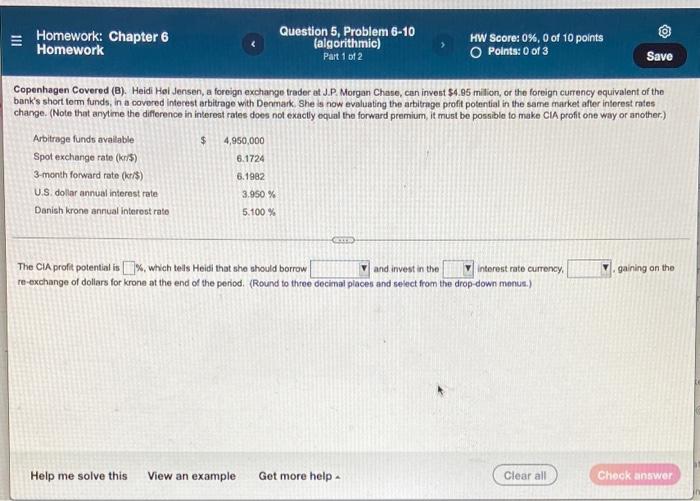

Question: Homework: Chapter 6 Homework Question 5, Problem 6-10 (algorithmic) Part 1 of 2 HW Score: 0%, 0 of 10 points O Points: 0 of 3

Homework: Chapter 6 Homework Question 5, Problem 6-10 (algorithmic) Part 1 of 2 HW Score: 0%, 0 of 10 points O Points: 0 of 3 Save Copenhagen Covered (8). Heidi Hi Jensen, a foreign exchange trader at J.P. Morgan Chase, can invest $4.95 million, or the foreign currency equivalent of the bank's short term funds, in a covered interest arbitrage with Denmark. She is now evaluating the arbitrage profit potential in the same market after interest rates change. (Note that anytime the difference in interest rates does not exactly equal the forward premium, it must be possible to make CIA profit one way or another.) $ Arbitrage funds available Spot exchange rate (kr/$) 4,950,000 6.1724 3-month forward rate (kr/$) 6.1982 U.S. dollar annual interest rate 3.950 % Danish krone annual interest rate 5.100% CETT Vand invest in the gaining on the The CIA profit potential is%, which tells Heidi that she should borrow interest rate currency. re-exchange of dollars for krone at the end of the period. (Round to three decimal places and select from the drop-down menus.) Help me solve this View an example Get more help. Clear all Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts