Question: . Homework: Chapter 10. Learning Objective 2. Topic Homework 1 Save Score: 0 of 1 pt Problem 10.L02.27 (similar to) B of 9 (6 complete)

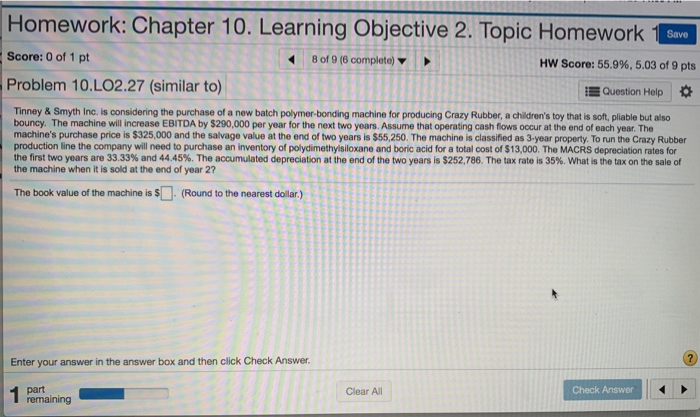

. Homework: Chapter 10. Learning Objective 2. Topic Homework 1 Save Score: 0 of 1 pt Problem 10.L02.27 (similar to) B of 9 (6 complete) HW Score: 55.9%, 5.03 of 9 pts O O O ES Question Help Tinney & Smyth Inc. is considering the purchase of a new batch polymer bonding machine for producing Crazy Rubber, a children's toy that is soft, pliable but also bouncy. The machine will increase EBITDA by $290,000 per year for the next two years. Assume that operating cash flows occur at the end of each year. The machine's purchase price is $325,000 and the salvage value at the end of two years is $55,250. The machine is classified as 3-year property. To run the Crazy Rubber production line the company will need to purchase an inventory of polydimethylsiloxane and boric acid for a total cost of $13,000. The MACRS depreciation rates for the first two years are 33.33% and 44.45%. The accumulated depreciation at the end of the two years is $252,786. The tax rate is 35%. What is the tax on the sale of the machine when it is sold at the end of year 2? The book value of the machine is $ . (Round to the nearest dollar.) Enter your answer in the answer box and then click Check Answer Check Answer 1 part remaining

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts