleim 5, question 9. 1. If a taxpayer has gains and losses from an activity, are they better off classifying the activity as a hobby or as a business? Explain why. Mr. D works full-time as a systems analyst for a consulting firm. In addition, he sells plants that he raises himself in a greenhouse attached to his residence. During the past 5 years, the results from raising and selling the plants have been as follows: Year Net Profit (Loss) from Scenario 1: Scenario 1 Year 1 (2,000) Year 2 (1,200) Year 3 1,000 Year 4 2,500 Total Years 1-4 300 Year 5 (500) 2. Please create a scenario (Scenario 2) where the cumulative profits in years 1-4 are still $300 but the taxpayer would be in a better position regarding year 5 losses. Scenario 2 Year 1 Year 2 Year 3 Year 4 Total Years 1-4 Scenario 1 (2,000) (1,200) 1,000 2.500 300 300 Year 5 (500) (500) 3. Comment on your answer to 2 above. Why is Scenario 2 better for the taxpayer? You may also show your erudition by citing, referencing, and attaching additional sources

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts