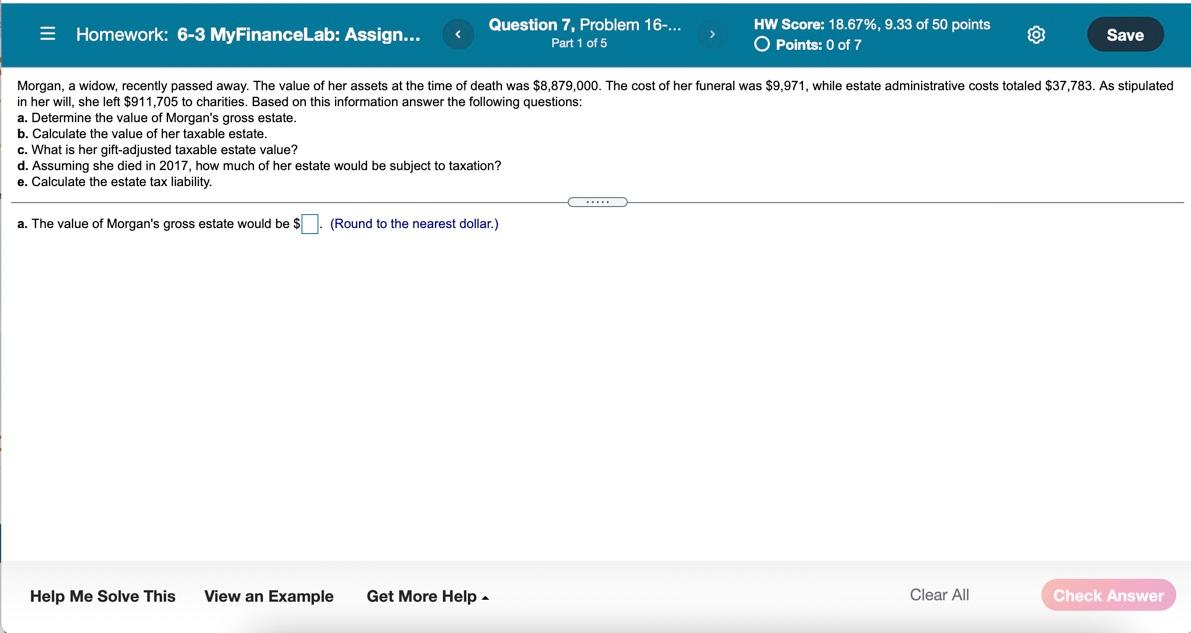

Question: = Homework: 6-3 MyFinanceLab: Assign... Question 7, Problem 16-... Part 1 of 5 HW Score: 18.67%, 9.33 of 50 points O Points: 0 of 7

= Homework: 6-3 MyFinanceLab: Assign... Question 7, Problem 16-... Part 1 of 5 HW Score: 18.67%, 9.33 of 50 points O Points: 0 of 7 Save Morgan, a widow, recently passed away. The value of her assets at the time of death was $8,879,000. The cost of her funeral was $9,971, while estate administrative costs totaled $37,783. As stipulated in her will, she left $911,705 to charities. Based on this information answer the following questions: a. Determine the value of Morgan's gross estate. b. Calculate the value of her taxable estate. c. What is her gift-adjusted taxable estate value? d. Assuming she died in 2017, how much of her estate would be subject to taxation? e. Calculate the estate tax liability. a. The value of Morgan's gross estate would be $ (Round to the nearest dollar.) Help Me Solve This View an Example Get More Help Clear All Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts