Question: Home Inser Draw Page Layout Formulas Data Review View Developer Times New Roman 14 A A General Paste C23x fic In cell D15, by using

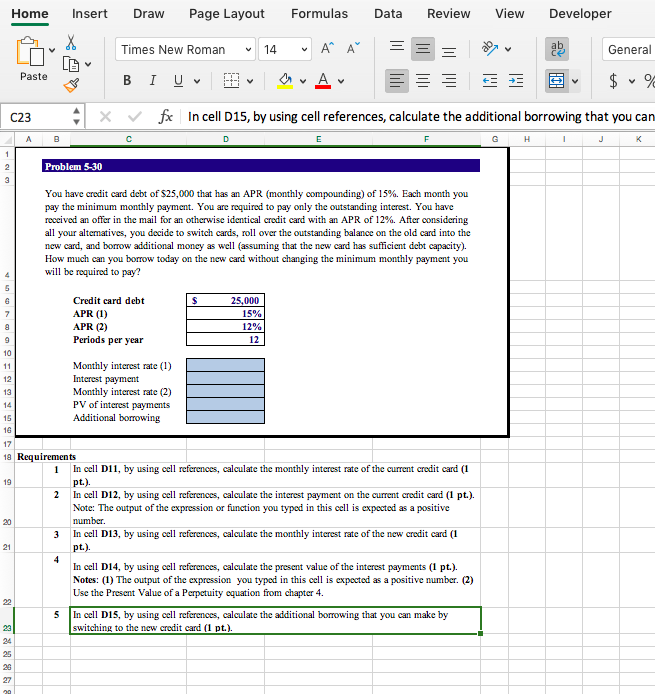

Home Inser Draw Page Layout Formulas Data Review View Developer Times New Roman 14 A A General Paste C23x fic In cell D15, by using cell references, calculate the additional borrowing that you can Problem 5-30 You have credit card debt of S25,000 that has an APR (monthly compounding of 15%. Each month you pay the minimum monthly payment. You are roquired to pay only the outstanding interest. You have received an offer in the mail for an otherwise identical credit card with an APR of 12%. After considering all your alternatives, you decide to switch cards, roll over the outstanding balance on the old card into the new card, and borrow additional moncy as well (assuming that the new card has sufficient debt capacity). How much can you borow today on the new card without changing the minimum monthly payment you will be required to pay? Credit card debt APR (1) APR (2) Periods per year 10 Monthly interest rate (1) Interest payment Monthly interest rate (2) PV of interest payments Additional borrowing 16 1 Requirements 1 In cell D11, by using cell references, calculate the monthly interest rate of the current credit card (1 2In cell D12, by using cell references, calculate the interest payment on the curent credit card (1 pt.). Note: The output of the expression or function you typed in this cell is expectod as a positive 3 In cell D13, by using cell references, calculate the monthly interest rate of the new credit card (1 21 pt.). In cell D14, by using cell references, calculate the present value of the interest payments (1 pt.). Notes: (1) The output of the expression you typed in this cell is expected as a positive number. (2) Use the Present Value of a Perpctuity equation from chapter 4 5 In cell D15, by using cell references, calculate the additional borrowing that you can make by switching to the new credit card (1 pt)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts