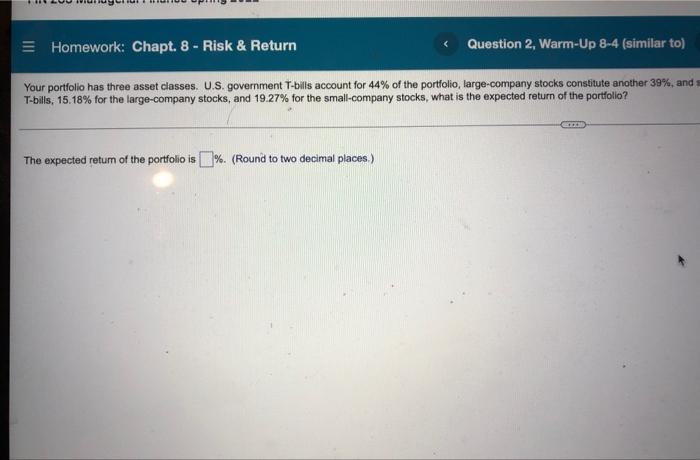

Question: = Homework: Chapt. 8 - Risk & Return Question 2, Warm-Up 8-4 (similar to) Your portfolio has three asset classes. U.S. government T-bills account for

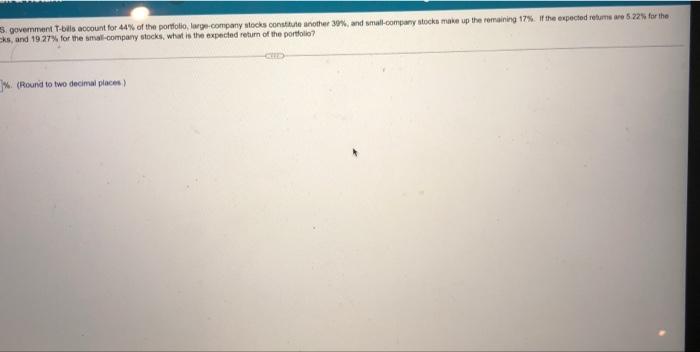

= Homework: Chapt. 8 - Risk & Return Question 2, Warm-Up 8-4 (similar to) Your portfolio has three asset classes. U.S. government T-bills account for 44% of the portfolio, large-company stocks constitute another 39%, and T-bills, 15.18% for the large-company stocks, and 19.27% for the small-company stocks, what is the expected return of the portfolio? The expected retum of the portfolio is 3%. (Round to two decimal places.) 5 government Tbilis account for 44% of the portfolio, large company stocks constitute another 30% and small company stock make up the remaining 17%. If the expected retume we 5 225 for the sks, and 19.27% for the small company stocks, what is the expected return of the portfolio 1x Round to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts