Question: @ Homework: Ch 8 Homework Question 1, P 8-8 (similar to) Part 1 of 3 HW Score: 0%, 0 of 5 points Points: 0 of

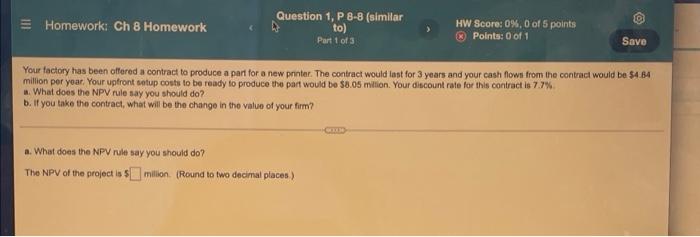

@ Homework: Ch 8 Homework Question 1, P 8-8 (similar to) Part 1 of 3 HW Score: 0%, 0 of 5 points Points: 0 of 1 Save Your factory has been offered a contract to produce a part for a new printer. The contract would last for 3 years and your cash flows from the contract would be $4.84 million per year. Your upfront setup costs to be ready to produce the part would be $8.05 million. Your discount rate for this contract is 7.7% What does the NPV rule say you should do? b. If you take the contract, what will be the change in the value of your firm? . What does the NPV rule say you should do? The NPV of the project is $milion (Round to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts