Question: Homework: Chapter 10. Learning Objective 2. Topic Homework 1 Save Score: 0 of 1 pt 4 of 18 (12 complete) HW Score: 66.67%, 12 of

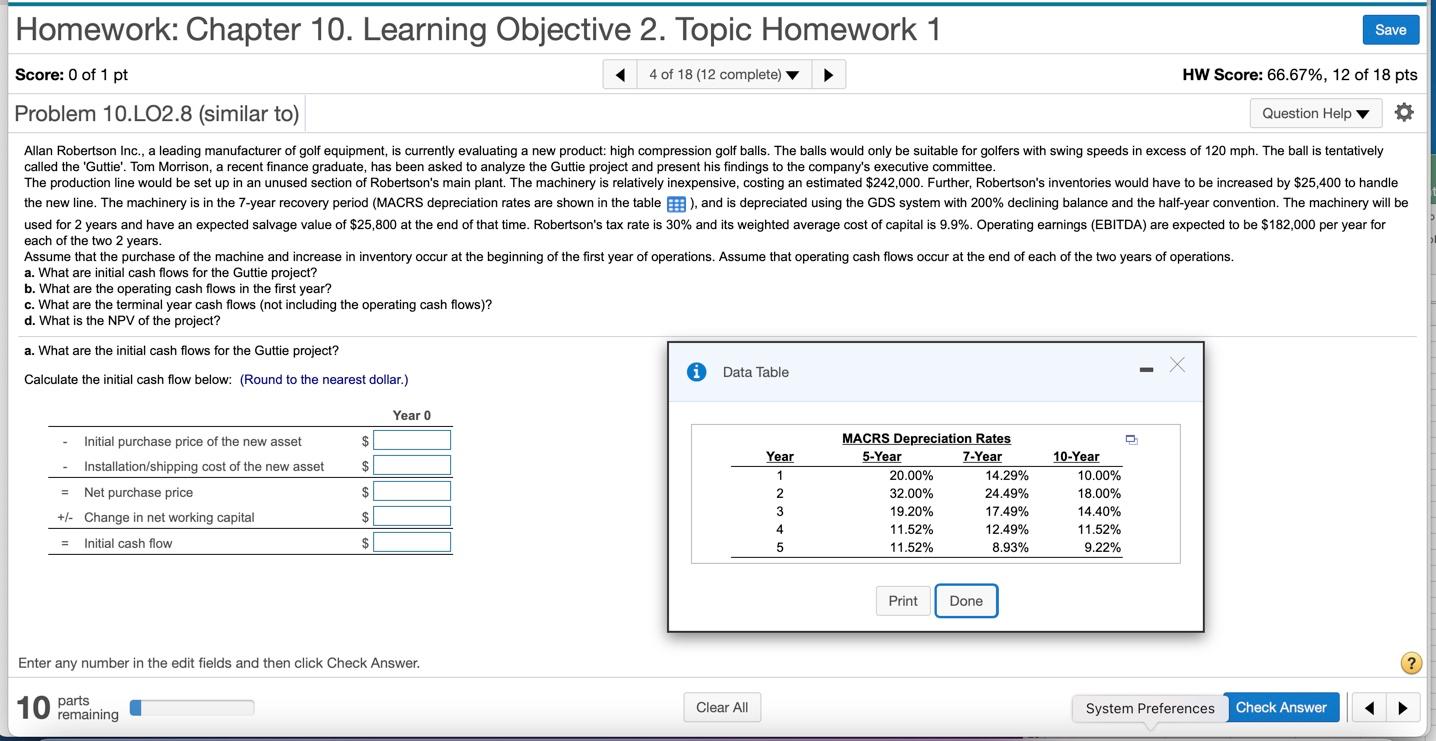

Homework: Chapter 10. Learning Objective 2. Topic Homework 1 Save Score: 0 of 1 pt 4 of 18 (12 complete) HW Score: 66.67%, 12 of 18 pts Problem 10.LO2.8 (similar to) Question Help Allan Robertson Inc., a leading manufacturer of golf equipment, is currently evaluating a new product: high compression golf balls. The balls would only be suitable for golfers with swing speeds in excess of 120 mph. The ball is tentatively called the 'Guttie'. Tom Morrison, a recent finance graduate, has been asked to analyze the Guttie project and present his findings to the company's executive committee. The production line would be set up in an unused section of Robertson's main plant. The machinery is relatively inexpensive, costing an estimated $242,000. Further, Robertson's inventories would have to be increased by $25,400 to handle the new line. The machinery is in the 7-year recovery period (MACRS depreciation rates are shown in the table ), and is depreciated using the GDS system with 200% declining balance and the half-year convention. The machinery will be used for 2 years and have an expected salvage value of $25,800 at the end of that time. Robertson's tax rate is 30% and its weighted average cost of capital is 9.9%. Operating earnings (EBITDA) are expected to be $182,000 per year for each of the two 2 years. Assume that the purchase of the machine and increase in inventory occur at the beginning of the first year of operations. Assume that operating cash flows occur at the end of each of the two years of operations. a. What are initial cash flows for the Guttie project? b. What are the operating cash flows in the first year? c. What are the terminal year cash flows (not including the operating cash flows)? d. What is the NPV of the project? a. What are the initial cash flows for the Guttie project? Calculate the initial cash flow below: (Round to the nearest dollar.) Data Table Year 0 $ $ Initial purchase price of the new asset Installation/shipping cost of the new asset Net purchase price +/- Change in net working capital $ Year 1 2 3 4 5 MACRS Depreciation Rates 5-Year 7-Year 20.00% 14.29% 32.00% 24.49% 19.20% 17.49% 11.52% 12.49% 11.52% 8.93% 10-Year 10.00% 18.00% 14.40% 11.52% 9.22% $ Initial cash flow $ Print Done Done Enter any number in the edit fields and then click Check Answer. ? 10 parts Clear All remaining System Preferences Check Answer Homework: Chapter 10. Learning Objective 2. Topic Homework 1 Save Score: 0 of 1 pt 4 of 18 (12 complete) HW Score: 66.67%, 12 of 18 pts Problem 10.LO2.8 (similar to) Question Help Allan Robertson Inc., a leading manufacturer of golf equipment, is currently evaluating a new product: high compression golf balls. The balls would only be suitable for golfers with swing speeds in excess of 120 mph. The ball is tentatively called the 'Guttie'. Tom Morrison, a recent finance graduate, has been asked to analyze the Guttie project and present his findings to the company's executive committee. The production line would be set up in an unused section of Robertson's main plant. The machinery is relatively inexpensive, costing an estimated $242,000. Further, Robertson's inventories would have to be increased by $25,400 to handle the new line. The machinery is in the 7-year recovery period (MACRS depreciation rates are shown in the table ), and is depreciated using the GDS system with 200% declining balance and the half-year convention. The machinery will be used for 2 years and have an expected salvage value of $25,800 at the end of that time. Robertson's tax rate is 30% and its weighted average cost of capital is 9.9%. Operating earnings (EBITDA) are expected to be $182,000 per year for each of the two 2 years. Assume that the purchase of the machine and increase in inventory occur at the beginning of the first year of operations. Assume that operating cash flows occur at the end of each of the two years of operations. a. What are initial cash flows for the Guttie project? b. What are the operating cash flows in the first year? c. What are the terminal year cash flows (not including the operating cash flows)? d. What is the NPV of the project? a. What are the initial cash flows for the Guttie project? Calculate the initial cash flow below: (Round to the nearest dollar.) Data Table Year 0 $ $ Initial purchase price of the new asset Installation/shipping cost of the new asset Net purchase price +/- Change in net working capital $ Year 1 2 3 4 5 MACRS Depreciation Rates 5-Year 7-Year 20.00% 14.29% 32.00% 24.49% 19.20% 17.49% 11.52% 12.49% 11.52% 8.93% 10-Year 10.00% 18.00% 14.40% 11.52% 9.22% $ Initial cash flow $ Print Done Done Enter any number in the edit fields and then click Check Answer. ? 10 parts Clear All remaining System Preferences Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts