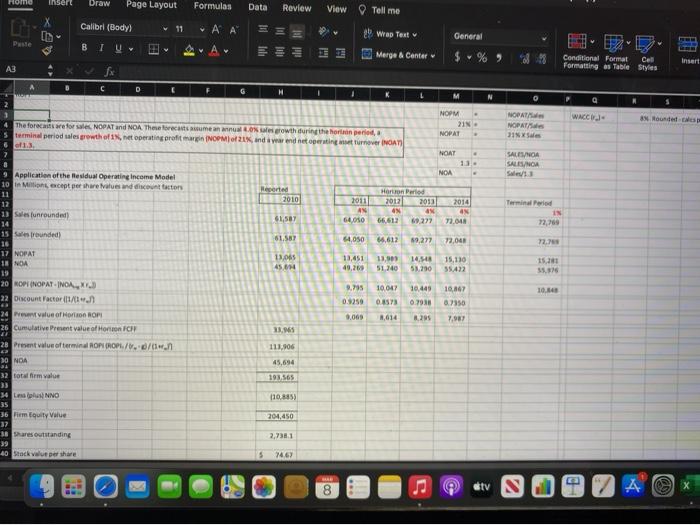

Question: Home insert Draw Page Layout Formulas Data Review View Tell me X Calibel (Body) 11 * ' Wrap Test B I SAA General $ %

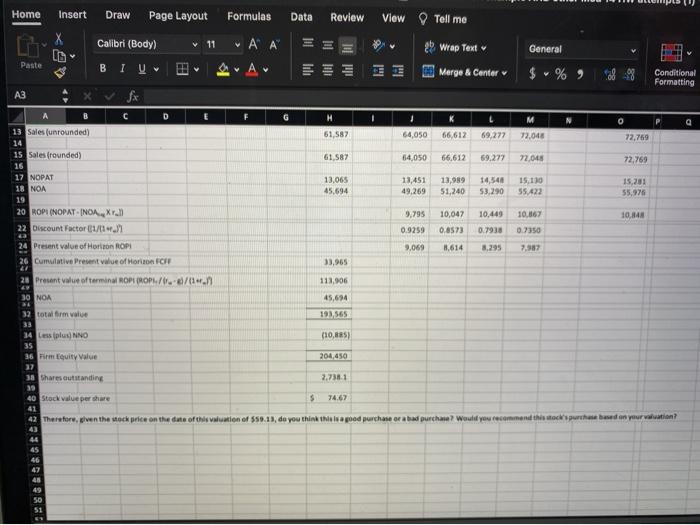

Home insert Draw Page Layout Formulas Data Review View Tell me X Calibel (Body) 11 * ' Wrap Test B I SAA General $ % ) Merge & Center Conditional Format Cel Formatting as Table Styles Insert A3 B D WACJE a onde The forecast for a NOPAT and NOA. The forecastsume an annual growth during the horren period, terminal period sales growth of net operating profitar INOMI 21%, indywend net operating turnover INAT 1.3. NORM 21. NOPAT NOPAT NOPAT 315 NOAT - SALINA SALES/NOR Set NOA 2010 2014 Horn Period 2012 2013 4N 69.277 2011 AN 64.010 Terminal 61,587 72,048 IN 72,769 61,587 4,050 66,612 $9,277 72,048 72.7 13.06 45. 15.110 13,451 49,269 13,909 51,740 148 53.250 15 35.876 9 Application of the fesidual Operating Income Model 10 in Mecept per share values and contactos 11 12 19 sesfunrounded 14 15 rounded) 16 17 NOPAT 18 NOA 19 20 ROPINOPATINOA, 22 Discount Factor / 24 alue of Horon ROP 26 Cumulative present value of Horron FCF EX 28 Present value of terminal ROPROP./././ 30 NOA 31 32 total firm value 10047 10.449 9.795 0.9259 10.14 0.7930 2.295 10,867 0.7350 7.00 0.009 1,014 18.MS 111,906 45,694 193,565 110.385) 204,450 34 Less NO 35 36 m quity Vue 37 30 Shares outstanding 39 40 Stack valueshare 2,7381 5 74.67 t 8 F atv 2 "A X Home Insert Draw Page Layout Formulas Data Review View Tell me X Calibri (Body) v 11 Wrap Text General ' Paste Merge & Center $ %, Conditional Formatting G M 51,587 64,050 66,612 69,272 72,048 72,769 61587 64,050 66.612 69,277 72.045 72,769 13.065 45,694 11,451 49.269 13,989 51,240 14,548 53.290 15, 110 55.422 15,201 55,976 9.795 10,047 10.449 10,8148 BI A3 fx A C D 13 Salesfunrounded) 14 15 Sales (rounded) 16 17 NOPAT 18 NOA 19 20 ROPI (NOPATINOA, r.1 22 Discount Factor (1) 24 Present value of Horizon ROP 26 Cumulative Present value of Horon FCHF 21 20 Preuent value of terminal ROP CROPI/-/ 30 NOA 32 total firm value 33 14 Les plus) NNO 35 36 Firm Equity Value 27 30 shares outstanding 10.867 0.7350 0.9259 0.8573 0.7930 3.295 9.069 8,614 7.987 33,965 113,906 45,694 198,565 (10,885) 204,450 2.7381 40 Stock value per share 74.67 41 42 Therefore, given the mock price on the date of this valuation of $59.13, do you think this is a good purchase or a bad purchase? Would you recommend this to purchased on your valuation? 46 47 48 49 50 51 61 Home insert Draw Page Layout Formulas Data Review View Tell me X Calibel (Body) 11 * ' Wrap Test B I SAA General $ % ) Merge & Center Conditional Format Cel Formatting as Table Styles Insert A3 B D WACJE a onde The forecast for a NOPAT and NOA. The forecastsume an annual growth during the horren period, terminal period sales growth of net operating profitar INOMI 21%, indywend net operating turnover INAT 1.3. NORM 21. NOPAT NOPAT NOPAT 315 NOAT - SALINA SALES/NOR Set NOA 2010 2014 Horn Period 2012 2013 4N 69.277 2011 AN 64.010 Terminal 61,587 72,048 IN 72,769 61,587 4,050 66,612 $9,277 72,048 72.7 13.06 45. 15.110 13,451 49,269 13,909 51,740 148 53.250 15 35.876 9 Application of the fesidual Operating Income Model 10 in Mecept per share values and contactos 11 12 19 sesfunrounded 14 15 rounded) 16 17 NOPAT 18 NOA 19 20 ROPINOPATINOA, 22 Discount Factor / 24 alue of Horon ROP 26 Cumulative present value of Horron FCF EX 28 Present value of terminal ROPROP./././ 30 NOA 31 32 total firm value 10047 10.449 9.795 0.9259 10.14 0.7930 2.295 10,867 0.7350 7.00 0.009 1,014 18.MS 111,906 45,694 193,565 110.385) 204,450 34 Less NO 35 36 m quity Vue 37 30 Shares outstanding 39 40 Stack valueshare 2,7381 5 74.67 t 8 F atv 2 "A X Home Insert Draw Page Layout Formulas Data Review View Tell me X Calibri (Body) v 11 Wrap Text General ' Paste Merge & Center $ %, Conditional Formatting G M 51,587 64,050 66,612 69,272 72,048 72,769 61587 64,050 66.612 69,277 72.045 72,769 13.065 45,694 11,451 49.269 13,989 51,240 14,548 53.290 15, 110 55.422 15,201 55,976 9.795 10,047 10.449 10,8148 BI A3 fx A C D 13 Salesfunrounded) 14 15 Sales (rounded) 16 17 NOPAT 18 NOA 19 20 ROPI (NOPATINOA, r.1 22 Discount Factor (1) 24 Present value of Horizon ROP 26 Cumulative Present value of Horon FCHF 21 20 Preuent value of terminal ROP CROPI/-/ 30 NOA 32 total firm value 33 14 Les plus) NNO 35 36 Firm Equity Value 27 30 shares outstanding 10.867 0.7350 0.9259 0.8573 0.7930 3.295 9.069 8,614 7.987 33,965 113,906 45,694 198,565 (10,885) 204,450 2.7381 40 Stock value per share 74.67 41 42 Therefore, given the mock price on the date of this valuation of $59.13, do you think this is a good purchase or a bad purchase? Would you recommend this to purchased on your valuation? 46 47 48 49 50 51 61

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts