Question: Homework 2 1. Suppose John borrows $25,000 as a fixed payment loan from the Bank of Pacific. The interest rate is 10% and repayment period

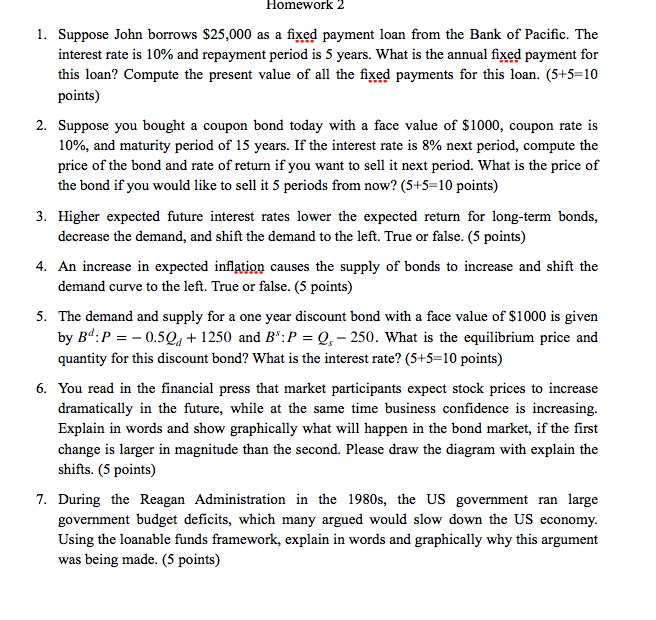

Homework 2 1. Suppose John borrows $25,000 as a fixed payment loan from the Bank of Pacific. The interest rate is 10% and repayment period is 5 years. What is the annual fixed payment for this loan? Compute the present value of all the fixed payments for this loan. (5+5=10 points) 2. Suppose you bought a coupon bond today with a face value of $1000, coupon rate is 10%, and maturity period of 15 years. If the interest rate is 8% next period, compute the price of the bond and rate of return if you want to sell it next period. What is the price of the bond if you would like to sell it 5 periods from now? (5+5=10 points) 3. Higher expected future interest rates lower the expected return for long-term bonds, decrease the demand, and shift the demand to the left. True or false. (5 points) 4. An increase in expected inflation causes the supply of bonds to increase and shift the demand curve to the left. True or false. (5 points) 5. The demand and supply for a one year discount bond with a face value of $1000 is given by Bd:P = -0.594 + 1250 and B":P = 0; 250. What is the equilibrium price and quantity for this discount bond? What is the interest rate? (5+5=10 points) 6. You read in the financial press that market participants expect stock prices to increase dramatically in the future, while at the same time business confidence is increasing. Explain in words and show graphically what will happen in the bond market, if the first change is larger in magnitude than the second. Please draw the diagram with explain the shifts. (5 points) 7. During the Reagan Administration in the 1980s, the US government ran large government budget deficits, which many argued would slow down the US economy. Using the loanable funds framework, explain in words and graphically why this argument was being made. (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts