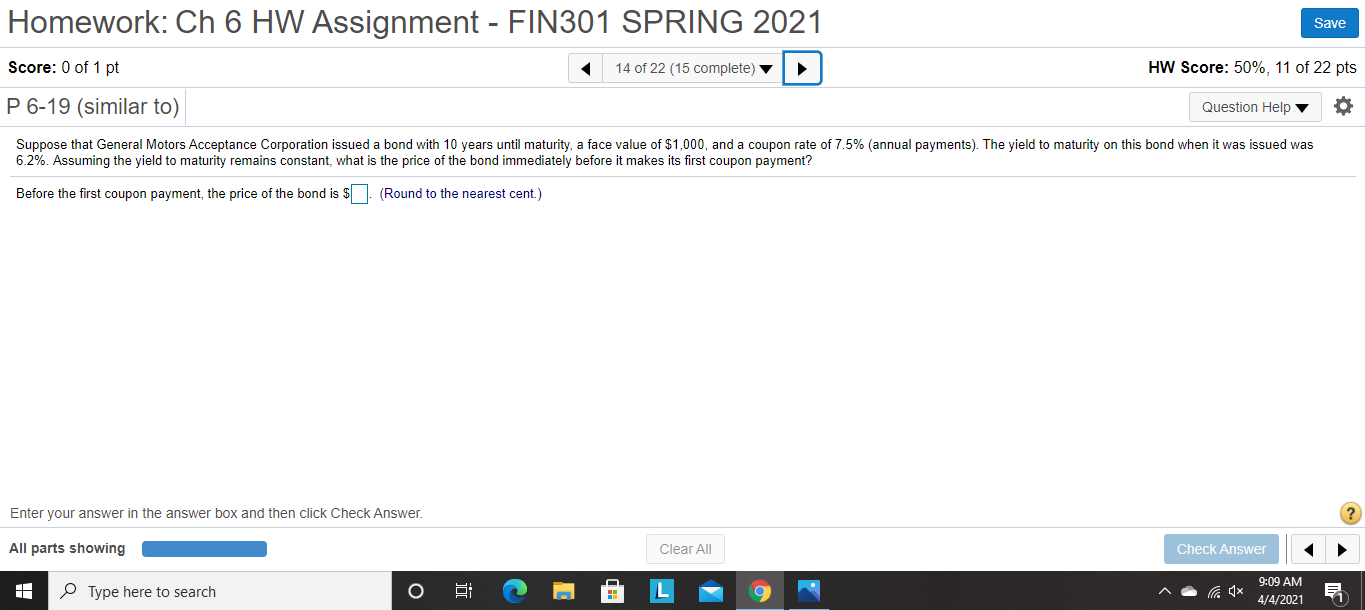

Question: Homework: Ch 6 HW Assignment - FIN301 SPRING 2021 Save Score: 0 of 1 pt 14 of 22 (15 complete) HW Score: 50%, 11 of

Homework: Ch 6 HW Assignment - FIN301 SPRING 2021 Save Score: 0 of 1 pt 14 of 22 (15 complete) HW Score: 50%, 11 of 22 pts P 6-19 (similar to) Question Help Suppose that General Motors Acceptance Corporation issued a bond with 10 years until maturity, a face value of $1,000, and a coupon rate of 7.5% (annual payments). The yield to maturity on this bond when it was issued was 6.2%. Assuming the yield to maturity remains constant, what is the price of the bond immediately before it makes its first coupon payment? Before the first coupon payment, the price of the bond is $. (Round to the nearest cent.) Enter your answer in the answer box and then click Check Answer. All parts showing Clear All Check Answer 9:09 AM H Type here to search o (x 4/4/2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts