Question: Homework 3 (Chapter 9-Valuing Stocks) due before 2/20/2023 11:59 pm Please show all your work to receive full credit. You could write the financial calculator

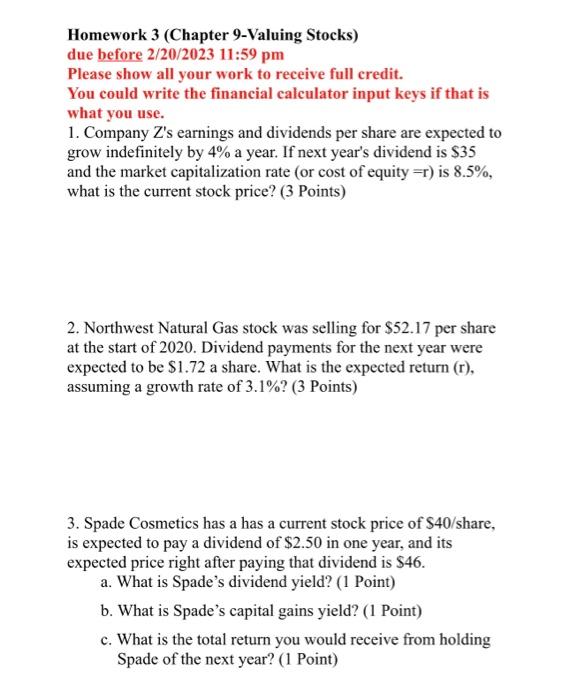

Homework 3 (Chapter 9-Valuing Stocks) due before 2/20/2023 11:59 pm Please show all your work to receive full credit. You could write the financial calculator input keys if that is what you use. 1. Company Z's earnings and dividends per share are expected to grow indefinitely by 4% a year. If next year's dividend is $35 and the market capitalization rate (or cost of equity =r ) is 8.5%, what is the current stock price? (3 Points) 2. Northwest Natural Gas stock was selling for $52.17 per share at the start of 2020 . Dividend payments for the next year were expected to be $1.72 a share. What is the expected return (r), assuming a growth rate of 3.1% ? (3 Points) 3. Spade Cosmetics has a has a current stock price of $40/ share, is expected to pay a dividend of $2.50 in one year, and its expected price right after paying that dividend is $46. a. What is Spade's dividend yield? (1 Point) b. What is Spade's capital gains yield? (1 Point) c. What is the total return you would receive from holding Spade of the next year? (1 Point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts