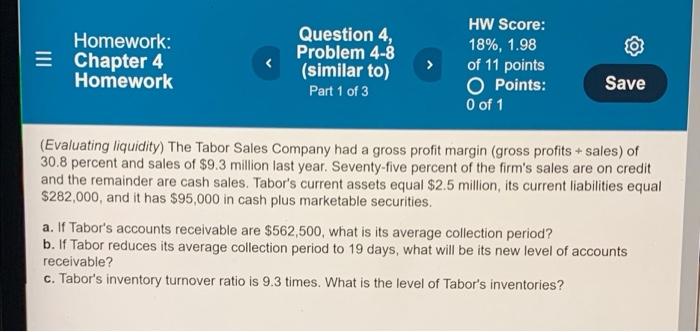

Question: Homework: Chapter 4 Homework Question 4, Problem 4-8 (similar to) Part 1 of 3 HW Score: 18%, 1.98 of 11 points O Points: O of

Homework: Chapter 4 Homework Question 4, Problem 4-8 (similar to) Part 1 of 3 HW Score: 18%, 1.98 of 11 points O Points: O of 1 Save (Evaluating liquidity) The Tabor Sales Company had a gross profit margin (gross profits + sales) of 30.8 percent and sales of $9.3 million last year. Seventy-five percent of the firm's sales are on credit and the remainder are cash sales. Tabor's current assets equal $2.5 million, its current liabilities equal $282,000, and it has $95,000 in cash plus marketable securities a. If Tabor's accounts receivable are $562,500, what is its average collection period? b. If Tabor reduces its average collection period to 19 days, what will be its new level of accounts receivable? c. Tabor's inventory turnover ratio is 9.3 times. What is the level of Tabor's inventories

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts