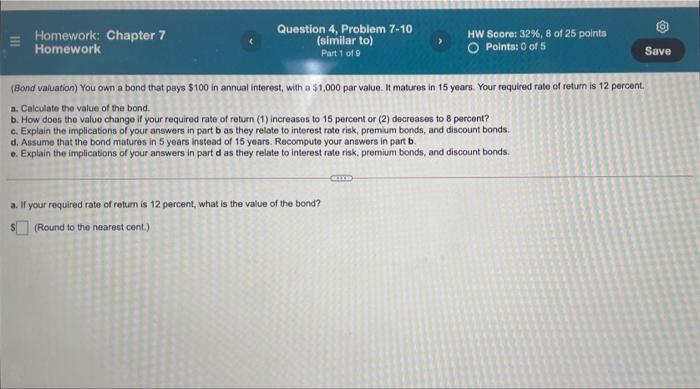

Question: Homework: Chapter 7 Homework Question 4, Problem 7-10 (similar to) Part 1 of 9 HW Score: 32%, 8 of 25 points O Points: 0 of

Homework: Chapter 7 Homework Question 4, Problem 7-10 (similar to) Part 1 of 9 HW Score: 32%, 8 of 25 points O Points: 0 of 5 Save (Bond valuation) You own a bond that pays $100 in annual interest, with a $1,000 par value. It matures in 15 years. Your required rate of return is 12 percent. a. Calculate the value of the bond. b. How does the value change if your required rate of return (1) increases to 15 percent or (2) decreases to 8 percent? c. Explain the implications of your answers in part b as they relate to interest rate risk, premium bonds, and discount bonds. d. Assume that the bond matures in 5 years instead of 15 years. Recompute your answers in part b. .. Explain the implications of your answers in part d as they relate to interest rate risk, premium bonds, and discount bonds. CD a. If your required rate of return is 12 percent, what is the value of the bond? (Round to the nearest cent)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts