Question: Homework: 4.14 Score: 0 of 1 pt Problem 4-107 (algorithmic) Save 3 of 3 (0 complete) HW Score: 0%, O of 3 pts EQuestion Help

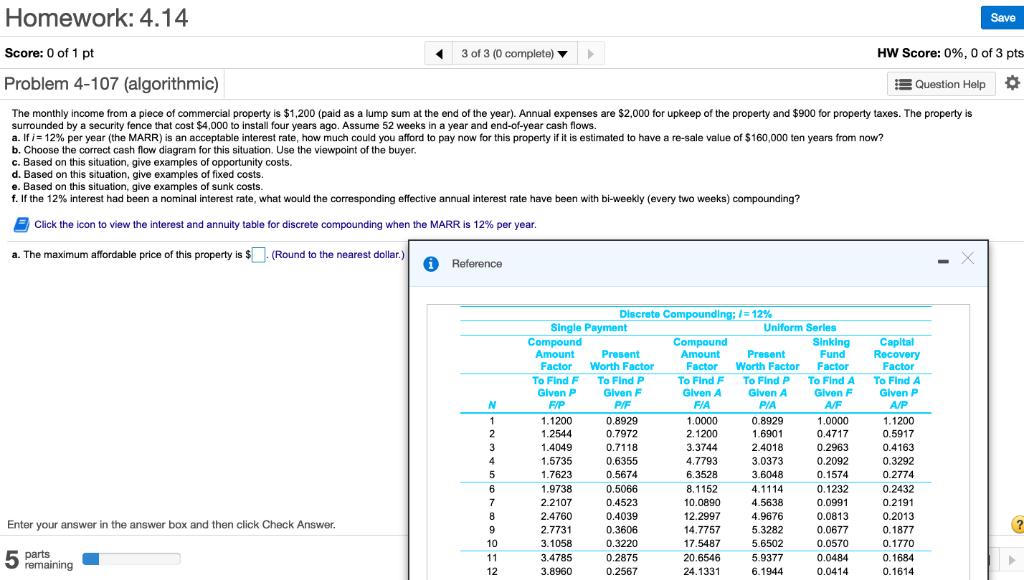

Homework: 4.14 Score: 0 of 1 pt Problem 4-107 (algorithmic) Save 3 of 3 (0 complete) HW Score: 0%, O of 3 pts EQuestion Help The monthly income from a piece of commercial property is $1,200 (paid as a lump sum at the end of the year). Annual expenses are $2,000 for upkeep of the property and $900 for property taxes. The property is surrounded by a security fence that cost $4,000 to install four years ago. Assume 52 weeks in a year and end-of-year cash flows. a. If i= 12% per year (the MARR) is an acceptable interest rate, how much could you afford to pay now for this property if it is estimated to have a re-sale value of $160,000 ten years from now? b. Choose the correct cash flow diagram for this situation. Use the viewpoint of the buyer c. Based on this situation, give examples of opportunity costs. d. Based on this situation, give examples of fixed costs. e. Based on this situation, give examples of sunk costs. f. If the 12% interest had been a nominal interest rate, what would the corresponding effective annual interest rate have been with bi-weekly (every two weeks) compounding? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year a. The maximum affordable price of this property is $(Round to the nearest dollar.) Reference Discrete Co ndin /s12% Single Payment Unlform Series Sinking Capltal Amount Present Present Factor Worth Factor Factor Fund Recovery Factor Worth Factor To Find F To Find P To Find F To Find PTo Find A Given A Gven AGiven FGiven P To Find A 0.8929 1.1200 3.3744 4.7793 6.3528 2.4018 3.0373 3.6048 1.4049 0.7118 0.6355 0.5674 0.5066 0.4523 0.4039 0.3606 0.3220 0.2875 0.2567 0.2963 0.2092 0.3292 1.7623 1.9738 2.2107 2.4760 10.0890 12.2997 14.7757 17.5487 20.6546 24.1331 0.1232 0.0991 0.0813 0.0677 0.0570 0.0484 0.0414 4.5638 4.9676 5.3282 0.2191 0.2013 0.1877 0.1770 Enter your answer in the answer box and then click Check Answer 3.1058 5 parts rema 1 5.9377 6.1944 3.8960 0.1614

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts