Question: question 3 only. thank you! 2. Answer the questions. - 1) The current stock price for Firm D is $100 while the next dividend is

question 3 only. thank you!

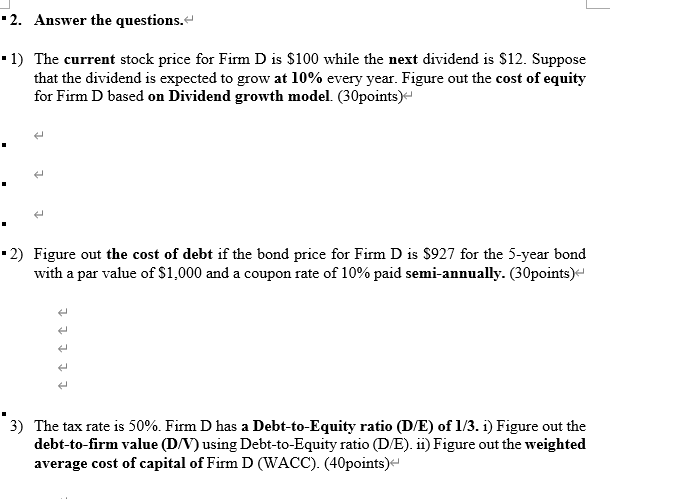

2. Answer the questions. - 1) The current stock price for Firm D is $100 while the next dividend is $12. Suppose that the dividend is expected to grow at 10% every year. Figure out the cost of equity for Firm D based on Dividend growth model. (30points) L 2) Figure out the cost of debt if the bond price for Firm D is $927 for the 5-year bond with a par value of $1,000 and a coupon rate of 10% paid semi-annually. (30points) - 3) The tax rate is 50%. Firm D has a Debt-to-Equity ratio (D/E) of 1/3. i) Figure out the debt-to-firm value (D/V) using Debt-to-Equity ratio (D/E). 11) Figure out the weighted average cost of capital of Firm D (WACC). (40points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts