Question: undefined Homework: Ch 6 HW Assignment - FIN301 SPRING 2021 Save Score: 0 of 1 pt 18 of 22 (15 complete) HW Score: 50%, 11

undefined

undefined

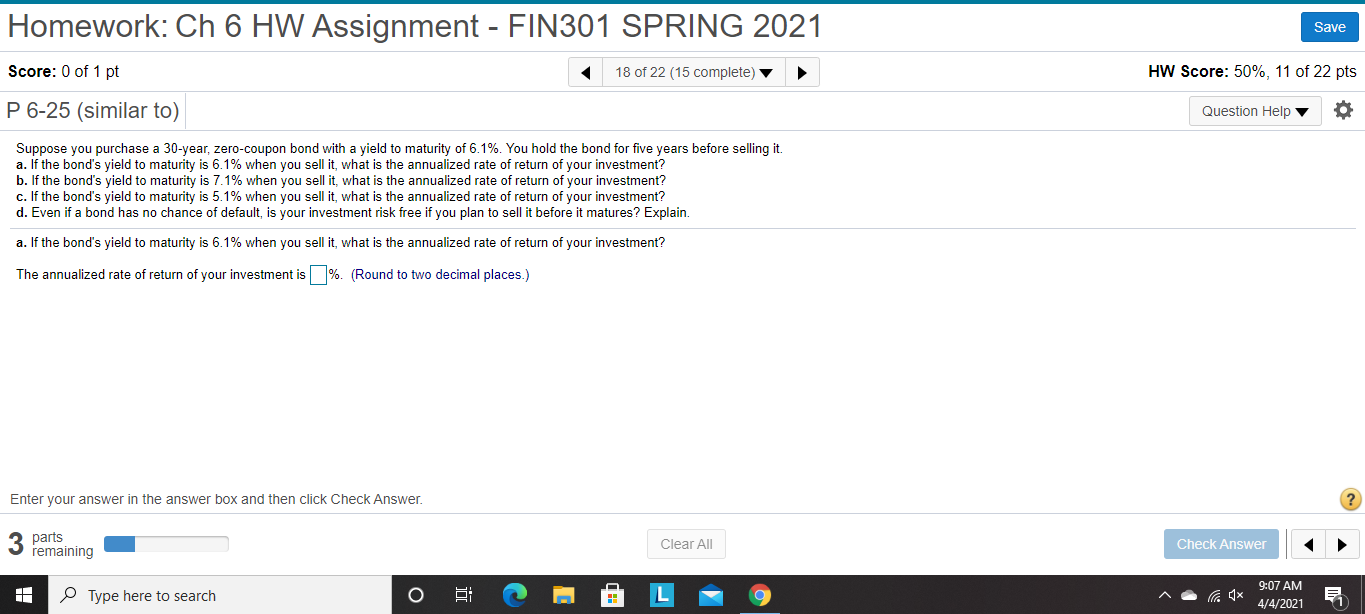

Homework: Ch 6 HW Assignment - FIN301 SPRING 2021 Save Score: 0 of 1 pt 18 of 22 (15 complete) HW Score: 50%, 11 of 22 pts P 6-25 (similar to) Question Help Suppose you purchase a 30-year, zero-coupon bond with a yield to maturity of 6.1%. You hold the bond for five years before selling it. a. If the bond's yield to maturity is 6.1% when you sell it, what is the annualized rate of return of your investment? b. If the bond's yield to maturity is 7.1% when you sell it, what is the annualized rate of return of your investment? c. If the bond's yield to maturity is 5.1% when you sell it, what is the annualized rate of return of your investment? d. Even if a bond has no chance of default, is your investment risk free if you plan to sell it before it matures? Explain. a. If the bond's yield to maturity is 6.1% when you sell it, what is the annualized rate of return of your investment? The annualized rate of return of your investment is %. (Round to two decimal places.) Enter your answer in the answer box and then click Check Answer. 3 parts remaining Clear All Check Answer Type here to search x 9:07 AM 4/4/2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts