Question: Homework: 7.10 Score: 0 of 1 pt Problem 7-48 (algorithmic) Save HW Score: 44.44%, 4 of 6 of 9 (4 complete) Question Help Certain new

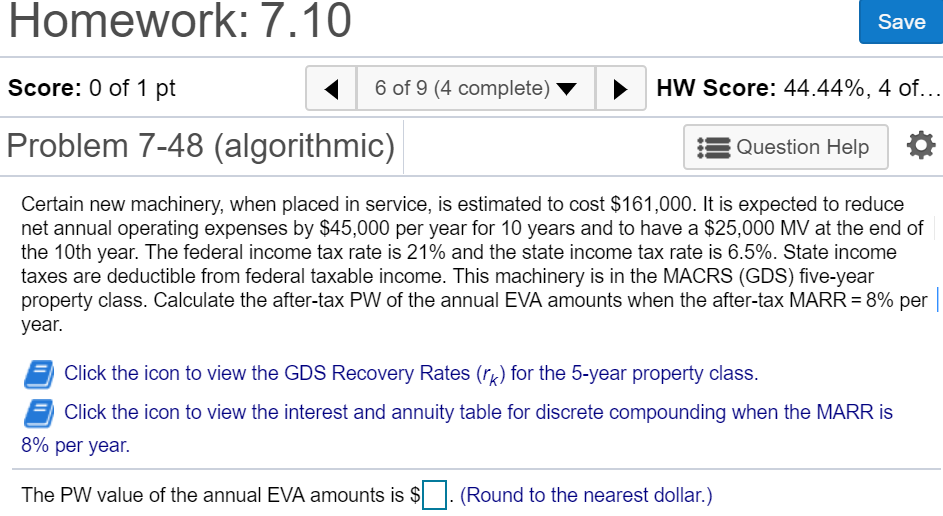

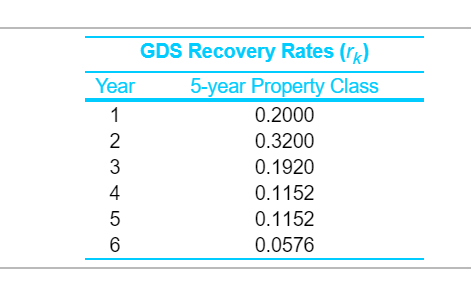

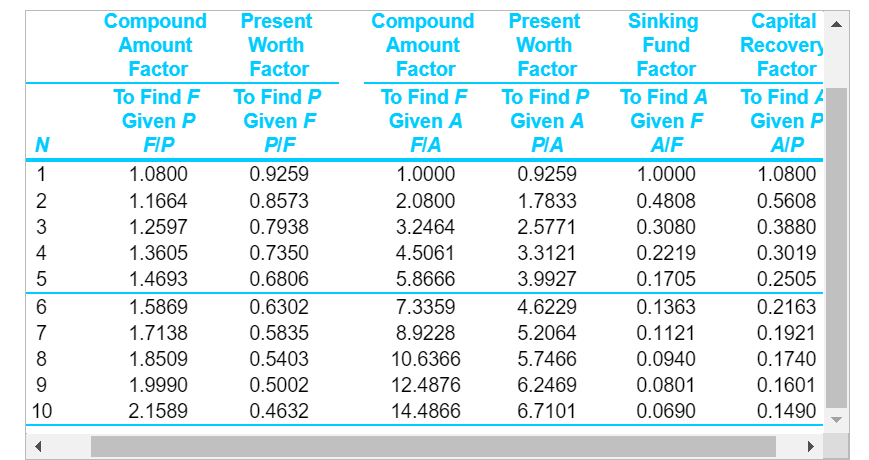

Homework: 7.10 Score: 0 of 1 pt Problem 7-48 (algorithmic) Save HW Score: 44.44%, 4 of 6 of 9 (4 complete) Question Help Certain new machinery, when placed in service, is estimated to cost $161,000. It is expected to reduce net annual operating expenses by $45,000 per year for 10 years and to have a $25,000 MV at the end of the 10th year. The federal income tax rate is 21% and the state income tax rate is 6.5%. State income taxes are deductible from federal taxable income. This machinery is in the MACRS (GDS) five-year property class. Calculate the after-tax PW of the annual EVA amounts when the after-tax MARR-8% per l year Click the icon to view the GDS Recovery Rates (rx) for the 5-year property class. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 8% per year. The PW value of the annual EVA amounts is s(Round to the nearest dollar) GDS Recovery Rates (rk) Year5-year Property Class 0.2000 0.3200 0.1920 0.1152 0.1152 0.0576 2 3 4 6 Sinking Fund Factor To Find A Capital Recover Factor Compound Present Compound Present Amount Factor To Find F Given P FIP 1.0800 1.1664 1.2597 1.3605 1.4693 1.5869 1.7138 1.8509 1.9990 2.1589 Worth Factor To FindP Given F PIF 0.9259 0.8573 0.7938 0.7350 0.6806 0.6302 0.5835 0.5403 0.5002 0.4632 Amount Factor To Find F Given A FIA 1.0000 2.0800 3.2464 4.5061 5.8666 7.3359 8.9228 10.6366 12.4876 14.4866 Worth Factor To Find P To Find Given P AIP 1.0800 0.5608 0.3880 0.3019 0.2505 0.2163 0.1921 0.1740 0.1601 0.1490 Given AGiven AIF PIA 0.9259 1.7833 2.5771 3.3121 3.9927 4.6229 5.2064 5.7466 6.2469 6.7101 1.0000 0.4808 0.3080 0.2219 0.1705 0.1363 0.1121 0.0940 0.0801 0.0690 2 4 6 8 10 Homework: 7.10 Score: 0 of 1 pt Problem 7-48 (algorithmic) Save HW Score: 44.44%, 4 of 6 of 9 (4 complete) Question Help Certain new machinery, when placed in service, is estimated to cost $161,000. It is expected to reduce net annual operating expenses by $45,000 per year for 10 years and to have a $25,000 MV at the end of the 10th year. The federal income tax rate is 21% and the state income tax rate is 6.5%. State income taxes are deductible from federal taxable income. This machinery is in the MACRS (GDS) five-year property class. Calculate the after-tax PW of the annual EVA amounts when the after-tax MARR-8% per l year Click the icon to view the GDS Recovery Rates (rx) for the 5-year property class. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 8% per year. The PW value of the annual EVA amounts is s(Round to the nearest dollar) GDS Recovery Rates (rk) Year5-year Property Class 0.2000 0.3200 0.1920 0.1152 0.1152 0.0576 2 3 4 6 Sinking Fund Factor To Find A Capital Recover Factor Compound Present Compound Present Amount Factor To Find F Given P FIP 1.0800 1.1664 1.2597 1.3605 1.4693 1.5869 1.7138 1.8509 1.9990 2.1589 Worth Factor To FindP Given F PIF 0.9259 0.8573 0.7938 0.7350 0.6806 0.6302 0.5835 0.5403 0.5002 0.4632 Amount Factor To Find F Given A FIA 1.0000 2.0800 3.2464 4.5061 5.8666 7.3359 8.9228 10.6366 12.4876 14.4866 Worth Factor To Find P To Find Given P AIP 1.0800 0.5608 0.3880 0.3019 0.2505 0.2163 0.1921 0.1740 0.1601 0.1490 Given AGiven AIF PIA 0.9259 1.7833 2.5771 3.3121 3.9927 4.6229 5.2064 5.7466 6.2469 6.7101 1.0000 0.4808 0.3080 0.2219 0.1705 0.1363 0.1121 0.0940 0.0801 0.0690 2 4 6 8 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts