Question: = Homework: 4-3 MyFinanceLab: Assignm... Question 1, Problem P7-... Part 1 of 5 HW Score: 0%, 0 of 50 points O Points: 0 of 8

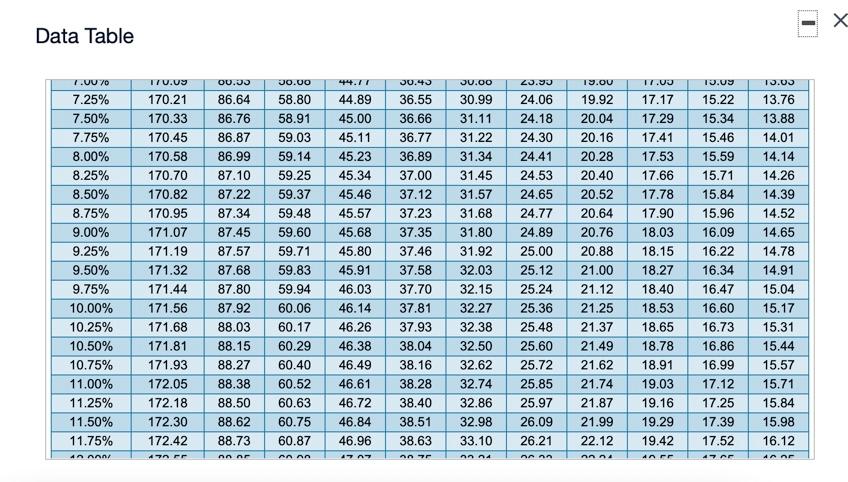

= Homework: 4-3 MyFinanceLab: Assignm... Question 1, Problem P7-... Part 1 of 5 HW Score: 0%, 0 of 50 points O Points: 0 of 8 O Save Shirley, a recent college graduate, excitedly described to her older sister the $1,470 sofa, table, and chairs she found today. However, when asked she could not tell her sister which interest calculation method was to be used on her credit-based purchase. Calculate the monthly payments and total cost for a bank loan assuming a one-year repayment period and 13.25 percent interest. Now, assume the store uses the add-on method of interest calculation. Calculate the monthly payment and total cost with a one-year repayment period and 11.25 percent interest. Explain why the bank payment and total cost are lower even though the stated interest rate is higher. Click on the table icon to view the MILPF table ! The monthly payment for a bank loan assuming one-year repayment period and 13.25 percent interest is $ (Round to the nearest cent.) Help Me Solve This View an Example Get More Help Clear All Check Answer Data Table 44.7 1.0070 7.25% 7.50% 7.75% 8.00% 8.25% 8.50% 8.75% 9.00% 9.25% 9.50% 9.75% 10.00% 10.25% 10.50% 10.75% 11.00% 11.25% 11.50% 11.75% 4A AANI ITU.US 170.21 170.33 170.45 170.58 170.70 170.82 170.95 171.07 171.19 171.32 171.44 171.56 171.68 171.81 171.93 172.05 172.18 172.30 172.42 OU.33 86.64 86.76 86.87 86.99 87.10 87.22 87.34 87.45 87.57 87.68 87.80 87.92 88.03 88.15 88.27 88.38 88.50 88.62 88.73 30.00 58.80 58.91 59.03 59.14 59.25 59.37 59.48 59.60 59.71 59.83 59.94 60.06 60.17 60.29 60.40 60.52 60.63 60.75 60.87 Ann 44.89 45.00 45.11 45.23 45.34 45.46 45.57 45.68 45.80 45.91 46.03 46.14 46.26 46.38 46.49 46.61 46.72 46.84 46.96 1707 30.43 36.55 36.66 36.77 36.89 37.00 37.12 37.23 37.35 37.46 37.58 37.70 37.81 37.93 38.04 38.16 38.28 38.40 38.51 38.63 J0.00 30.99 31.11 31.22 31.34 31.45 31.57 31.68 31.80 31.92 32.03 32.15 32.27 32.38 32.50 32.62 32.74 32.86 32.98 33.10 23.93 24.06 24.18 24.30 24.41 24.53 24.65 24.77 24.89 25.00 25.12 25.24 25.36 25.48 25.60 25.72 25.85 25.97 26.09 26.21 19.00 19.92 20.04 20.16 20.28 20.40 20.52 20.64 20.76 20.88 21.00 21.12 21.25 21.37 21.49 21.62 21.74 21.87 21.99 22.12 17.00 17.17 17.29 17.41 17.53 17.66 17.78 17.90 18.03 18.15 18.27 18.40 18.53 18.65 18.78 18.91 19.03 19.16 19.29 19.42 13.09 15.22 15.34 15.46 15.59 15.71 15.84 15.96 16.09 16.22 16.34 16.47 16.60 16.73 16.86 16.99 17.12 17.25 17.39 17.52 13.03 13.76 13.88 14.01 14.14 14.26 14.39 14.52 14.65 14.78 14.91 15.04 15.17 15.31 15.44 15.57 15.71 15.84 15.98 16.12 -- 4 r nn AAAA Ann nnn. ar an

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts