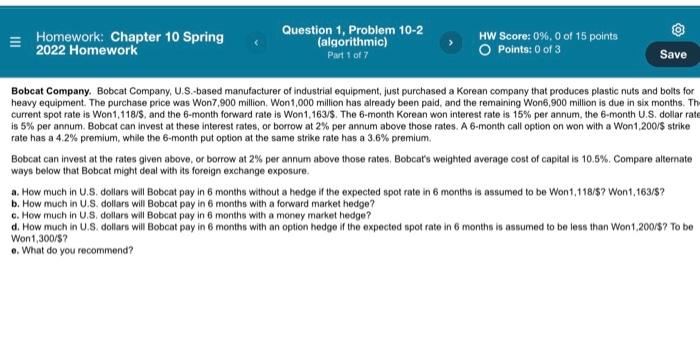

Question: Homework: Chapter 10 Spring 2022 Homework Question 1. Problem 10-2 (algorithmic) Part 1 of 7 HW Score: 0%, 0 of 15 points O Points: 0

Homework: Chapter 10 Spring 2022 Homework Question 1. Problem 10-2 (algorithmic) Part 1 of 7 HW Score: 0%, 0 of 15 points O Points: 0 of 3 Save Bobcat Company. Bobcat Company, U.S.-based manufacturer of industrial equipment, just purchased a Korean company that produces plastic nuts and bolts for heavy equipment. The purchase price was Won7,900 million Won 1.000 million has already been paid, and the remaining Won6,900 million is due in six months. Th current spot rate is Won1,118/S, and the 6-month forward rate is Won1,163/$. The 6-month Korean won interest rate is 15% per annum, the 6-month U.S. dollar rate is 5% per annum. Bobcat can invest at these interest rates, or borrow at 2% per annum above those rates. A 6-month call option on won with a Won1,200/$ strike rate has a 4.2% premium, while the 6-month put option at the same strike rate has a 3.6% premium Bobcat can invest at the rates given above, or borrow at 2% per annum above those rates, Bobcats weighted average cost of capital is 10.5%. Compare alternate ways below that Bobcat might deal with its foreign exchange exposure. How much in U.S. dollars will Bobcat pay in 6 months without a hedge if the expected spot rate in 6 months is assumed to be Won1,118/$? Won1,163/$? b. How much in U.S. dollars will Bobcat pay in 6 months with a forward market hedge? c. How much in U.S. dollars will Bobcat pay in 6 months with a money market hedge? d. How much in U.S. dollars will Bobcat pay in 6 months with an option hedge if the expected spot rate in 6 months is assumed to be less than Won 1.200/$? To be Won 1,300/S? o. What do you recommend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts