Question: Homework: Lab 11 Question 3, Problem 18-6 (algorithmic) Part 1 of 12 HW Score: 0%, 0 of 5 points O Polnts: 0 of 1 Save

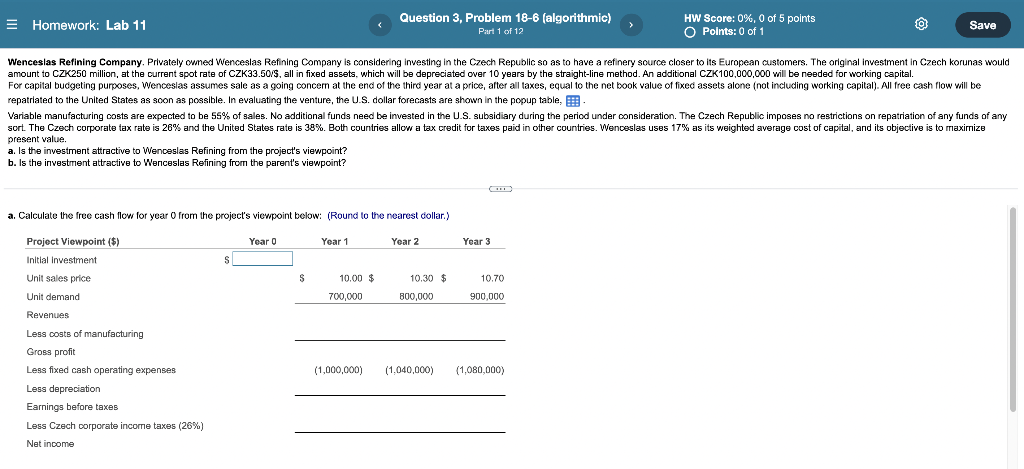

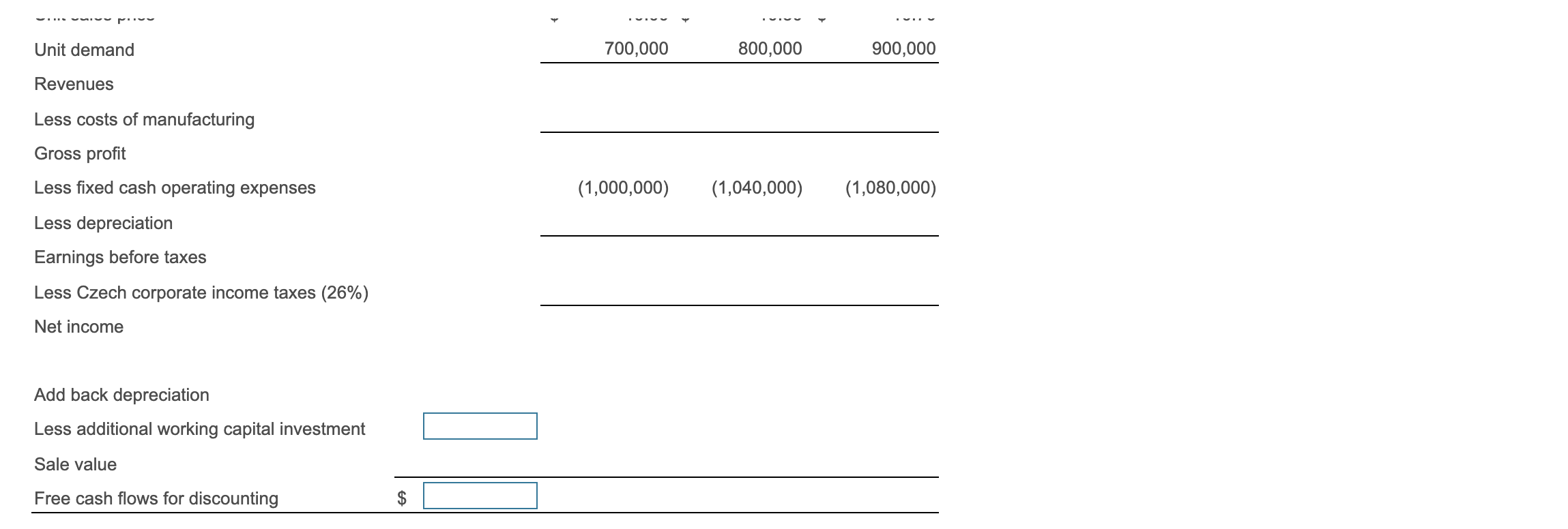

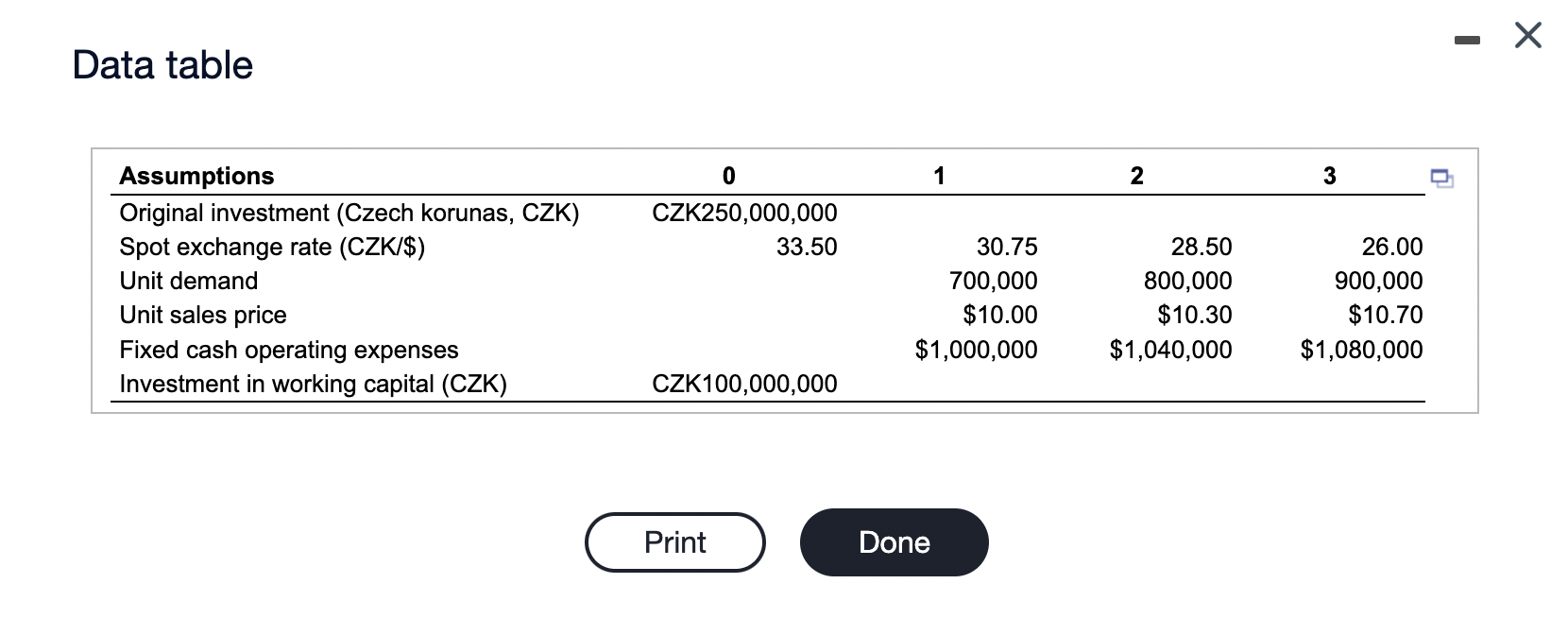

Homework: Lab 11 Question 3, Problem 18-6 (algorithmic) Part 1 of 12 HW Score: 0%, 0 of 5 points O Polnts: 0 of 1 Save Wenceslas Refining Company. Privately owned Wenceslas Refining Company is considering investing in the Czech Republic so as to have a refinery source closer to its European customers. The original investment in Czech korunas would amount to CZK250 million, at the current spot rate of CZK33.50/5, all in fixed assets, which will be depreciated over 10 years by the straight-line method. An additional CZK100,000,000 will be needed for working capital. For capital budgeting purposes, Wenceslas assumes sale as a going concem at the end of the third year at a price, after all taxes, equal to the net book value of fixed assets alone (not including working capital). All tree cash flow will be repatriated to the United States as soon as possible. In evaluating the venture, the U.S. dollar forecasts are shown in the popup table, , Variable manufacturing costs are expected to be 55% of sales. No additional funds need be invested in the U.S. subsidiary during the period under consideration. The Czech Republic imposes no restrictions on repatriation of any funds of any sort. The Czech corporate tax rate is 26% and the United States rate is 38%. Both countries allow a tax credit for taxes paid in other countries. Wenceslas uses 17% as its weighted average cost of capital, and its objective is to maximize present value. a. Is the investment attractive to Wenceslas Refining from the project's viewpoint? b. Is the investment attractive to Wenceslas Refining from the parent's viewpoint? a. Calculate the free cash flow for year from the project's viewpoint below: (Round to the nearest dollar.) Year 0 Year 1 Year 2 Year 3 S Project Viewpoint ($) Initial Investment Unit sales price Unit demand Revenues S 10.00 $ 10.30 $ 10.70 700,000 800,000 900,000 Less costs of manufacturing Gross profit Less fixed cash operating expenses (1,000,000) (1.040,000) (1,080,000) Less depreciation Earnings before taxes Less Czech corporate income taxes (26%) Net income uvrir Unit demand 700,000 800,000 900,000 Revenues Less costs of manufacturing Gross profit Less fixed cash operating expenses Less depreciation (1,000,000) (1,040,000) (1,080,000) Earnings before taxes Less Czech corporate income taxes (26%) Net income Add back depreciation Less additional working capital investment Sale value Free cash flows for discounting $ - Data table 0 1 2 3 CZK250,000,000 33.50 Assumptions Original investment (Czech korunas, CZK) Spot exchange rate (CZK/$) Unit demand Unit sales price Fixed cash operating expenses Investment in working capital (CZK) 30.75 700,000 $10.00 $1,000,000 28.50 800,000 $10.30 $1,040,000 26.00 900,000 $10.70 $1,080,000 CZK100,000,000 Print Done Homework: Lab 11 Question 3, Problem 18-6 (algorithmic) Part 1 of 12 HW Score: 0%, 0 of 5 points O Polnts: 0 of 1 Save Wenceslas Refining Company. Privately owned Wenceslas Refining Company is considering investing in the Czech Republic so as to have a refinery source closer to its European customers. The original investment in Czech korunas would amount to CZK250 million, at the current spot rate of CZK33.50/5, all in fixed assets, which will be depreciated over 10 years by the straight-line method. An additional CZK100,000,000 will be needed for working capital. For capital budgeting purposes, Wenceslas assumes sale as a going concem at the end of the third year at a price, after all taxes, equal to the net book value of fixed assets alone (not including working capital). All tree cash flow will be repatriated to the United States as soon as possible. In evaluating the venture, the U.S. dollar forecasts are shown in the popup table, , Variable manufacturing costs are expected to be 55% of sales. No additional funds need be invested in the U.S. subsidiary during the period under consideration. The Czech Republic imposes no restrictions on repatriation of any funds of any sort. The Czech corporate tax rate is 26% and the United States rate is 38%. Both countries allow a tax credit for taxes paid in other countries. Wenceslas uses 17% as its weighted average cost of capital, and its objective is to maximize present value. a. Is the investment attractive to Wenceslas Refining from the project's viewpoint? b. Is the investment attractive to Wenceslas Refining from the parent's viewpoint? a. Calculate the free cash flow for year from the project's viewpoint below: (Round to the nearest dollar.) Year 0 Year 1 Year 2 Year 3 S Project Viewpoint ($) Initial Investment Unit sales price Unit demand Revenues S 10.00 $ 10.30 $ 10.70 700,000 800,000 900,000 Less costs of manufacturing Gross profit Less fixed cash operating expenses (1,000,000) (1.040,000) (1,080,000) Less depreciation Earnings before taxes Less Czech corporate income taxes (26%) Net income uvrir Unit demand 700,000 800,000 900,000 Revenues Less costs of manufacturing Gross profit Less fixed cash operating expenses Less depreciation (1,000,000) (1,040,000) (1,080,000) Earnings before taxes Less Czech corporate income taxes (26%) Net income Add back depreciation Less additional working capital investment Sale value Free cash flows for discounting $ - Data table 0 1 2 3 CZK250,000,000 33.50 Assumptions Original investment (Czech korunas, CZK) Spot exchange rate (CZK/$) Unit demand Unit sales price Fixed cash operating expenses Investment in working capital (CZK) 30.75 700,000 $10.00 $1,000,000 28.50 800,000 $10.30 $1,040,000 26.00 900,000 $10.70 $1,080,000 CZK100,000,000 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts