Question: = Homework: Chapter 12 Homework Question 1, Problem 12-1 (algorithmic) Part 1 of 2 HW Score: 0%, 0 of 20 points Points: 0 of 5

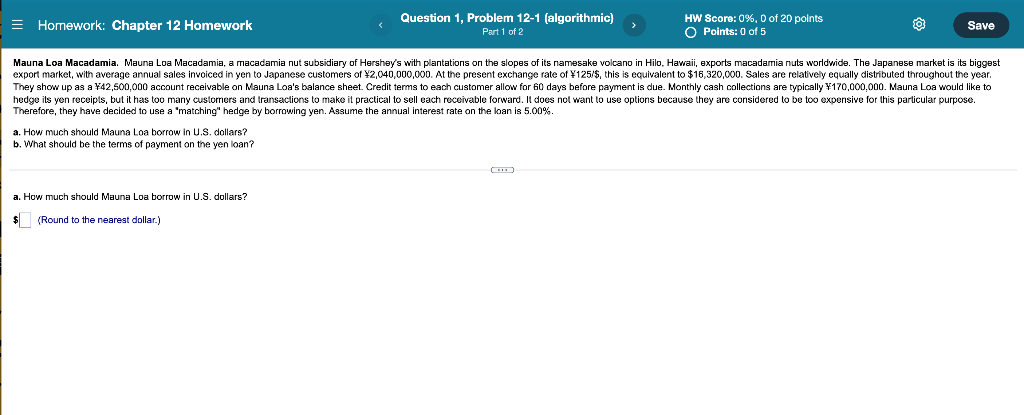

= Homework: Chapter 12 Homework Question 1, Problem 12-1 (algorithmic) Part 1 of 2 HW Score: 0%, 0 of 20 points Points: 0 of 5 Save Mauna Loa Macadamia. Mauna Loa Macadamia, a macadamia nut subsidiary of Hershey's with plantations on the slopes of its namesake volcano in Hilo, Hawaii, exports macadamia nuts worldwide. The Japanese market is its biggest export market, with average annual sales invoiced in yen to Japanese customers of 2,040,000,000. At the present exchange rate of 125/$, this is equivalent to $16,320,000. Sales are relatively equally distributed throughout the year They show up as a 42,500,000 account receivable on Mauna Loa's balance sheet. Credit terms to each customer allow for 60 days before payment is due. Monthly cash collections are typically 170,000.000. Mauna Loa would like to hedge ils yen receipts, but it has too many customers and transactions to make it practical to sell each receivable forward. It does not want to use options because they are considered to be too expensive for this particular purpose. Therefore, they have decided to use a 'matching" hedge borrowing yen. Assume the annual interest rate on the loan is 5.00%. a. How much should Mauna Loa borrow in U.S. dollars? b. What should be the terms of payment on the yen loan? a. How much should Mauna Loa borrow in U.S. dollars? $ (Round to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts