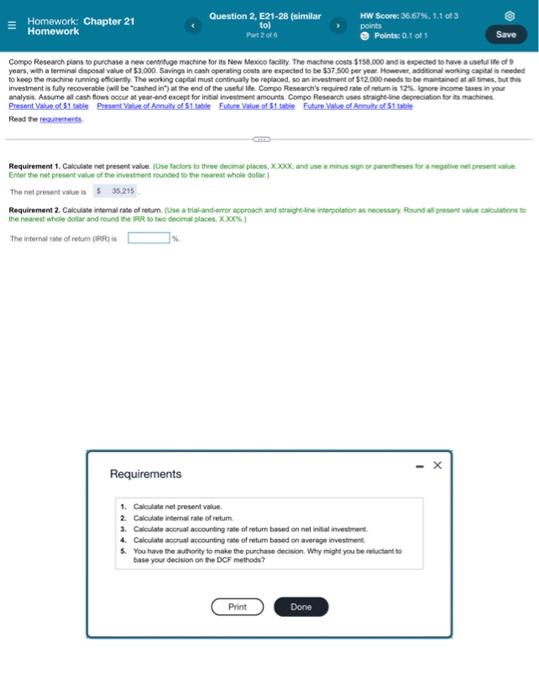

Question: Homework: Chapter 21 Homework Question 2, E21-28 (similar to) Part 2 of HW Score: 36.67%, 1.1 of 3 points Points: 0.1 of 1 Save

Homework: Chapter 21 Homework Question 2, E21-28 (similar to) Part 2 of HW Score: 36.67%, 1.1 of 3 points Points: 0.1 of 1 Save Compo Research plans to purchase a new centrifuge machine for its New Mexico facility. The machine costs $158,000 and is expected to have a useful life of 9 years, with a terminal disposal value of $3,000. Savings in cash operating costs are expected to be $37.500 per year. However, additional working capital is needed to keep the machine running efficiently. The working capital must continually be replaced, so an investment of $12.000 needs to be maintained at all times, but this investment is fully recoverable (will be "cashed in) at the end of the useful ife. Compo Research's required rate of return is 12% Ignore income taxes in your analysis. Assume all cash flows occur at year-end except for initial investment amounts Compo Research uses straight-line depreciation for its machines Present Value of $1 table Present Value of Annuity of $1 table Future Value of 51 table Future Value of Annuity of $1 table Read the requirements Requirement 1. Calculate net present value. (Use factors to three decimal places, XXXX, and use a minus sign or parentheses for a negative net present value Enter the net present value of the investment rounded to the nearest whole dollar) The net present value is $35.215 Requirement 2. Calculate internal rate of return. (Use a trial-and-error approach and straight-line interpolation as necessary Round all present value calculations to the nearest whole dollar and round the IRR to two decimal places, XXX%) The internal rate of return (IRR) is Requirements 1. Calculate net present value. 2. Calculate internal rate of retum 3. Calculate accrual accounting rate of return based on net initial investment 4. Calculate accrual accounting rate of return based on average investment 5. You have the authority to make the purchase decision. Why might you be reluctant to base your decision on the DCF methods? Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts