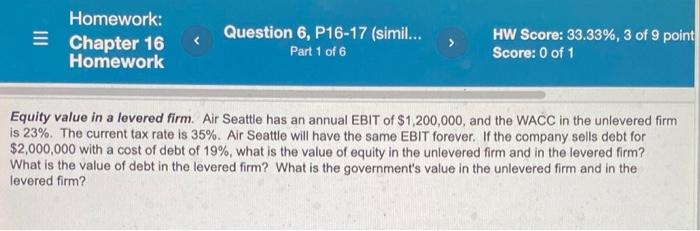

Question: Homework: Chapter 16 Homework Question 6, P16-17 (simil... Part 1 of 6 HW Score: 33.33%, 3 of 9 point Score: 0 of 1 Equity value

Homework: Chapter 16 Homework Question 6, P16-17 (simil... Part 1 of 6 HW Score: 33.33%, 3 of 9 point Score: 0 of 1 Equity value in a levered firm. Air Seattle has an annual EBIT of $1,200,000, and the WACC in the unlevered firm is 23%. The current tax rate is 35%. Air Seattle will have the same EBIT forever. If the company sells debt for $2,000,000 with a cost of debt of 19%, what is the value of equity in the unlevered firm and in the levered firm? What is the value of debt in the levered firm? What is the government's value in the unlevered firm and in the levered firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts